Do you believe that trees can grow to the sky? Well, apparently the market has been pricing Palantir (NASDAQ:PLTR) stock this way, with the company trading at valuation multiples that go far beyond what we could consider excessively expensive.

Even though Palantir’s trajectory, especially over the last two years, has been impressive (to say the least), many investors may be thinking that the 345% growth over the last twelve months could indicate that the robust growth and improvement in fundamentals are already priced into the stock. The fact is, Palantir in 2025 will still be the leading pure AI player in the software segment, capturing demand in a way that no other company has been able to match.

Because of this, the demand for Palantir’s software services has been highly unpredictable, more likely to still be in its early innings, as the AI revolution still has a massive space to fill, especially in software offerings yet to be developed. Other companies will come, but for now, Palantir is best positioned to capture this demand. For this reason, analysts have been consistently revising projections upwards with each quarter reported by Palantir, and this will likely continue to drive the stock upwards.

Because of this, I still see 2025 as a great opportunity to buy Palantir, even at such valuations.

Overview on PalantirBefore diving deeper into the Palantir thesis, for those not familiar with what the company actually does, it was founded in 2003 with the mission to build data-driven operations and decision-making software. Its early focus was primarily on intelligence and defense, working across national security contexts. As such, much of its software legacy was informed by the kind of learnings in those front-line deployment settings.

At the moment, Palantir operates across different industries, in various locations both within and outside of government, in the commercial sector, and also in non-profit sectors. The company primarily operates with three software platforms, which are:

- Gotham, which is their operating system for intelligence and defense, designed to integrate all the data into one platform and use it for decision-making and mission planning in high-stakes environments like the battlefield.

- Foundry, which does the same as Gotham but on the commercial side to cut costs, enhance efficiency, and create new productsintegrating with other data platforms like Snowflake (NYSE:SNOW), Azure, and AWS.

- Apollo, responsible for deploying and managing complex software footprints across many different environments, allowing developers to write code that works with all cloud services.

Palantir As The Greatest Software Name on AIAll the work done by Palantir over the past few years has been at the heart of the AI revolution. According to the company’s CEO, Alex Karp, The world is in the midst of a U.S.-driven AI revolution that is reshaping industries and economies, and we are at the center of it.

Its commercial business has been able to handle and analyze very large, complex, and often unstructured data from a variety of sources. And arguably, there is no other software company that has managed to do this as well as Palantir at the moment.

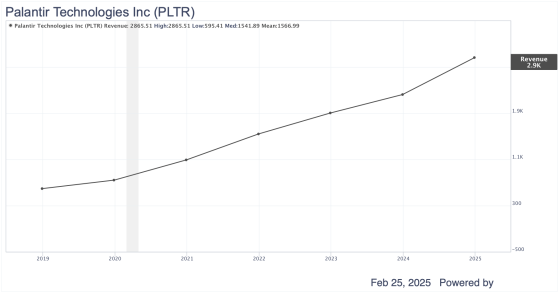

As a result, Palantir’s business growth has been breathtaking, with companies turning to AI solutions generating an unwavering demand for the company’s software. Let’s look at the evolution of the company’s revenues over the past five years. From 2019 to 2023, Palantir’s revenues grew from $742.6 million to $2.86 billion, marking a staggering CAGR of 29.6%.

When we look at the company’s top-line performance over the last five quarters, closely capitalizing on the recent demand for AI, revenues grew from 13% to 36% between Q2 2023 and Q4 2024. Much of this acceleration is obviously connected to the enormous competitive advantages of Palantir’s commercial business. In Q4 2024 alone, revenues grew by 64% year-over-year and 20% quarter-over-quarter in Q3.

A SaaS Juggernaut on Growth and ProfitabilityBecause it is a software company experiencing ultra-high demand for its services, Palantir has been able to balance growth and profitability exceptionally well. Starting with the most recent quarter, Q4 2024, the company generated the largest profit in its twenty-year history, reaching $165 million in net income.

Arguably, the company’s management has been doing a great job of entering new business, securing deals, and streamlining expenses. For example, in Q4 2024, the U.S. commercial customer count was 382, a 43% increase from the same period in 2023.

But what stands out to me the most is that, typically, when a company is experiencing rapid revenue growth, operating margins are affected. But this doesn’t seem to be the case for Palantir. As recent numbers show, the company grew revenues by 36% in Q4, while operating margins grew to 39%, up from 37% in Q2.

To highlight this, let’s look at an interesting metric: the Rule of 40. Essentially, this rule involves calculating the sum of a SaaS (Software-as-a-Service) company’s revenue growth rate and profit margin, which should be at least 40%. As the percentage moves above or below this threshold, investors can determine whether a SaaS company is effectively managing its expansion while maintaining financial sustainability, as both extremesrapid growth at the cost of profits or high profitability with slow growthcan be problematic.

Source: Palantir’s IR’s

Palantir’s latest data on the Rule of 40 stands at 81%, an improvement from the 68% reported in Q2 2024 and the mere 38% reported in Q2 2023. To get an idea of how relevant this metric is, observe the chart below to see how Palantir has outperformed all the major software giants in the fourth quarter, even achieving operating margins higher than Microsoft (NASDAQ:MSFT).

Source: Company’s filings, author.

It’s worth noting here that, although these companies have lower scores than Palantir for various reasons, achieving higher scores every quarter is an increasingly difficult task, as this involves sustaining very high growth rates at very high operating margins. The vast majority tend to excel in one area, not both. The projection, however, is that from Q1 2025 onwards, Palantir will deliver revenue growth of 37.8%, gradually decreasing to 34% in Q2 2025 and 31.2% in Q3 2025. On the other hand, EPS growth rates are expected to continue growing by 61% in Q1 2025, and slowly decline to 47.1%and 39.4% in Q2 2025 and Q3 2025, respectively.

Even so, assuming that operating margins decline to the mid-30s and revenues grow in the mid-20s, Palantir would still have a Rule of 40 largely above the benchmark and most other software giants.

Valuation, the Key Topic of DebateFinally, although it is quite evident the exceptional growth of Palantir and the marked improvement of its fundamentals each quarter, arguably, many investors struggle to digest the multiples the market is paying due to all the expectations surrounding Palantir.

Palantir is trading at a Price-to-Sales (P/S) multiple of 71x over the last twelve months, and 56x for 2025. Considering market projections that sales could reach $4.79 billion in 2026, Palantir would still be trading at a 44x forward P/S. Microsoft, for example, the top software company in the world, trades at a P/S of 12.4x, and 8.6x in Fiscal 2027.

But let’s now look at it in terms of the bottom line, particularly adjusted for growth. Palantir is trading at a forward P/E ratio of 162.8x, where forecasts suggest an EPS CAGR of 25.6% for the next three to five years, resulting in a PEG ratio of 6.3xalmost more than six times that of Nvidia (NASDAQ:NVDA).

Clearly, it is very difficult to justify such multiples based on these metrics, and arguably, Excel spreadsheets modeling future growth can be highly inaccurate for a company in such a rapid growth stage, where it is clear that demand is still far from stabilizing.

One example of this is that every quarter, Palantir has revised its guidance upward, clearly indicating that even the company cannot predict how far it can go.

As this continues, and should continue for at least the next few quarters, analysts will constantly update their projections upward, which should continue to support the stock trading higher, even though extremely stretched valuations are already pricing in perfection. Over the last six months, analysts have revised the majority of projections up by double digits until 2033.

Source: GuruFocus

But let’s try, through a reverse DCF model, to create some bull, bear, and base cases for Palantir to try to determine what growth metrics the company would need to achieve to justify its highly debated valuations.

Let’s start with the bear case.

Currently, analysts project Palantir to achieve revenue growth at a 5-year CAGR of 34.7%. Let’s assume that growth comes slightly below that, at a 33% CAGR over this period. Then, Palantir reported operating margins of 39% in Q4 2024. Since Palantir is in its early growth stages, let’s assume a 5% operating margin CAGR, maintaining an average over the next five years unchanged.

I will also assume, based on the last twelve months, a tax rate of 4.3%, D&A to CapEx of 188%, and a CapEx percentage of 0.4% of revenue. For changes in net working capital, I will conservatively assume zero. I’ll assume a discount rate (WACC) of 10%, conservative given the volatility of a growth stock like Palantir. Also, a long-term growth rate of 3%, in line with GDP growth.

Source: Author, GuruFocus and SA data.

In this case, we would arrive at an implied value of just $25.51 per share for Palantir stock, meaning about a 72% downside if Palantir reports a 5-year revenue CAGR of 34.7% and 5% operating margin CAGR over the same period.

Now, let’s move to the base case.

Let’s assume that Palantir manages to grow revenue at a 39% CAGR over the next five years, and operating margins grow at a 10% CAGR over the same period. I will assume the same metrics for the tax rate, CapEx, and D&A, as well as the long-term growth rate from the bear case as a standard. However, I will account for a WACC of 9%, slightly less conservative, and changes in net working capital at 5%, as the company is seeing significant growth in sales and it’s estimated that there could be fluctuations in receivables or payables.

Source: Author, GuruFocus and SA data.

In this scenario, we arrive at an implied market price of $48 per share, a 47% downside.

Finally, let’s look at the bull case, or what growth rates Palantir would need to achieve to reach its current share price.

Let’s assume a 5-year revenue CAGR of 44% and EBIT margins growing at a 15% 5-year CAGR. Unlike the bear and base cases, we will assume a change in NWC of 10% per year and a less conservative WACC of 8%.

Source: Author, GuruFocus and SA data.

Under this scenario, we would have an implied share price of $90.99 per share, essentially in line with the latest share price.

Although this exercise is highly speculative, it provides a dimension of the growth rates Palantir would need to achieve over the next five years to simply justify its current share price. But of course, one thing is what the company is intrinsically worth, and another is what the market is willing to pay. Clearly, companies uniquely positioned to capitalize more robustly than their peers on secular growth trends deserve a premium.

Even in this exercise, considering a base case indicating Palantir is about 47% overvalued, we could argue that this may be a reasonable premium for a company that keeps revising its guidance upward each quarter, where there are no signs of demand cooling for its services, which are increasingly resulting in margin synergies.

The Bottom LineI don’t believe that trees can grow to the sky, but as long as Palantir shows no signs of its demand cooling down, the journey of its stock towards the sky should continue triumphantly. Thus, being at the center of the AI revolution within one of the most robust margin segments in the world (software), valuations are just a detail, which for now, shouldn’t be an obstacle to seeing Palantir reach new peaks throughout 2025.

This content was originally published on Gurufocus.com