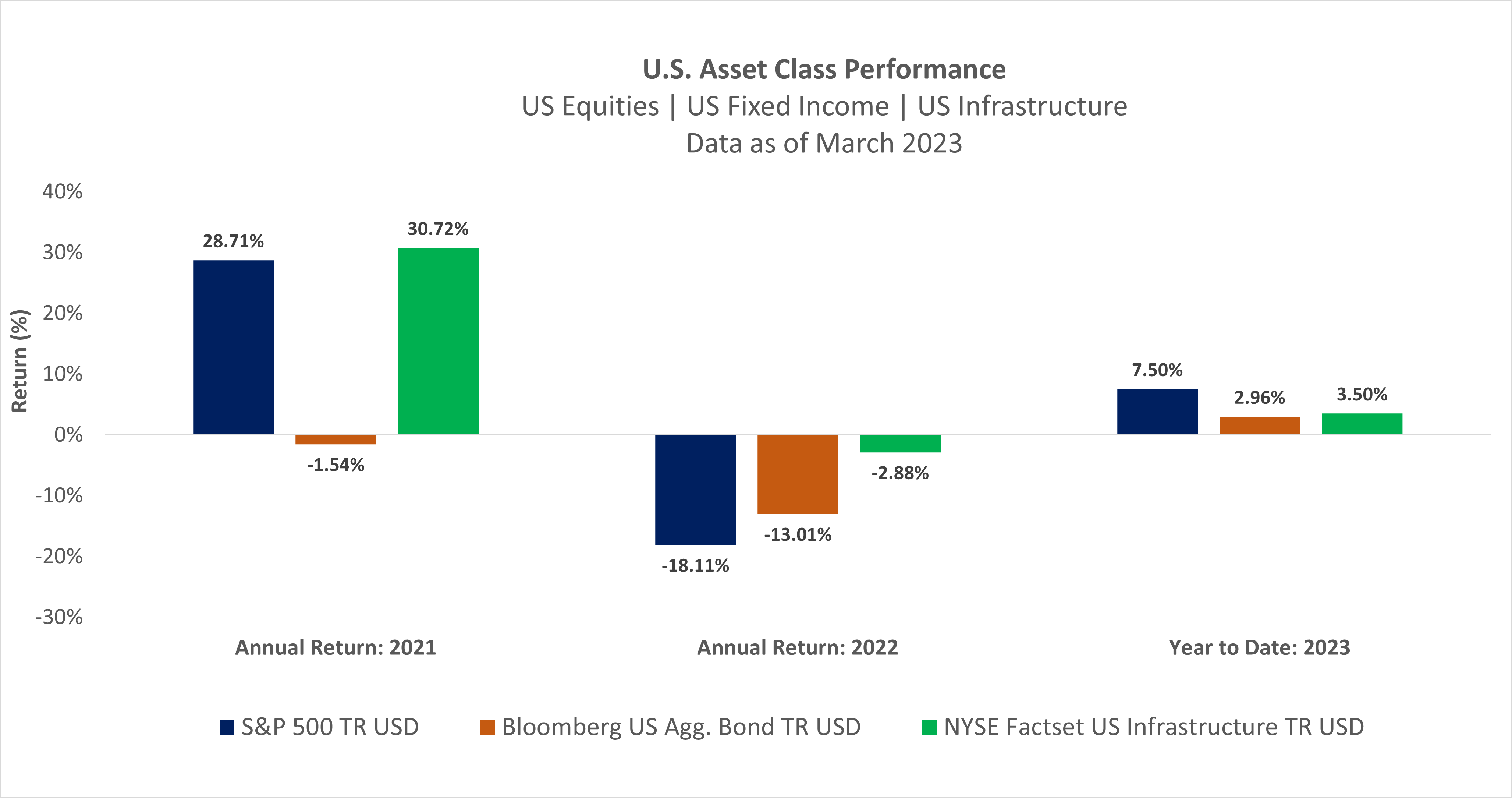

With US equity and fixed income markets generating negative outlier returns in 2022, the 2023 year-to-date performance of both assets classes has been a welcomed sight for most investors. However, the US Infrastructure asset class has been performing comparatively well thus far in the year; building on the noticeably strong performance exhibited in previous years.

As observed from the chart above, US infrastructure as an asset class performed well in 2021 and 2022, relative to US equity and US fixed income. Thus far in 2023, the performance of the asset class has been noteworthy, as it can be a meaningful contributor within a balanced portfolio.

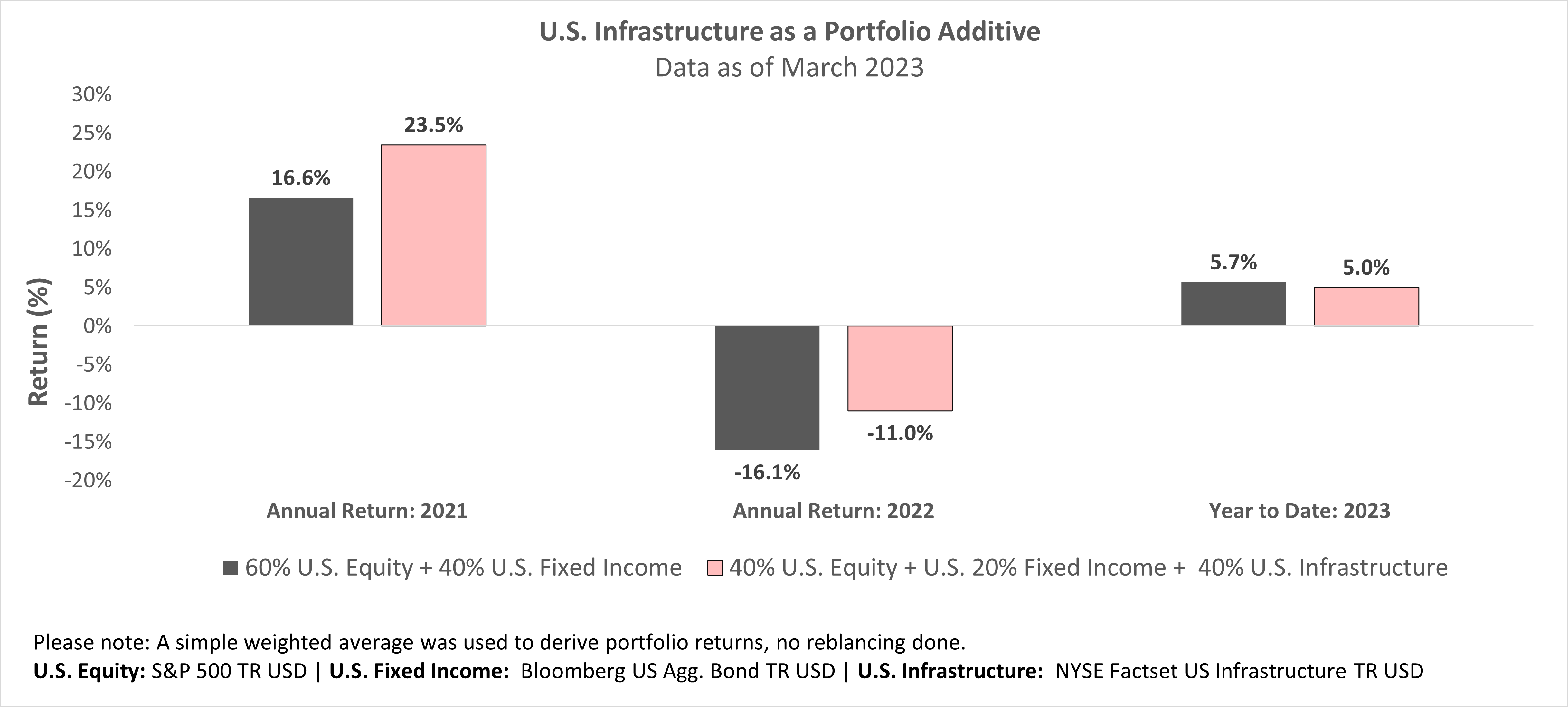

As mentioned in a previous article, infrastructure is classified as an alternative asset class, as such its returns are often uncorrelated with traditional asset classes. In the current inflationary and rising rate environment, integrating alternative assets such as infrastructure into one’s portfolio can prove beneficial, as it acts as an inflation hedge while also providing stable cash flows and capital appreciation. As demonstrated in the following chart, the inclusion of US infrastructure within one’s current portfolio allocation can be a performance additive.

In looking at the recent performance of a portfolio that has moderate (~ 40%) US infrastructure exposure, it has either performed similarly or better than a 60% Equity/40% Fixed Income portfolio. The strong demand for construction equipment and services in recent years, along with the constructive legislative actions that have been passed in the US, are benefiting the industry and asset class as a whole. Recent price increases for construction materials such as steel and concrete directly boosted the top and bottom lines for suppliers through much of 2022. Although supply chain disruption translated into higher production and shipping costs for equipment manufacturers, these companies were able to pass costs along to customers to preserve margins during a period of high demand. From a legislative standpoint, the passage of the Infrastructure Investment and Jobs Act and CHIPS Act will boost domestic construction, further elevating industry stakeholders as a whole.

Investing in US Infrastructure

For investors looking to add US Infrastructure exposure to their portfolio, the following ETFs offer pure-play exposure to this asset class.

Global X U.S. Infrastructure Development ETF | Ticker: PAVE | Expense Ratio: 0.47%

PAVE seeks to invest in companies that stand to benefit from a potential increase in infrastructure activity in the United States, including those involved in the production of raw materials, heavy equipment, engineering, and construction.

iShares U.S. Infrastructure ETF | Ticker: IFRA | Expense Ratio: 0.30%

IFRA seeks to track the investment results of an index composed of equities of U.S. companies that have infrastructure exposure and that could benefit from a potential increase in domestic infrastructure activities.

First Trust NASDAQ® Clean Edge® Smart Grid Infrastructure Index Fund | Ticker: GRID | Expense Ratio: 0.63%

GRID is designed to track the performance of common stocks in the grid and electric energy infrastructure sector. The index includes companies that are primarily engaged and involved in electric grid, electric meters and devices, networks, energy storage and management, and enabling software used by the smart grid infrastructure sector.

First Trust Alerian US NextGen Infrastructure ETF | Ticker: RBLD | Expense Ratio: 0.65%

RBLD seeks to provide exposure to U.S. infrastructure companies with securities listed on recognized U.S. securities exchanges that build, operate and own infrastructure assets, across all industries and sectors.

As the investment landscape of 2023 continues to take shape, ensuring that one has a fully diversified portfolio is important. US Infrastructure provides investors with the opportunity to invest in a long-tenured asset class that is of material importance to the US economy. By having exposure to said asset class, investors are facilitating another avenue of growth in their portfolio, while also minimizing volatility from traditional asset classes.

This content was originally published by our partners at ETF Central.