Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54.15 and the initial downside target at $45.55) are justified from the risk/reward perspective.

Although crude oil climbed above the level of $50 yesterday, this improvement was very temporary and the black gold closed the day below this barrier. In this way light crude invalidated the earlier breakout, which will likely trigger further declines. How low could the commodity go in the coming days?

Crude Oil's Technical Picture

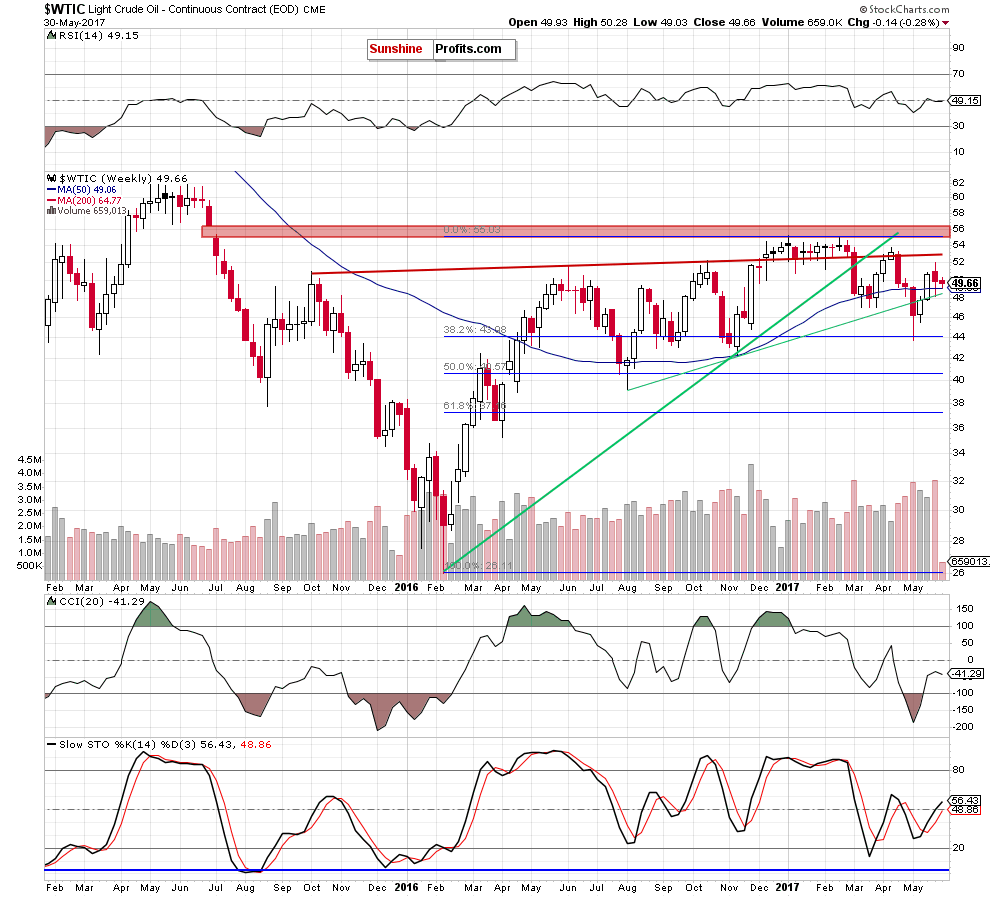

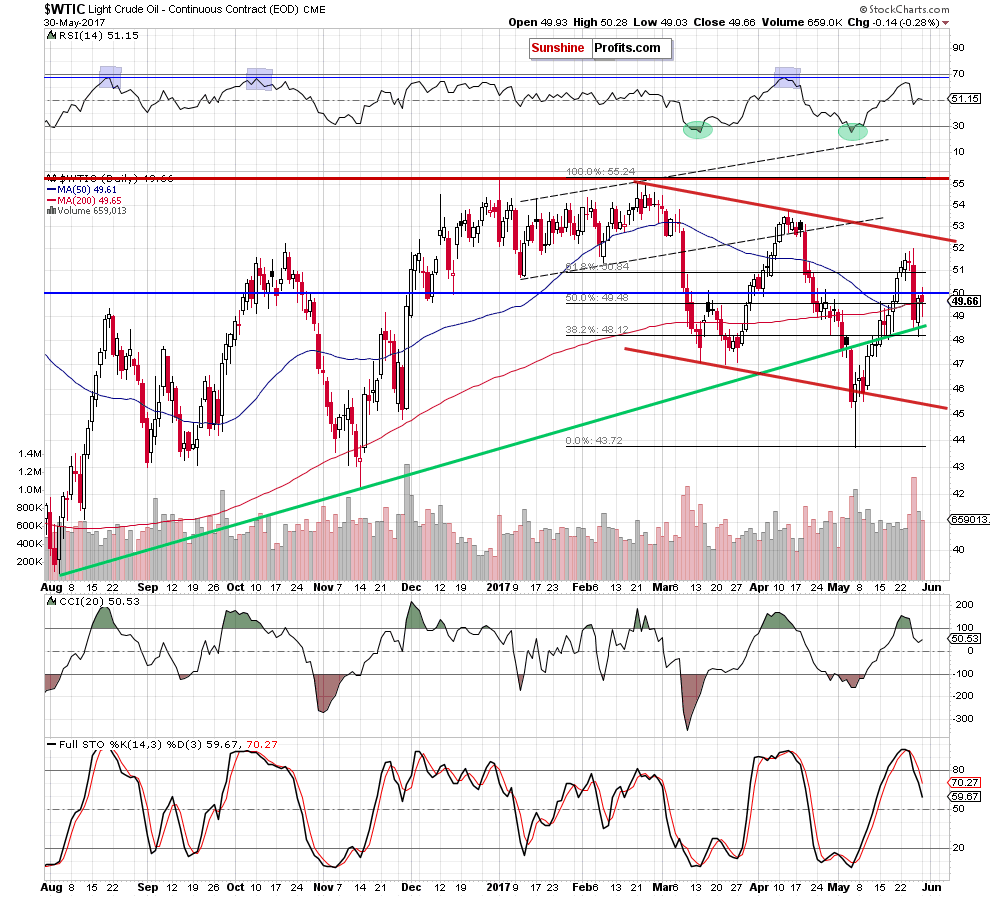

Let’s take a closer look at the charts and find out what are they telling about future moves (charts courtesy of http://stockcharts.com).

Today’s alert will be quite short, because the technical picture of the commodity hasn’t changed much and the short-term outlook remains bearish. As we mentioned earlier, light crude moved a bit higher after yesterday’s market’s open, which resulted in a climb above the barrier of $50. As it turned out, this improvement was very temporary and the black gold erased earlier gains in the following hours, closing the day below $50.

Breakout's Invalidation

In this way, the commodity invalidated the earlier tiny breakout, which pushed the black gold lower earlier today. How low could light crude go in the coming days? We believe that the best answer to this question will be the quote from our yesterday’s alert:

(…) if we take a closer look at the size of volume, we see that it was much smaller than s day earlier, which suggests that oil bulls are weaker than their opponents at the moment.

Additionally, the sell signals generated by the daily indicators remain in place, supporting oil bears and lower prices of the black gold. If this is the case and crude oil moves lower, the first downside target will be the long-term green support line based on the August and November lows (currently around $48.53). If crude oil drops under this important support, the next target for oil bears will be around $45.55, where the previously-broken lower border of the red declining trend channel is.

Summing up, short (already profitable) positions are justified from the risk/reward perspective as crude oil invalidated the small breakout above the barrier of $50. This negative development together with the sell signals generated by the indicators suggest lower prices of the black gold in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54.15 and the initial downside target at $45.55) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.