Robotic surgical systems provider Intuitive Surgical Inc. (NASDAQ:ISRG) has been one of the hottest stocks over the past year, consistently notching higher highs and many from the Wall Street punditry expecting more upside ahead. Moreover, recent quarterly updates show that surgery volumes have remained resilient, defying expectations of a potential slowdown from a drop in pandemic-related patient backlogs. Additionally, the early success of the next-generation Da Vinci 5 robotics system has exceeded expectations, extending the company's long-term growth potential. Given the powerful rally in recent months, though, the stock appears fairly valued, with much of its growth potential already factored into its current price.

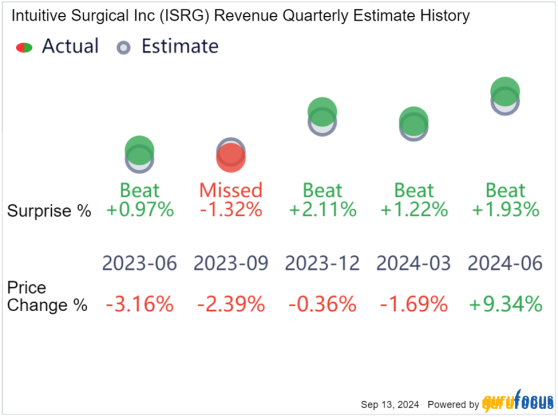

Recent financials and business updates continue to impress Intuitive's latest quarterly results have been impressive, laying concerns over the fading pandemic-related backlog to rest. On the top-line front, the company has recorded comfortable beats over the past three quarters.

The company has consistently outperformed earnings expectations in recent quarters, with beats ranging from 3.02% to an impressive 40.72%. In the most recent quarter, the company beat estimates by 14.69%, following a robust 32.11% surprise in the preceding quarter.

The key takeaways from its second-quarter performance are clearly showcased in the summary below. Its results reflect powerful growth, with a 17% year-over-year bump in procedures along with 14% growth in the Da Vinci system's installed base. It placed 341 new Da Vinci systems, contributing to an impressive 14% increase in sales to $2.01 billion.

Perhaps the biggest highlight was its superb 70% gross margin, where many were forecasting a potential slowdown with the scaling of Da Vinci 5 systems. As such, we can conclude the company's procedure growth is now primarily fueled by fresh demand rather than the clearing of its pandemic-related backlogs. As we look ahead, the procedure growth forecast for the year is at an exciting 15.50% to 17%, adding to its long-term bull case.

Source: Intuitive Surgical's second-quarter earnings deck

Moreover, there is much to get excited about in Intuitive's future, spearheaded by the groundbreaking Da Vinci 5 system. Marked by enhanced precision, imaging, efficiency and ergonomics, along with advanced analytics, the new system appears to be a major upgrade over its predecessors. Eight systems were placed during the first quarter and 70 more were added in the following quarter, which indicates healthy demand, though supply constraints are expected through mid-2025. The new system also attracts a 30% higher average selling price, offering a robust tailwind as supply increases.

Exceptional profitability metrics continue powering future growthPerhaps one of the key factors fueling Intuitive's bullish outlook is its stellar profitability and financial profile, a snapshot of which can be seen below.

We can see that Intuitive boasts exceptional profitability metrics, with a gross margin of almost 67% and an operating margin of 26%, comfortably ahead of industry averages. What's exceptional is that, despite multiple new product iterations, it has consistently maintained margins in the 65% to 70% range over the past several years. Moreover, its net margin of almost 28% underscores its superior cost control and efficiency operations, along with an ability to convert revenue into profits at a stellar rate. Additionally, the company demonstrates excellent capital efficiency with a return on equity of 15.77% and a return on assets of 13.68%.

Moreover, the company's financial strength has grown remarkably thanks to consistent profits and zero debt, offering ample flexibility for future investments, acquisitions and navigating downturns. Additionally, with its debt-free status and robust equity-to-asset ratio of 0.88, it can effectively allocate capital strategically without the burden of interest obligations.

Further, a DuPont (NYSE:DD) analysis offers an even deeper breakdown of Intuitive's ROE, which is 14.77%. A key component of the heartening results is its asset turnover of 0.50 times, underscoring its efficiency in using assets to generate sales. Additionally, its equity multiplier of 1.17 reflects a conservative use of leverage.

Moreover, its operating margin of 24.80%, layered with low tax and interest burdens, adds to the company's operational and financial management. Overall, this decomposition highlights Intuitive's ability to sustain top and bottom-line growth without a reliance on debt.

Moreover, forward-looking statements suggest Intuitive is poised for vigorous growth over the next three years, with key metrics pointing to a remarkable future. Revenue is projected to grow from $8.09 billion this year to $10.83 billion by 2026, reflecting a cumulative increase of 33.87%. On an annualized basis, this revenue growth rate comes in at roughly 15.08%.

Similarly, its earnings per share is expected to grow rapidly, rising from $5.71 in 2024 to $8.94 by 2026, marking a colossal 56.55% increase. This implies an annualized earnings growth rate of a spectacular 16.41%. Therefore, it arguably remains the pick of the high-performing players in the health care space.

The stock seems fairly pricedIntuitive Surgical has a lot going for it, as evidenced by the stock's impressive surge over the past year. Consequently, we have seen plenty of momentum behind it across multiple time frames, beating the S&P 500 by massive margins. However, with the shares trading near all-time highs, many, including myself, feel it has run too far and is now priced to perfection.

The current price of around $494 is ahead of the average target by roughly $4, but notably higher than its GF Value of $439.30, indicating substantial overvaluation. The sizeable gap between the GF Value and current price implies most of the growth potential for the stock is priced in. Though the high target of $586 remains an outlier, multiple analysts have recently upgraded or issued new buy ratings for the stock. A major outperformance or other positive catalysts could potentially push the stock higher, but in all likelihood, it seems ripe for a correction.

Further the Peter Lynch chart for Intuitive throws more weight behind the overvaluation argument. The current stock price (blue line) drastically exceeds both the Peter Lynch earnings line (black line), based on a price-earnings ratio of 15, and the red line, which represents the stock's price at its median price-earnings ratio of 45.20 over the past 15 years.

The massive disconnect between its price and fundamental valuation metrics suggests the stock trades at a sizeable premium relative to its historical averages. Hence, with the stock trading significantly ahead of key benchmarks, it further highlights Intuitive is priced for perfection, meaning any underperformance or failure in meeting growth expectations should result in considerable downward pressure.

Moreover, the following chart highlights Intuitive's lofty price-earnings ratio of 84.88, which significantly trumps its peers. Though many of its peers are trading at a remarkable premium, the company's elevated ratio comfortably trounces them by significant margins. Intuitive's current price-earnings ratio signals high investor expectations, leaving little margin of safety.

Source: Author's own compilation based on historical data

TakeawayIntuitive Surgical has had a monumental run, mainly driven by its encouraging results, which is reflected in its rising stock price and powerful financial performance. The company's fundamentals remain strong with a 17% year-over-year increase in procedure growth and a 14% gain in the Da Vinci system's installed base, along with consistent earnings beats. The next-generation Da Vinci 5 system, featuring enhanced precision and efficiency, adds long-term growth potential, though supply constraints will likely persist through mid-2025.

Further, the company has exceptional profitability with gross margins near 70% and strong ROE and ROA figures, backed by zero debt and superior financial management.

Nevertheless, the stock appears overvalued, trading significantly above its GF Value and historical valuation metrics, as shown by its Peter Lynch chart and a lofty price-earnings ratio of 84.88. Though multiple analysts foresee potential upside, Intuitive's current pricing leaves little margin for error.

This content was originally published on Gurufocus.com