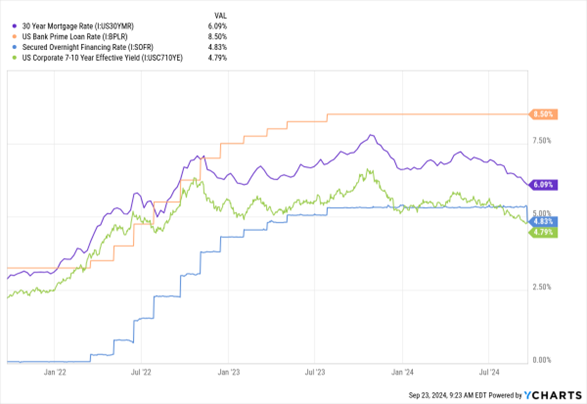

Take a look at the MoneyShow Chart of the Week below. It shows four rates – the prime rate in orange, the Secured Overnight Financing Rate (SOFR) in light blue, the average 30-year mortgage rate in purple, and the effective yield on 7-10 year corporate debt in green.

Data by YCharts

What should jump out at you right away? That borrowing costs for high-grade corporations who tap the bond market for money – and US home buyers who take out long-term mortgages – peaked LAST OCTOBER! We’ve already seen corporate debt yields drop about 150 basis points from the peak, while long-term mortgage rates have sunk about 170 bps.

At the same time, we’re only NOW seeing SOFR reflect the Fed’s cut. That means business loans, derivatives, and other financial products tied to that short-term rate are only now being repriced. The prime rate will also drop 50 bps as soon as this chart updates with one more day of data. That means rates charged on variable-rate credit cards and home equity lines of credit (HELOCs) are only now falling.

What happens next? A lot depends on what bond INVESTORS think the Fed’s recent move – and the ones it will make in the rest of 2024 and into 2025 – will mean for growth and inflation.

Right now, the market consensus is that the Fed will engineer a soft landing via its cuts...rather than fuel another bout of punishing inflation. As long as that remains the case, long-term yields can level out here while short-term rates keep coming down. That’s the ideal scenario.

But if investors start worrying the Fed is going too far, they’ll dump bonds. That will drive long-term yields higher even as short-term rates dip. That’s the NOT-ideal scenario.

Me? I remain in the Be Bold / Don’t worry so much camp. And I still like things I’ve recommended in the past, including the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT), up more than 6% in the last 90 days, and the VanEck Gold Miners ETF (NYSE:GDX), up more than 18% during that same time frame!