The US Dollar is Being Devalued and Americans are Investing Just To Keep Up

It’s like that dream where you run as fast you can but you’re just running in place.

The US dollar continues to lose value over time, as shown in the above graphic.

One can blame this on big government or on big, greedy corporations. If one did, they would be right to an extent.

This has two underlying reasons.

- Federal government focus on short-term needs and long-term fiscal irresponsibility.

- Central bank focus on short-term needs and long-term monetary irresponsibility.

Going deeper, politicians who are pressured to solve short-term problems by the public do so because they can.

The US dollar, and all other fiat currencies are just that, fiat. They are simply backed by an order to print money and are created out of thin air. Up until 1971, the US dollar was to some degree backed by gold. Removing any connection to a commodity and sped up how fast it gets devalued.

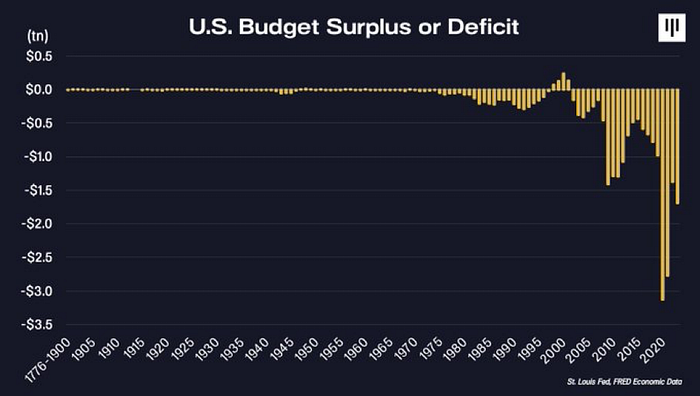

This picked up even further in 2008 as quantitative easing became a popular monetary policy, with the US government borrowing more money and sending out stimulus checks to the public. It picked up the pace even more in 2020 in response to the COVID 19 pandemic.

The more money is created, the less the value of money. If you are saving your money, your savings are made less valuable in that moment. And unlike the government or central bank, you don’t hold all this new money that made the old money less valuable. You just have less valuable money.

Before 1971, the US dollar was backed, at least in part by gold.

Until 1914, the British Pound was on the gold standard. That was cancelled to fund World War I, and briefly re-instated in a very unpopular effort by Winston Churchill from 1925–1931 before being nixed forever. Read more about the history of the British Pound here.

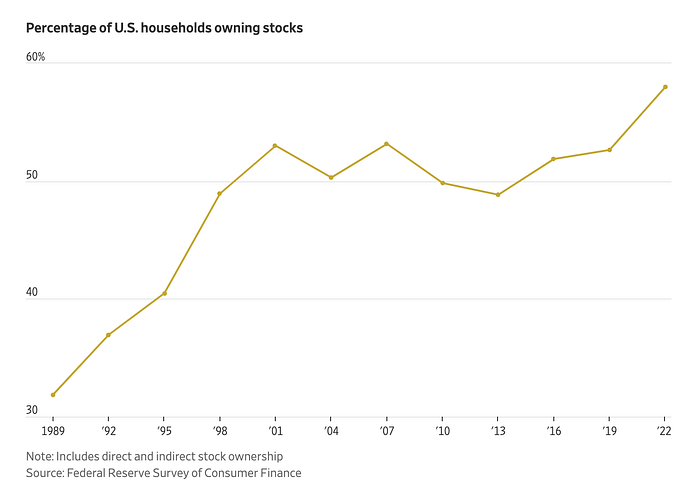

57% of Americans Own Stocks

Back to the U.S. in the current day.

To at least keep up with this devaluation, Americans have been investing more into the stock market. In other words, they’ve been forced to take on more risk to counter the greater risk — not investing and losing the value of one’s savings.

This figure does not include other popular investment targets: real estate, Bitcoin, precious metals and other alternative investments have continued to grow in popularity.

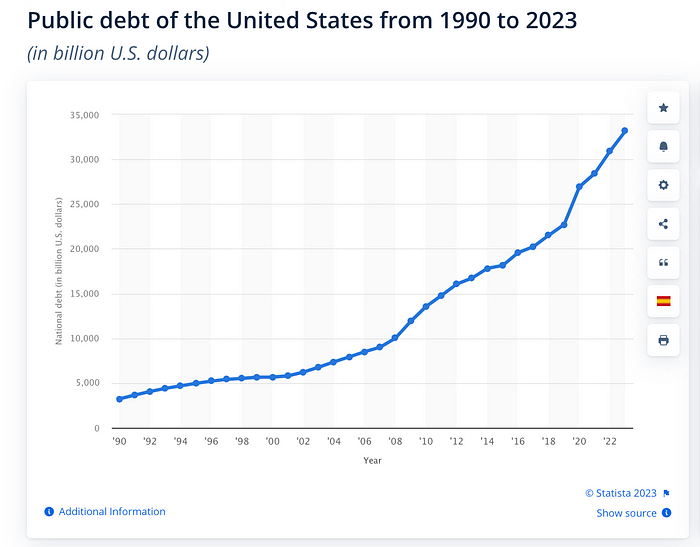

The US National Debt is Getting Worse

This problem is not going away. There was once was a time that the Federal Government actually balanced the budget. But looking at this graph, that sounds more something from a fairy tale than a history book.

The Federal Reserve and the U.S. Federal Government need to get their irresponsible spending habits reigned in, or much greater suffering could occur.

Hard Money is the Solution

When money is easy to obtain, goods and services get expensive. When money is harder to obtain, goods and services are cheaper.

By backing the US dollar with an actual thing (commodity), it would force the government to operate on three principles that every decent citizen has to:

- You have to make money before you spend it

- If you want to borrow money, you need to pay it back.

- If you need more money, you need to create more value.

I offer three potential solutions. In all three, it would involve fiscal responsibility and would likely get pushback from the current powers that be at the Fed and in the U.S. Government. If you agree with any of these, I ask that you drop something in the comments below and share this with a friend.

- Re-institute the gold standard. This would probably be the most painful and least do-able solution. It couldn’t really be done 1:1 but implemented in an intelligent way could in some way curtail spending. In other words, the Fed could not generate more money digitally or print more money unless more gold was obtained to back it. The end goal would be to back the dollar with a commodity and force the government to end endless spending. The U.S. was on the gold standard until 1971, and spending and inflation have skyrocketed since then. So returning it to prior, more fiscally responsible policy would be one solution. Gold is hard money, whereas the dollar is “soft” or “easy” money because it can be generated in an instant. But it would come with so much destruction, I don’t recommend this solution.

- Back the US dollar by the US GDP. This would involve a complex algorithm and would be difficult to implement. To work, it would need to force a cap on additional spending unless GDP was increased. Since spending is currently spiraling out of control, I would suggest that the GDP would need to outpace spending by a certain percentage until the budget was balanced. I should also note that I am aware that the revenue collected by the Department of Treasury is not the same as revenue, but percentages of this could be set up properly, and these could go up together or with GDP leading, then debt would hypothetical decrease over time.

- A New Gold Standard — Back the US dollar with Bitcoin. Now, if you’re into Bitcoin, I am probably going to lose you here. How would this actually get implemented? Good question, and I don’t think anyone has ever stated a 100% correct answer. But, here’s why. Bitcoin is hard money, like gold, but digital. It’s hard, because it takes a lot of resources to generate and in fact only 21 million will ever be created. As long as our society doesn’t bomb itself back into the Stone Age, we will have the internet, and Bitcoin is the leading candidate for the money of internet. It’s also backed by a decentralized computer network over the world that’s proven secure. No politician has figured out how to generate more than 21 million Bitcoin over the past 14 years. The same can’t be said of the US dollar. I believe implementation would include the US Treasury buying and holding Bitcoin like El Salvador has done. Like in the above two suggestions, USD would need to be tethered in some way digitally to the commodity of Bitcoin, and only so much new money could be created by how much was held.

Could this both be a national solution and an investment strategy for an individual to guard against government overspending and inflation?