Income is back, but so is bond market volatility. Here, Kevin Flanagan, Head of Fixed Income Strategy at Wisdom Tree shares his thoughts on what’s on the horizon and how investors can position their portfolios to benefit from higher yields while weathering the market fluctuations that accompany Fed rate hikes.

1. The era of negative interest rates has ended, and income is back. Where do bond markets go from here?

Fixed income investors have good reason to celebrate in 2023. On March 16th of this year, the Federal Reserve’s current rate-hiking cycle eclipsed its one-year birthday. In this short time, the effective federal funds rate rose from 0.08% in early March of 2022 to 4.58% as of March 16, 2023.

Despite doling out what has felt like a relentless onslaught of hikes, the Fed might not be ready to push pause just yet. Flanagan remarked that fixed income investors should expect no shortage of bond market volatility in 2023, as the market anticipates what rate moves could be next.

“What happened in the bond market last year is only part of the story. Just look at the market over the past few months to start 2023 and the remarkable volatility it has endured.”

Flanagan pointed to the juxtaposition of February 2023’s strong U.S. jobs report and the collapse of Silicon Valley Bank as an example of mixed signals the Fed is digesting. In his testimony to Congress, Fed Chair Powell expressed dissatisfaction with the outcome of the rate hiking cycle, pointing directly to a still-too-tight labor market.

“The Fed has indicated the hiking cycle didn’t have the intended effect, which means the FOMC is willing to raise rates further and for longer than initially communicated. Don’t fight the Fed, even if it’s on the back half of a rate-hiking cycle,” noted Flanagan.

Investors seeking to benefit from higher short-term rates, who aren’t interested in running the risk of further hikes, could consider floating rate treasuries for their portfolio. “Floating rate treasuries provide exposure to higher yields on the shorter end of the curve, with very limited duration exposure and no corporate credit risk.” Flanagan, ever precise, was sure to specify, “They carry one week of duration exposure, to be exact. They’re really a hidden jewel in the fixed income world.”

For Your Research: WisdomTree Floating Rate Treasury Fund (USFR)

Flanagan finished his 2023 outlook with a cautiously optimistic tone. Although he readily admitted how perilous timing rate changes can be, Flanagan believes the current interest rate climate – one with continued upward support – may be setting the stage for bond markets to broadly benefit from softening rates later in 2023.

“We could finish with a true duration rally to close 2023.” He explained this would require falling interest rates across most maturities on the yield curve.

2. What are practical ways investors can take advantage of a higher, albeit inverted, yield curve? What might its shape signal to investors?

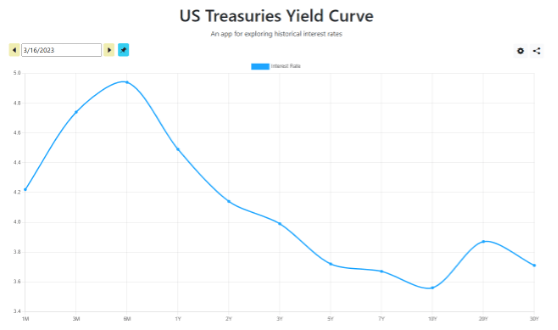

U.S. interest rates have risen broadly across all maturities, but nowhere as sharply as the short end of the curve. Traditionally, investors have taken a downward-sloping yield curve to signal recession, but Flanagan pointed to some nuances to consider in 2023.

Source: https://www.ustreasuryyieldcurve.com/

“I’m a student of history – he who doesn’t study it tends to relive past lessons – but I’d consider a few nuances this time,” Flanagan said. “The longer yield curve inversions last, the more reliable an indicator they become. This inversion is steep, but we’d wait to see it last for a longer time to mean something.”

He went on to explain the effect quantitative easing has had on how yield levels are playing out across the curve, which is unique to this hiking cycle. “During COVID-19, the Fed expanded its balance sheet from $4 trillion to $9 trillion, with a significant portion driven by repurchasing bonds with five-year maturities or longer. It has created a ceiling on what the long end of the curve can do.”

Considering the list of key risks and opportunities investors are weighing in 2023, Flanagan proposed a simple strategy to help bond investors strike the right balance: a fixed income barbell.

“Most investors are familiar with laddered bonds. You buy and hold bonds across a range of maturities. A barbell is like a laddered strategy, except you take out the middle rungs.”

To build it to spec, investors might plug floating rate treasuries into the short end of their barbell. This provides access to elevated income levels with trace duration and credit risk. Then, to populate the “long” end of the barbell, consider adding core bonds with durations just above that of the Bloomberg Barclays (LON:BARC) U.S. Aggregate Bond Index. Assuming some duration exposure positions the portfolio to benefit should rates broadly weaken in 2023.

For Your Research: WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY)

3. Low interest rates drove an entire generation of investors from bonds to equities for over a decade. What role can fixed income play in their portfolios?

Investing experiences in early adulthood shape how households manage money over a lifetime, as made famous in this research paper by the National Bureau of Economic Research. Like the research suggests, high domestic stock returns, muted inflation, and low bond yields experienced over the past decade have shaped investor preferences. Put another way, investors are used to equities being the only game in town.

“Negative interest rates have been a significant challenge for income-seeking investors, but now, you can build a more normalized portfolio at current yield levels,” Flanagan responded. “Equity investors can earn yield with greater stability by using fixed income as a diversification method.”

Investors seeking to de-risk their portfolios over a lifetime shouldn’t overlook the potential of bonds now that a state of normalcy has been reinstated. Flanagan also proposed an additional layer, one with high-yield credit exposure, to the fixed income barbell portfolio. For investors making a transition from equities to bonds, this has the potential to boost yields at an acceptable level of risk.

This content was originally published by our partners at ETF Central.