In an era marked by escalating geopolitical tensions and evolving global dynamics, the United States again finds itself at a crossroads. The resilience of its critical supply chains is under unprecedented stress, influenced by multifaceted geopolitical risks that threaten its technological and energy sovereignty.

As global competition intensifies, particularly in the realms of technology and energy, the urgency for America to secure its leadership through strengthened domestic production and reduced dependencies has never been more pronounced.

Despite America's prominence on the global stage, maintaining its leadership requires significant domestic investment in critical technologies and resources. This is particularly pressing given the current vulnerabilities in key sectors.

For example, OPEC controls over 80% of the world's proven oil reserves and accounts for 40% of the world's crude oil production, which underscores the importance of energy security. Similarly, the U.S. faces challenges in semiconductor manufacturing, a sector dominated by foreign companies.

In addition, major portions of the world's computing and memory chips are currently produced outside the U.S. in Taiwan and Korea, and all advanced chip-making machines are manufactured by a single Dutch company, highlighting a strategic vulnerability.

This situation underscores the urgent need for America to reduce its dependence on international sources for essential technologies and energy, which can be achieved through reshoring—bringing production and manufacturing back to domestic soil.

While investors can approach this theme by assembling a mix of infrastructure, energy, semiconductor, and defense ETFs, there is a simpler solution available.

The Xtrackers U.S. National Critical Technologies ETF CRTC +0.21% can offer a one-stop-shop investment vehicle that provides exposure to leading U.S. companies across technology, healthcare, defense, communication, and energy sectors—all critical to America's future and its strategic independence, while insulating against exposure to countries not aligned with US strategic interests .

How does CRTC ETF work?

CRTC CRTC+0.21% is driven by the Solactive Whitney U.S. Critical Technologies Index, which begins by selecting companies based on their alignment with the United States' modernization priorities and their exposure to geopolitical risks.

Modernization priorities refer to the sectors and technologies that the U.S. government identifies as essential for maintaining and advancing the nation's competitive edge in the global economy.

For an investor, this means focusing on companies that are actively involved in areas like artificial intelligence, renewable energy, cybersecurity, and advanced manufacturing. These areas are crucial because they not only represent the future of technology but are also supported by government policies and funding, which can enhance their growth potential and stability.

Geopolitical risks involve the potential for a company's operations or profitability to be affected by political decisions or conflicts. This can include sanctions imposed by governments, trade disputes, or military conflicts that might affect a company's ability to operate in certain regions or trade.

From an investor's perspective, understanding these risks is vital because they can affect a company's bottom line and, consequently, the investor's returns. Companies with higher exposure to geopolitical risks might face sudden and severe impacts on their operations and stock prices.

Companies are also evaluated for their industry's connection to critical technology areas defined by U.S. strategic objectives, which in this context include fostering innovation and securing a technological advantage over other nations. Additionally, a geostrategic risk rating score assesses each company's involvement in countries considered risky by the U.S. government.

Specifically, critical technologies are defined by the U.S. Department of Defense in the National Defense Science and Technology Strategy (NDSTS). Guided by the overarching National Defense Strategy, the NDSTS identifies 14 key technological domains that are vital for maintaining U.S. military and economic supremacy:

- Biotechnology

- Quantum science

- Future Generation Wireless Technology (FutureG)

- Advanced Materials

- Trusted AI and Autonomy

- Integrated Network Systems-of-Systems

- Microelectronics

- Space Technology

- Renewable Energy Generation and Storage

- Advanced Computing and Software

- Human-Machine Interfaces

- Directed Energy

- Hypersonics

- Integrated Sensing and Cyber

For investors, companies engaged in developing or manufacturing these technologies represent opportunities for growth driven by sector trends and government support. These technologies often receive favorable regulatory conditions and financial incentives, such as those provided by the CHIPS Act, which can lead to higher profitability and stock performance.

Finally, the geostrategic risk rating score is a measure used to evaluate a company's exposure to countries that pose high geopolitical risks, as identified by the U.S. government. This scoring helps minimize the potential negative impacts on investments due to international tensions or unfavorable government actions like sanctions or regulatory crackdowns.

For investors, a favorable score means that a company has managed its international exposure wisely, limiting its operations in high-risk regions, which in turn reduces the likelihood of sudden adverse impacts on the company's financial health and stock price.

What's under the hood of CRTC ETF?

As of April 16th, 2024, CRTC's portfolio includes a diverse mix of 226 holdings, strategically spread across various sectors: information technology (38.97%), health care (16.96%), industrials (11.08%), communication services (10.68%), energy (8.20%), consumer discretionary (6.37%), utilities (4.35%), and materials (3.18%).

The ETF's top holdings showcase a balance between large-cap companies, combining growth-oriented stocks such as Nvidia (NASDAQ:NVDA), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL), and Microsoft (NASDAQ:MSFT) with value-oriented firms like Exxon Mobil (NYSE:XOM), Chevron (NYSE:CVX), Verizon (NYSE:VZ), and BP (LON:BP). Investors in CRTC CRTC+0.21% benefit from quarterly distributions, with a 30-day SEC yield of 1.37%. Moreover, a net expense ratio of 0.35% positions this ETF as an affordable option, considering its extensive sectoral and style diversification.

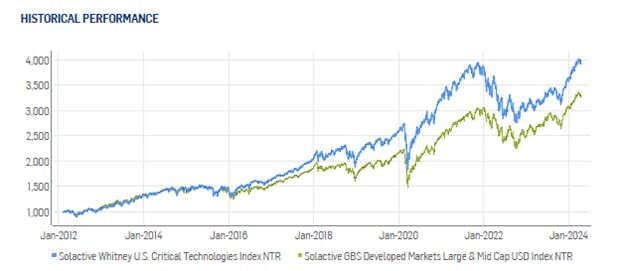

Historically, the strategy employed by CRTC has shown its effectiveness, as the ETF has outperformed the Solactive GBS Developed Markets Large & Mid Cap USD Index from January 2012 to January 2024.

Whether used as a core holding or a satellite allocation, CRTC offers a comprehensive investment solution for those looking to invest in America's critical sectors and technologies.

This content was originally published by our partners at ETF Central.