Historically, the manufacturing sector has played an integral role in the US economy, with it accounting for 25% of US GDP in the 1980s. However, over the past four decades, contributions from the manufacturing sector to the US GDP have steadily declined, with it accounting for approximately 11 % as of 2021. While the decline in US manufacturing can be attributed to various economic developments, namely globalization, the transformation of the US into a service-based economy, and companies outsourcing production to countries with lower labor costs, the US remains one of the largest manufacturing economies in the world, and manufacturing continues to play a significant role in the overall health of the US economy.

Assessing the current manufacturing landscape

Against the backdrop of the global pandemic, the inefficiencies and limitations of a global supply chain that depended on the low-cost manufacturing capabilities of China applied to any business. Furthermore, with geopolitical tensions – both realized (Russian-Ukraine War) and anticipated (China-Taiwan) arising globally, many companies have begun re-examining their manufacturing business model, ultimately deciding to reshore their operations to the United States. In making this decision, companies are choosing to forgo beneficial production cost inputs, such as low-cost labor, which will be comparatively higher in the US – in an effort to mitigate supply chain risk that would greatly impact business continuity.

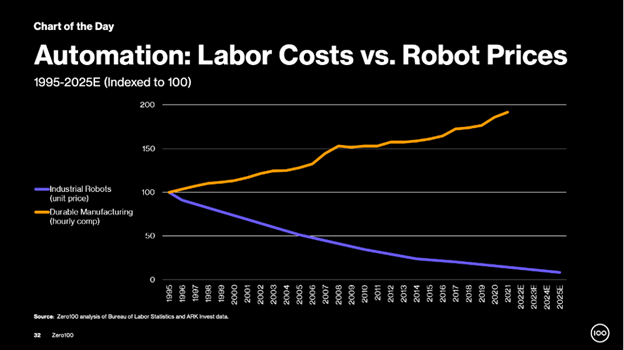

As detailed in Deloitte’s The future of freight: Transforming the movement of goods, American companies are believed to have reshored nearly 350,000 jobs in 2022, up from 260,000 in 2021. Major automobile and electronics manufacturers are set to build new facilities costing billions of dollars to manufacture their highest-value products in the United States—investments in battery production plants announced by automotive companies in 2022 alone exceed US$13 billion. Labor availability and cost of manufacturing in Western Europe and the United States are being mitigated by advances in robotics and automation, stimulating the reshoring of manufacturing for everything from kitchen utensils to hardwood flooring.

Reshaping the manufacturing landscape, through automation

For manufacturing businesses re-entering the US, utilizing technology – specifically the introduction of robotics automation – has enabled them to reshape their manufacturing process in a manner that allows them to achieve economies of scale fairly quickly. While one of the immediate benefits of robotics automation is the labor cost savings that can be achieved, it is also an avenue for great production efficiency and higher quality outputs.

Investing in automation

As more manufacturing businesses, across different industries, adopt automation as a means of production, the businesses that are the source of these robotic innovations are best positioned to be investments capable of offering growth over a long-term horizon. For investors interested in gaining exposure to the robotics and automation industry, the following solutions provide you with pure-play access.

iShares Robotics and Artificial Intelligence Multisector ETF (IRBO) is a global fund following companies from both developed and emerging markets that are involved in robotics and artificial intelligence. The fund’s underlying index uses company filings and public disclosures to identify eligible stocks. To be selected, a company must either derive 50% of its revenue, have a 20% market share, or generate $1 billion in annual revenue from industries with exposure to a robotics and artificial intelligence theme.

Global X Robotics & Artificial Intelligence ETF (BOTZ) provides cross-sector exposure to companies working on the development and production of robotics and artificial intelligence through a market-cap selected and weighted index. Eligible companies are listed in developed countries and must earn a significant portion of their revenue from, or have a stated business purpose in, the field of robotics or artificial intelligence. This field includes varied applications from the development of drones to healthcare robots and predictive analytics software.

As more companies decide to relocate to the US, the adoption of robotic automation represents the reinvigoration of American manufacturing and an opportunity for investors to benefit from technological advancements that will reshape an industry for years to come.

This content was originally published by our partners at ETF Central.