Palantir Technologies (NASDAQ:PLTR) continues to solidify its position as a market leader in AI and data analysis.

Palantir’s Q4 2024 results featured stunning growth in revenues, all-time contract victories, and enhanced profitability, solidifying its position in the commercial as well as the government market.

Despite the strong bull run the bullish run is firmly in place with the support from the U.S. commercial adoption as well as rising enterprise-level demand for Palantir’s AI solutions.

Q4 2024: Record-Breaking PerformancePalantir delivered a blowout quarter, beating estimates in all the key metrics. Revenue reached $828 million, a 36% year-over-year growth and 14% sequential growth. Excluding the effect of the strategic contracts, the revenue grew 39% year-over-year as the demand for its AI-driven enterprise solutions remained strong.

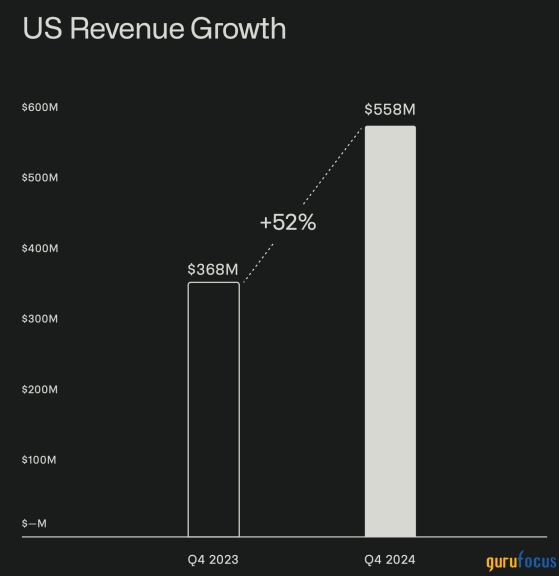

The star of the quarter was the U.S. commercial segment of the company, which grew 64% year-over-year and 20% quarter-over-quarter to $214 million. Palantir’s government sector also fared exceedingly well, with U.S. government revenues rising 45% year-over-year and 7% quarter-over-quarter to $343 million. U.S. revenues as a whole rose to $558 million, 52% higher compared with the same quarter last year.

Source: Palantir Q4

Beyond top-line expansion, Palantir also hit new value levels in terms of contracts. Palantir booked 129 deals with $1 million or more in value, 58 with $5 million or more, and 32 with $10 million or more. U.S. commercial total value under the terms of the contracts reached $803 million, 134% year-over-year growth and 170% growth from the fourth-quarter. These numbers illustrate Palantir’s transition from a government-based base of revenues toward a more diversified base of commerce.

Profitability also improved significantly. Adjusted operating income for Q4 came in at $373 million, representing a 45% margin, while full-year adjusted operating income reached $1.13 billion with a 39% margin, up 1,100 basis points from the previous year. Free cash flow remained a major highlight, with $517 million in adjusted free cash flow during the quarter and $1.25 billion for the full year, translating to a 44% margin. The company ended the year with $5.2 billion in cash and no debt, positioning it well for future expansion.

Growth Drivers: Why Palantir’s AI Growth Is Not Yet OverPalantir’s AI-driven solutions are spreading rapidly across verticals such as defence, energy, healthcare, finance, and manufacturing. It is being utilized by organizations to optimize processes as well as ensure more efficiency.

For example, the Cleveland Clinic used Palantir’s AI to reduce emergency department wait times by 38 minutes as well as reduce the down times of its operating rooms for orthopaedic procedures by 40%. Anduril enhanced the supply chain management 200x with Palantir’s Warp Speed AI, while Rio Tinto (LON:RIO) extended the deal with Palantir to optimize the use of automated trains. The U.S. government is also the backbone of Palantir’s business, with multi-year renewals of contracts with visibility of revenues.

Palantir extended its U.S. Army Vantage relationship for four more years and reached FedRAMP High Authorization, which also expands its ability to work with federal agencies. U.S. government revenues grew 30% year-over-year in 2024 to $1.2 billion, cementing Palantir’s long-term position as a trusted provider in the areas of defense and intelligence.

Lastly, Palantir’s U.S. commercial business keeps growing at a breakneck rate with year-over-year annual revenues rising 54% at $702 million. Palantir’s U.S. commercial base grew five times in the last three years. Deal value remaining in the U.S. commercial market grew 99% year-over-year at $1.79 billion, indicating notable visibility for revenues in the future. Therefore, Palantir’s enterprise adoption continues accelerating, which would indicate commercial growth as a significant contributor to revenues in the future.

Is Palantir Still Worth Buying?Palantir’s valuation remains a key point of contention. With a price-to-sales (P/S) ratio of 86x, the stock trades at a significant premium to most AI and software peers, even surpassing high-growth companies like Snowflake (NYSE:SNOW) and Nvidia (NASDAQ:NVDA). The company’s price-to-earnings (P/E) ratio of 533.42 and forward P/E of 184.27 suggest that Palantir’s current valuation is heavily reliant on expectations of future growth and profitability expansion rather than present earnings power. Other valuation multiples, such as price-to-book (PB) at 47.36 and price-to-free-cash-flow (P/FCF) at 219.37, further indicate a stretched valuation.

However, Palantir’s Rule of 40 score of 81% is a standout metric that justifies its premium. The Rule of 40, which measures a company’s revenue growth and profitability combined, shows that Palantir is far ahead of its historical performance and most software peers. This significant jump from 38% in Q2 2023 to 81% in Q4 2024 suggests the company is becoming more operationally efficient while maintaining high growth.

Source: Palantir Q4

Palantir’s financial strength remains solid, with $5.2 billion in cash, no debt, and a free cash flow margin of nearly 40%, which reduces financial risk despite its high valuation. While traditional valuation metrics flag the stock as expensive, its improving profitability, expanding commercial adoption, and dominant AI positioning support the bullish thesis.

Investors should be aware of overbought conditions, as indicated by the 14 day relative strength index (RSI) of 53, signaling that a short-term pullback could be imminent. While long-term growth potential remains intact, Palantir must continue delivering high-margin growth and expanding its total addressable market (TAM) to justify its valuation further.

Risks: What Can Damp the Bull CaseDespite its strong fundamentals, Palantir is also vulnerable. A significant risk is geographic concentration of revenues. Though U.S. revenues continue their meteoric ascent, expansion in Europe is underwhelming at just 4% year-over-year. Inability to have meaningful international expansion would limit Palantir’s long-term growth. Competition is also a considerable risk. Upstart (NASDAQ:UPST) rival AI model DeepSeek is gaining considerable market shares with ultra-low-cost models.

Palantir’s pricing power is at risk of being pressured with the bigger commoditization of AI. Palantir’s investors also have to keep in mind the point that the stock is in the overbought state. Though the long run is bullish, investors can be prepared for the short run’s volatility.

TakeawayPalantir’s explosive growth, rising profitability, and AI dominance fuel its momentum, but rich valuation and overbought levels warrant caution. Long-term potential remains strong, but near-term pullbacks could offer better entry points.

This content was originally published on Gurufocus.com