Interactive Brokers (NASDAQ:IBKR) is a global leader in the brokerage industry, renowned for its innovative technology, cost-efficient operations, and ability to adapt to dynamic market environments. The company offers access to over 150 markets worldwide and caters to a diverse client base, ranging from institutional investors to advanced retail traders.

In my previous analysis, I highlighted the company's ability to navigate the challenges posed by declining interest rates while leveraging its competitive advantages to drive growth. I also emphasized the significant impact of rate cuts on its net interest income (NII), with management estimating a $64 million reduction in annual NII for every 25 basis points (bps) cut. At the time, a 75 bps rate reduction was forecasted through the end of 2025, creating a considerable headwind for revenue. However, the rate outlook has since shifted with only one 25 bps cut in late 2024, and current expectations now suggest just one additional 25 bps reduction in 2025. This revised rate environment eases some pressure on the company's interest-sensitive income streams.

While lower rates challenge NII, the company's diversification of revenue streams, including commissions and trading-related activities, provides some insulation. Strategic initiatives such as expanding trading hours, introducing Forecast X exchange, and enhancing retail-friendly platforms underscore its growth potential and reinforce its appeal across its client base.

In this article, I will explore the key metrics and developments that shaped Interactive Brokers' performance in Q4 2024.

Strategic Initiatives and Competitive PositioningInteractive Brokers is a global leader in the brokerage industry, renowned for its innovative technology, cost-efficient operations, and ability to adapt to dynamic market environments. The company provides access to over 150 markets worldwide and caters to a diverse client base, ranging from institutional investors to advanced retail traders. Its Trader Workstation platform and automation-driven low-cost structure make it a standout choice for professional and active investors.

Interactive Brokers distinguishes itself with its multi-currency platform, allowing clients to trade across global markets without incurring conversion fees, an invaluable feature for international investors. Additionally, its wide range of account types enhances user flexibility. For example I recently opened a Family Advisor Account, which enables me to manage multiple family portfolios. With this, I opened accounts for some of my family members through my Family Advisor Account, managing their portfolios with their full permission. This type of feature fosters a sticky ecosystem that encourages users to consolidate more of their financial activities within the Interactive Brokers platform. There are still areas for improvement, but in my opinion, it demonstrates how Interactive Brokers is ahead of the competition, offering these features at a lower price.

Beyond its core offerings, the company has made strides in innovation, creating Forecast X exchange, which allows trading on measurable outcomes, such as political or economic events. Regulated by the CFTC, this new asset class reflects Interactive Brokers' commitment to offering unique and forward-thinking investment opportunities. Another significant broker now offers access to IBKR's exchange, and I believe other brokers could follow this path. I believe the Forecast X exchange will gain broader adoption as it starts to attract more brokers and clients.

In Q4 2024, retail clients drove the fastest account and client equity growth for the company, reflecting its success in broadening appeal beyond institutional investors. Recent upgrades to its mobile and desktop platforms have made Interactive Brokers more accessible to retail traders, allowing it to compete effectively with retail-focused platforms like Robinhood (NASDAQ:HOOD). At the same time, the company maintains its premium brand image by continuing to serve institutional investors with advanced tools and services.

Q4 2024 Performance PreviewInteractive Brokers closed 2024 with strong results, solidifying its position. The company reported $1.39 billion in revenue, a 22% year-over-year (YoY) increase, and exceeded Wall Street expectations by delivering an EPS of $2.03, $0.19 above consensus estimates.

NII reached a record $807 million for the quarter, despite the impact of a single 25 basis point rate cut in late 2024. The quarter benefited from increased margin borrowing and higher segregated fund balances from strong customer deposits driven by a continued risk on environment. With only one additional 25 bps cut anticipated in 2025, the rate environment now appears more favorable for Interactive Brokers' NII than previously expected, alleviating some of the pressure on NII.

Commission revenue grew by 37% YoY, continuing to benefit from higher trading volumes and options activity. This diversification of revenue streams, particularly through trading-related fees, has allowed Interactive Brokers to offset much of the impact of the declining interest rate environment.

The company also demonstrated operational efficiency, with execution, clearing, and distribution fees rising by 15% YoY, well below the pace of revenue growth.

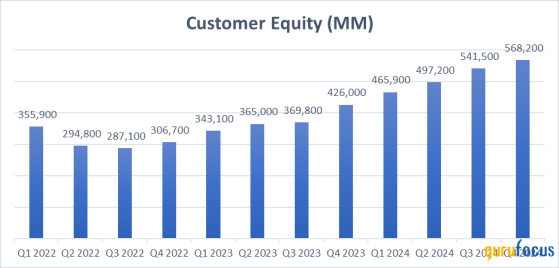

Customer growth remained robust during the quarter, with individual accounts and client equity continuing to drive momentum. Customer equity rose 33% YoY to $568.2 billion, outpacing account growth due to larger deposits and market revaluations. Daily average revenue trades also surged by 61% YoY to reach 3.1 million, supported by strong activity in options trading, which has been a critical driver of growth.

Source: Author

One of the significant drivers of client equity momentum, in my opinion, is the convenience of trading overnight hours. Interactive Brokers offers more than 10,000 US stocks and ETFs during overnight hours and is poised to offer options and futures once exchanges extend these hours. Although somewhat behind in cryptocurrency, IBKR currently offers only four coins: Bitcoin, Ethereum, Stablecoin, and Bitcoin Cash. Efforts are underway to increase this number to attract more customers, though regulatory constraints are a factor.

The balance sheet remains in a healthy state, with leverage and liquidity metrics well within acceptable ranges. There are no share repurchase plans in the immediate future, which I believe is mainly due to the current stock price; therefore, management has opted to increase the dividend.

Valuation & RisksInteractive Brokers is well-positioned for growth, but there are several risks to consider, primarily relating to interest rates and economic conditions. The improved interest rate outlook marks a significant shift from earlier in the year. With only one further 25 bps cut now anticipated for 2025, the company faces a more manageable macroeconomic landscape. Typically, a higher rate environment is better for NII margin. However, I think there might be more than one cut in 2025, although I estimate these cuts will be offset by increased commission revenue as traders become more active in a risk-on environment under the current administration.

Interactive Brokers operates in a competitive environment, with key players such as Charles Schwab (NYSE:SCHW) & TD (TSX:TD) Ameritrade, and Robinhood competing for market share. While Interactive Brokers has a clear edge in serving institutional clients and advanced retail traders, competitors continue to innovate and expand their offerings. The company must consistently differentiate itself through technology, cost efficiency, and unique products like the Forecast X exchange to maintain its leadership position.

While the company's automation-driven cost structure and innovative product pipeline provide it with a durable advantage, its ability to adapt to evolving market conditions and client needs will be critical to sustaining growth.

Source: Author

From a valuation perspective, Interactive Brokers currently trades at a price-to-sales (P/S) ratio of 4x, with a forward P/S of 3.8x, compared to industry peers' averages of 5.2x and 4.2x, respectively. Its price-to-earnings (P/E) ratio stands at 29.7x, with a forward P/E of 26x, which contrasts with the industry average of 31.4x and 19.3x. This divergence between Interactive Brokers' current and forward P/E compared to the industry suggests that the company is valued fairly but might lack the growth premium of some competitors.

The PEG ratio of 1.4x indicates that the company offers a reasonable valuation relative to its growth prospects. Additionally, its price-to-book (P/B) ratio of 4.9x aligns closely with industry peers, further supporting the case that the company is trading near fair value.

Source: GuruFocus

Compared to its historical value the company is trading at a higher P/E and forward P/E ratio. Last time, Interactive Brokers' was trading at around this multiple was after 2021. However, bear in mind that since then the stock has risen over 185%.

My Final TakeInteractive Brokers has demonstrated growth and adaptability in a competitive industry. Its commitment to low-cost, technology-driven access to global markets, along with innovative products, positions it as a leading brokerage. These unique features enhance user engagement, making Interactive Brokers a broker of choice for many investors

Given its strong market position, I view IBKR as fairly valued, possibly leaning towards overvalued. Potential upside could come from further market share gains, volume increases, and strategic innovations. Despite potential headwinds from interest rate changes, IBKR remains a stable long-term investment.

This content was originally published on Gurufocus.com