A slightly lower-than-expected rate of inflation last month shows that the Federal Reserve's rapid interest rate hikes are yielding results. Treasury yields stabilized amid growing bets on a Fed pause after the 10th-straight month of headline inflation declines. With signs of slower economic growth and the banking sector turmoil, it would be surprising if the central bank opts for an eleventh-rate hike in June, even if the U.S. created more jobs than expected in April. Fed funds futures contracts are even pricing in a first rate cut in Q4 2023 and now see the year-end rate near 4.50%. Meanwhile, credit-default swaps on Treasuries were on the rise, suggesting that worries about a U.S. default are growing if no agreement can be reached on the debt ceiling in the coming weeks.

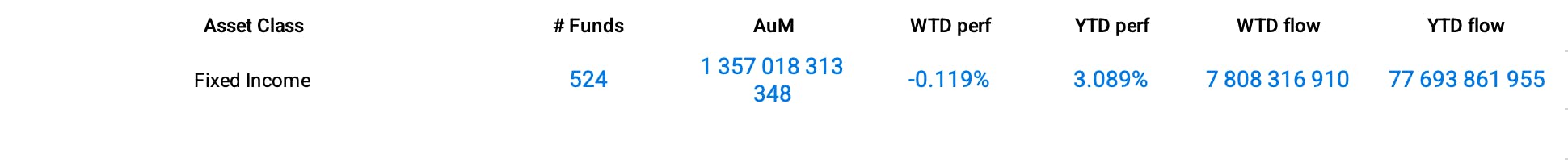

Against this backdrop, the 10-year Treasury yield hovered around 3.47% while the yield on the 30-year Treasury note was flirting around 3.79%. U.S. bond ETFs continued to witness large inflows: $7.8 billion for the week, twice higher than inflows in equity ETFs, and almost $78 billion since the beginning of the year (2.5x inflows in equity ETFs).

Group Data

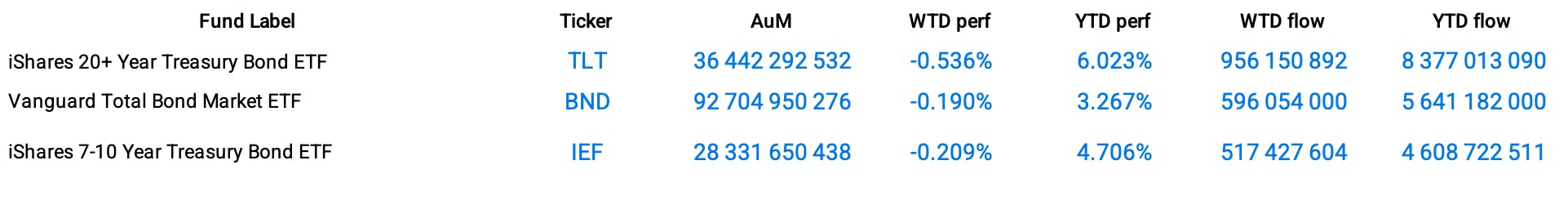

Funds Specific Data

This content was originally published by our partners at ETF Central.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI