After beating Q2 deliveries, which served as a rallying focal point, much is expected of Tesla (NASDAQ:TSLA) earnings scheduled for July 23rd. Based on eight analyst forecasting inputs collected by Zacks Investment Research, Tesla’s earnings per share (EPS) for the quarter is expected at $0.47.

The last time Tesla beat EPS expectations was in Q2 ‘23 with a 13% surprise. In the meantime, Morgan Stanley’s auto and space research expert Adam Jonas placed TSLA price target at unchanged $310 while leveling up Tesla Energy division from $36 to $50 per share.

Goldman Sachs’ most recent Tesla price target got a boost from $175 to $248, but with unchanged neutral rating. Although this puts TSLA stock 5% lower than its current price of $261 at press time, GS expects a higher full-year 2024 EPS outlook from $1.90 to $2.05.

For comparison, Tesla’s EPS for 2023 was $3.41. Notwithstanding Robotaxi day speculation on August 8th, does Tesla’s energy division have enough potential to surprise investors as Morgan Stanley’s upped rating suggests?

Tesla Energy’s Evolution

Back in August 2008, Elon Musk’s “Master Plan” for the company outlined that a sports car EV was just a starting point for zero-emission electric power generation. It took until November 2016 for this plan to gain momentum, with the all-stock acquisition of SolarCity for $2.6 billion.

This was the stepping stone for Tesla’s one-stop shop energy experience – EVs, charging, solar, and storage. Since then, Tesla introduced Powerwall+ in 2021 with an integrated solar inverter, representing a major milestone for a more seamless solar-plus-storage integration.

In June, Tesla launched Powerwall 3 with a continuous 11.5kW energy supply. This is a massive 130% improvement from Powerwall 2 at 5kW. Likewise, Powerwall 3 upped the load start capability by 75% to 185 LRA, making it a more robust system to handle energy drain bursts from HPC systems like Bitcoin mining or AC units.

This feature aligns with a 119% increased direct current (DC) capacity to 20kW, making the system more efficient during non-peak conditions, while also ensuring that excess energy is funneled into storage. The latter is found in LFP (lithium iron phosphate) batteries that offer less degradation over time.

At present, Americans can get a 30% federal tax credit on Powerwall orders, set at a 10-year warranty, with or without Tesla’s solar panels or solar roof. Tesla offers Megapacks as infinitely stackable units at 3.9 MWh per unit for enterprises.

Tesla Energy Division’s Financials

Ahead of July’s earnings call in the Q2 deliveries report, Tesla noted a 9.4 gigawatt hours (GWh) worth of energy storage deployed, breaking previous records. For comparison, a power plant with a 1 GWh continuous capacity can supply around 34,843 households annually, assuming that each household consumes 10,500 kWh (28.7 kWh daily).

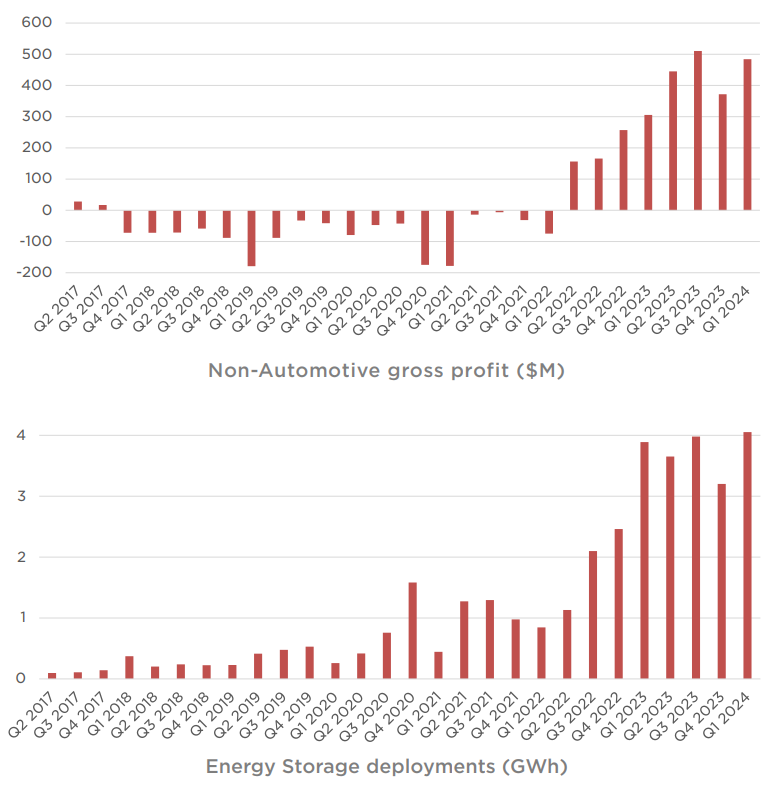

In Q1, Tesla deployed 4,053 MWh of energy as the previous record. That put Tesla’s Energy Generation and Storage revenue at 7% year-over-year growth to $1.6 billion, with a 140% uptick in gross profit of $403 million.

Ahead of the commissioned second general assembly line in Lathrop Megafactory for 40 GWh Megapacks, this places Tesla’s energy division as the highest margin business. Presently at 24.6%, it is significantly higher than the EV margin of 17.4% in Q1.

The aforementioned Morgan Stanley (NYSE:MS) analyst Adam Jones forecasts an increase to 26% Tesla Energy gross margin by 2030, from his previous projection of 23%. In earnings per share terms, that would make Tesla Energy go up to $2.00.

At the same time, Goldman Sachs (NYSE:GS) analysts predict that Tesla’s automotive business will decline to a 15.3% gross margin (non-GAAP) in Q2 compared to 17.4% in Q1.

“We believe this will be driven by lower production (both qoq and yoy), and the incentive/pricing actions Tesla has used.”

Tesla’s Bottom Line

As Elon Musk initially envisioned, the electric vehicle lineup continues to fill the coffers of Tesla’s broader ecosystem. This was made possible by the company’s dominant EV market share in the US at around 50%, alongside EU’s market share of 18.7%.

So far, Tesla Energy has been the company’s most successful non-automotive venture, just in time as Chinese automakers press the company’s core EV business. Although that pressure seems to be crippling for Tesla’s long-term outlook, the regulatory regime favors the company.

Last Friday, the EU increased tariffs on China’s EVs up to 37.6% to “ensure fair competition and a level playing field”, per EU trade chief Valdis Dombrovskis to Bloomberg. Likewise, the European Commission president Ursula von der Leyen doesn’t appreciate that “global markets are now flooded with cheaper Chinese electric cars”.

Additionally, it appears that the Chinese government is also a fan of Tesla EVs.

Ahead of robotaxi day announcement, and the advances in level 3 Full Self-Driving capability, this bodes well for Tesla’s bottom line. During 2025, when Goldman Sachs expects to see 2.1 million deliveries compared to 1.811 million outlook for 2024, the rumored $25k-priced model is yet to ramp up EV demand by breaking the affordability barrier as the main mass adoption obstacle.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.