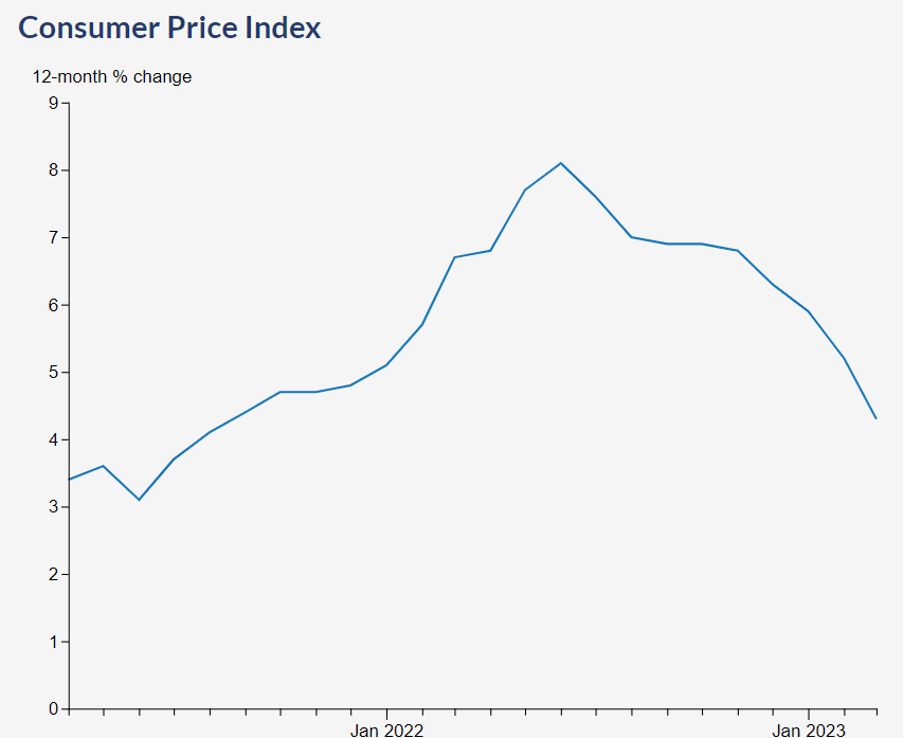

March’s inflation numbers solidified a downward trend in Canadian inflation, with the CPI coming down to 4.3%, posting the lowest growth since August 2021 (4.1%). Taken at face value, the news seems neutral to slightly positive for investors and consumers alike. Inflation has been trending down for the past 5 months and has essentially been cut in half in less than a year. Overall, this is positive on a relative basis, and the Bank of Canada (BoC) can likely take some comfort in knowing their rate hikes are having an effect (however painful for investors).

The main detractors of CPI

- The numbers were helped by a decrease in energy prices which saw gasoline fall by (13.8%) in March, and a slowdown in the price of groceries which have continued to push higher, much to the dismay of consumers and the BoC.

- Childcare and Housekeeping Services were down 14.2% YoY.

- Video equipment decreased 8.4% YoY.

Although any decrease in the rate of growth is welcomed by consumers and investors, it’s important to remember that prices are still rising, and picking up speed in some sectors of the economy.

Main contributors

- Travel tours saw a 36.7% increase since February, signalling a shift in consumer behaviour towards travel and tourism, rather than home goods.

- Homeowners’ maintenance and repairs also saw an increase YoY of 4.7%.

- Mortgage interest costs rose at the fastest pace on record (26.4% YoY).

The increase in mortgage interest costs is very significant and highlights a key aspect of the bluntness of rate hikes as a policy tool. The drastic increase in interest expense incurred by new homebuyers, or homeowners forced to renew mortgages at higher rates is fuelling the apparent inflationary fire in the Shelter sector, which makes up roughly 30% of the entire CPI Index! As more and more mortgages come up for renewal, this number will likely remain elevated and could potentially provide a floor for how low inflation can drop.

Are the official inflation measures broken?

You may have caught the use of the word “apparent” when discussing inflation, and there is a good reason for it.

As per the BoC’s own definition, interest costs are not considered inflationary forces, since they essentially act as a reduction in disposable income. Benjamin Tal, Deputy Chief Economist of CIBC (TSX:CM) Capital Markets recently came out with an analysis of the true inflationary number once mortgage interest costs are stripped out, and the true number is much closer to the BoC’s target of 2%.

That is to say, the BoC has seemingly done its job. The main question is, are they aware of this?

I’m personally leaning toward “yes”. Their recent decision to hold interest rates and observe the lags work their way through the economy is an indication that they are aware of their own definition and realize that further hikes would likely lead to deflationary forces in the economy.

It’s important to note that while the weapons against inflation are wielded by the BoC, the official tally is kept by StatsCan. This can lead to an overstatement of the actual inflation numbers which plays an important role in inflation expectations. If investors and consumers see a higher reported number (as a result of interest payments for example), they could be influenced to believe inflation will remain elevated for longer, which could lead them to ask for higher wages, further contributing to the actual inflation number.

It's a sticky situation, but so long as the BoC is aware of its own definitions, this is more of a cautionary tale for investors to look past the official numbers.

So we’ve reached the inflation target. Now what?

Assuming the actual inflation numbers are much closer to the 2% target than reported, investors have a reason to rejoice. On the one hand, it means interest charges on Margin Accounts have likely reached their peaks. That’s a relief.

It also means the BoC is much closer to a cut than another hike, which will certainly help longer-duration assets such as high-yield/corporate bonds and equities. Attempting to predict when, or if a cut is coming this year is a fool's game, but directionally speaking it will be positive for investors when it does arrive.

The BMO (TSX:BMO) Long Corporate Bond Index ETF and BMO Mid Corporate Bond Index ETF provide yields between 4.5%-5.1%, and durations ranging from 6 to 12 years, meaning that would be the expected % change in price for every 1% change in interest rates. Given the low likelihood of further rate hikes in the face of economic weakness, these two funds would be a good way to collect yield while also taking advantage of potential price appreciation.

This content was originally published by our partners at the Canadian ETF Marketplace.