Intel Corporation (NASDAQ:INTC) finds itself in the midst of one of the most complex transformations in the company's history.

Once the cornerstone of personal computing, Intel now faces the twin challenge of overcoming years of execution missteps while reimagining itself for the age of the AI.

New leader Lip-Bu Tan, who brings years of semiconductor experience to the helm, has Intel doubling down on domestic production, AI-focused computing, and full-stack foundry strategy that's intended to reduce reliance on competitors like TSMC. Yet with profitability being attacked and the competition heating up, investors are right to ask: is Intel's transformation rooted in substance or wish?

While the stock has stabilized in recent months, the fundamentals remain polarized. Revenue has begun to recover, product segments are picking up steam, and Intel is reaping strategic victories from the CHIPS Act. Yet earnings remain weak, cash flow remains spotty, and its core data center segment continues to slip.

Here's a dive into Intel's business segments, strategic shifts, fundamentals, and valuation landscape to determine if the turnaround thesis has legsor if you should just buy the excitement.

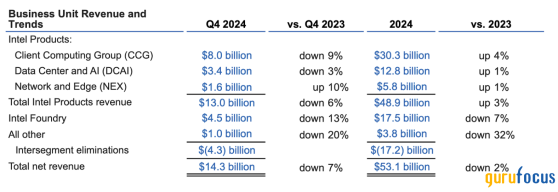

A Closer Look at the Business: PCs Powered by AI, Data Centers, and Edge ComputingIntel's Client Computing Group (CCG) reported Q4 2024 revenue of $8.0 billion and operating income of $3.1 billion on a margin of 38.1%. That was the highest profitability by the segment in one year and came as the company gains growing traction in the segment for AI PCs. Intel's on-device effort for AI is resonating as more than 200 independent software vendors now enable more than 400 AI features. Intel expects by the end of the year in 2025 that it will have shipped more than 100 million AI PCsled by the Panther Lake architecture that launches in the second half of the year.

Data Center and AI (DCAI) continues the more complex segment. Revenue came in flat at $3.4 billion, yet the operating margin fell all the way down to 6.9% as AMD (NASDAQ:AMD)'s EPYC product line and Nvidia (NASDAQ:NVDA)'s leadership in the data center take their toll. Intel's counter measures the two Gaudi 3 AI accelerators and competing road map that leverages MRDIMM memory and enhanced Xeon platforms. Preliminary feedback from the newly-formed x86 Ecosystem Advisory Group is positive, yet Intel has work yet to do if it's going to shore up server-side market share.

Network and Edge (NEX) was the standout, earning $1.6 billion in revenue on 20.9% operating marginsits highest ever. The segment benefited from demand for industrial automation and edge AI, supported by the launch of Intel's Core Ultra processors at CES. Again smaller in absolute terms, the consistent margin growth in NEX offers a template for what scalable AI-driven growth looks like across Intel's portfolio.

Source: Intel's Earnings Release

Market Share, Execution, and the AMD DilemmaIntel's turnaround does not occur in isolation. AMD's expansionled by its Ryzen 9000 linehas propelled client CPU marketplace share well above 40%, up roughly 20 percentage points year-over-year. That's the direct result of Intel's blunders around its 13th and 14th Gen CPUs and the lukewarm reception for Arrow Lake-S. Intel still dominates volume based on deep OEM relationships, but the performance gap within the client and workstation markets has narrowed.

In the datacenter segment, the pace-setters are still AMD and Nvidia. AMD's server penetration increased above 24% towards the end of 2024, and Nvidia's AI accelerators dominate training workloads within hyperscale. Intel continues to establish Gaudi platform momentum and depends on a broad-based x86 strategy to dominate inference and custom silicon. Intel's potential reclamation of technical leadership based on the upcoming release of Panther Lake using Intel's internal 18A process will hinge on meeting yields and performance targets.

Its domestic production strength is where Intel shines. Its expanding foundry presence in the U.S. and Europepartially funded by the $7.86 billion CHIPS Act subsidymakes the company a trusted partner amid geopolitical tension. Execution there, however, is key. Foundry clients won't hesitate to switch if Intel gets quality wrong, misses deadlines, or prices inaccurately. Its break-even target in foundry operations by 2027 speaks to just how long the journey there might take.

Financial Deep Dive: Stabilization or Short-Term Fix? Intel's Q4 results appear strong on the page. Revenue was $14.3 billion, up by $500 million versus guidance. Non-GAAP EPS were $0.13 and gross margin sequentially grew to 42.1%. Free cash flow for the year were positive at $8.3 billionerratic versus history. GAAP net losses remained a whopping $18.8 billion in 2024 driven by write-offs, restructuring charges, and worse-than-expected results in core operations.

Profitability figures are grim. Operating margin is -8.9% and net margin -35.3%. Return on equity (ROE) stands at -17.8% and Intel's return on invested capital (ROIC) remains negative. These figures reflect not only pressures in the immediate term but also the longer-term challenge of scaling monetization. DCAI continues to dilute overall profitability and foundry operationsstrategically essentialare unprofitable today.

Cost discipline remains the focus. Intel has begun the process of simplifying the operations, and OpEx declined by 9% YoY in Q4. Capex remains elevated due to fab builds and EUV tooling, yet "Smart Capital" partnerships and government support offset the cost. Intel will begin deleveraging in 2025, which would improve investor confidence if accompanied by consistent margin growth.

Source: Intel's Q4 Earnings Presentation

Valuation Scenario: A Story of Concealed PotentialIntel's valuation suggests the market is in wait-and-see mode. It trades on a forward P/E of 49.1xhigh by historical norms but artificially so as earnings are depressed. Much more insightful are Intel's price-to-sales (1.92x) and price-to-book (1.06x) levels that are at or very near all-time lows. Its EV-to-EBITDA is at 114x both due to the low base earnings as well as the patience of investors.

Intel has been assigned a GF Value of $26.54 by GuruFocus and rated "fairly valued" by the GF Value Rank of 9/10. Modest upsidepossibly 1015%if Intel does execute on the road map is indicated by the valuation line. That said, the price-to-cash flow (12.6x) and the price-to-tangible-book (1.48x) indicate the skepticism the market has about Intel's ability to convert revenue into sustainable cash flow. Intel's valuation continues to depend on execution and margin turnaround with negative ROIC and little operating leverage.

DCF models that assume modest 810% revenue CAGR growth, gross margin rates returning to 50%, and positive free cash flow by 2026 suggest intrinsic value in the $3035 per-share range. Any slip in 18A, foundry customer wins, or AI PC adoption would quickly narrow that range.

Final Lesson: Strategic Depth with High-Reward and High-Risk Intel finds itself in the middle of a multi-year journey that balances cost discipline, geopolitical opportunity, and innovation. While profitability now is unimpressive and the competition fierce, investments in next-gen silicon, domestic foundry capacity, and AI hold out patient investors' long-term potential. While the stock is fairly priced today, potential upside hinges on deliveringnot promisinga return to operational greatness.

This content was originally published on Gurufocus.com