This article was written exclusively for Investing.com

- Commodities are inflation barometers

- Metals, energy, agricultural commodities all point to the economic condition

- The Fed and Treasury ignore the signs

- Econometrics - An art, not a science

- Manipulating data - Weekly money supply stats disappear

In August 2020, the US Federal Reserve made a not-so-subtle change to its inflation policy. The Fed changed its 2% inflation target rate to an “average” of 2%. The central bank is willing to tolerate inflation well above its previous target before increasing the short-term Fed Funds rate over the coming years.

The tidal wave of central bank liquidity and government stimulus to stabilize the economy in the wake of the global pandemic is highly inflationary. It increases the money supply and US national debt. The Fed is taking a leap of faith when it comes to inflation, assuming it will be able to stop the rising tide of an economic condition that erodes money’s purchasing power.

Over the past months, commodity prices have been rising. Raw material prices are a barometer of inflation. Measuring inflation is a subjective art rather than a science. Commodities tell us that it is already at levels that need to be addressed with monetary policy, but the central bank continues to be highly accommodative.

If the period from 2008 through 2011 is a model for the years following the 2020 pandemic, we could be in for far higher commodity prices over the coming years. After all, the level of monetary and fiscal stimulus has been much higher in 2020/2021 than in the wake of the 2008 financial crisis.

Commodities are inflation barometers

Commodities are the raw materials that companies and individuals use each day. They are the essentials that power lives and businesses, provide nutrition and critical ingredients in products, and provide shelter via the metals, minerals, and industrial requirements for construction and infrastructure building.

Inflation is an economic condition that occurs when prices for goods and services move higher, and money’s purchasing power declines. Since commodities are essential products, they are highly sensitive to inflationary pressures. Since March 2020, commodity prices are not only signaling that inflation is on the horizon, but it is present and rising.

Metals, energy, agricultural commodities all point to the economic condition

Copper is a leader in the industrial metals and raw material sector. In March 2020, as the risk-off selling caused by COVID-19 sent prices cascading lower, nearby COMEX copper futures fell to $2.0595 per pound, the lowest price since June 2016. Since then, the red metal’s price has more than doubled.

Source: CQG

The monthly chart highlights that copper has moved steadily higher over the past thirteen months. The most recent high on the continuous futures contract was at $4.3630 in February. Copper futures were sitting near the high at the end of last week. Copper is the leader of the base metals that trade on the London Metals Exchange. Prices of LME aluminum, nickel, lead, zinc, and tin forwards have experienced dramatic appreciation over the past year as the building blocks for infrastructure are signaling inflationary pressures.

Crude oil is the leader of the energy sector. In April 2020, the NYMEX WTI futures price dropped to an all-time low below zero, and nearby ICE Brent futures fell to the lowest level of this century at $16 per barrel. The price carnage occurred as the energy demand evaporated as the global pandemic spread and social distancing guidelines caused business closures, and people hibernated to avoid the virus. Source: CQG

Source: CQG

The weekly chart illustrates the over $100 per barrel rise in the oil price from April 2020 to April 2021. Nearby NYMEX futures were just over the $62 level at the end of last week.

Grains are ingredients in the food that provide nutrition to the over 7.757 billion inhabitants of our planet. We are now at the start of the 2021 crop year in the northern hemisphere, with soybean, corn, and wheat prices at multi-year highs. Source: CQG

Source: CQG

Corn was trading at its highest price since July 2013 at the end of last week at over $6.50 per bushel. Source: CQG

Source: CQG

Nearby soybean futures at the $15.40 level are at an eight-year high. Source: CQG

Source: CQG

Wheat at over $7.10 per bushel recently reached its highest price since 2014. The primary ingredients in food have soared going into the growing and planting season for the 2021 crop. Source: CQG

Source: CQG

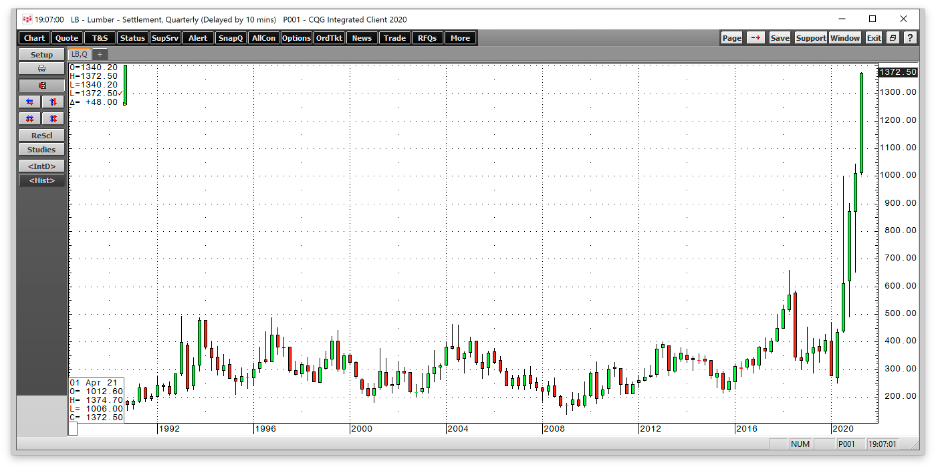

The quarter chart of lumber futures highlights that wood prices are at an all-time high at over $1,370 per 1,000 board feet.

Commodity prices are screaming that inflationary pressures are building. The price trends remain bullish, telling us that the value of money is declining.

The Fed and Treasury ignore the signs

Last year, the US Federal Reserve and government responded to the global pandemic with a tidal wave of liquidity and stimulus. The Fed funds rate remains at zero percent. The Fed continues to buy $120 billion in debt securities each month.

Source: Barchart

The June US 30-year Treasury Bond chart highlights the decline in the bond market pushing interest rates higher further out along the yield curve. The June bond fell from 183-06 in August 2020 to the most recent low at 153-29 in late March 2021. The T-bond futures fell to the lowest level since July 2019. At the end of last week, it was a lot closer to the recent low than the August 2020 high at 158-09.

The Fed has told markets not to expect an increase in the Fed Funds rate in 2021 and has not indicated any intention to taper its QE debt purchases. The Fed is ignoring the bond market. Moreover, it has turned a blind eye to rising commodity prices and other assets that continue to flash inflationary warning signs. The stock market is on an all-time high, real estate prices are soaring, and digital currencies have experienced parabolic rallies.

The dollar is the world’s reserve currency. The money supply has been rising because of the Fed’s liquidity. Meanwhile, the dollar index has been trending lower since March 2020.

Source: Barchart

The chart shows the dollar index, which measures the US currency against the euro and all other reserve currencies, declined from 103.96 in March 2020 to a low of 89.165 in early 2021. After a recovery to the 93.47 level in late March, the dollar continues its downward trend in April, closing last week below the 91 level.

The US Treasury is borrowing without abandon to fund the trillions in stimulus programs in the wake of the global pandemic. The bottom line is the Fed, US government, and other governments worldwide are ignoring the inflationary signals.

Econometrics - An art, not a science

In August 2020, the Fed made the not-so-subtle shift in the inflation target from 2% to an “average” of 2%. While PPI and CPI data indicate increasing inflation, the Fed continues down the path of accommodative monetary policy. Some of the FOMC members have said they are waiting to see “full employment” and wage growth before they act to end their dovish policies. Meanwhile, the central bank projects that US GDP will grow by 6.5% in 2021. The economic growth rate and path of monetary and fiscal policy are unprecedented.

Economics is a social rather than empirical science. Econometrics is subjective; the formulas are only as valuable as the inputs. The Fed assumes it can reserve the inflationary impact of accommodation, but that could be a leap of faith. Once inflationary pressures begin to rise, they can become a challenging beast to tame. Commodity prices are telling us that inflation has arrived. The Fed and US government could find themselves chasing inflation with interest rate hikes without the desired result. Inflation or stagflation could wind up being the pandemic’s price tag given the highest accommodation levels in history.

Manipulating data - Weekly money supply stats disappear

The US deficit is rising. The latest $2+ trillion infrastructure rebuilding package will likely push it over the $30 trillion level. The money supply continues to swell on the back of the central bank’s liquidity.

In a move that questions the Fed’s commitment to transparency, the central bank recently discontinued updating M1 and M2 weekly money supply data and will only update it monthly. In recent testimony before the US Congress, Fed Chairman Jerome Powell claimed that money does not matter because it is unrelated to inflation. If the value of money is irrelevant to inflation, what is related to the economic condition”?

Steve Hanke, professor of Applied Economics at Johns Hopkins University, recently said the move demonstrates a significant change in worldviews at the Fed. Hanke said, “In principle, they don’t think this data is important. They want to deep-six the monetarists, basically and push them off to the sidelines. They want to bury Milton Friedman once and for all and be done with it, and their preference would probably to not report any monetary statistics.”

Bonds, stocks, commodities, digital currencies, traditional currencies, real estate, and other asset prices are climbing. The US economy is growing at 6.5% or more. China just reported GDP growth of 18.3%. Inflationary signs are everywhere. What will be the Fed’s next move? Perhaps redefining inflation would be another approach to masking the condition.

Time will tell if the approach to stabilizing the economy is only increasing COVID-19’s price tag. Markets could be in for a rocky road as high prices hit consumers over the coming months. Markets reflect the political and economic landscapes. We are at a dangerous juncture with an inflationary fire smoldering. Be careful in markets; volatility is on the horizon. Central banks and governments could be out of ammo when they finally decide to deal with the pressures they currently choose to ignore.