The saying that ‘everything is bigger in Texas’ is often in reference to the enormity of the state’s geographical area, but that phrase may take on new meaning when thinking about the economic growth and increasing number of firms relocating to the Lone Star State in recent years. The Texas Capital Texas Equity Index ETF (Ticker: TXS) is a recently launched fund that aims to capitalize on Texas’s economic growth by investing in publicly listed companies headquartered in the state. In this article we’ll highlight why the Texas business environment has become increasingly attractive for firms and how this new solution will reflect a diversified offering of companies.

A compelling business environment

Based on recent reporting done by Forbes, Texas is the headquarters of 55 Fortune 500 companies as the state has become a preferred destination for many businesses choosing to relocate, particularly those formerly residing in California. But the allure of the Lone Star State is not its cowboy culture, but the compelling business environment it has, specifically in regard to taxation. Compared to California, Texas offers more attractive tax rates and, notably, no personal or business income tax.

Beyond taxation, the infrastructure landscape of Texas is among the most developed in the nation, with diverse transit options, including roadways, highways, and seaports. Regarding the latter, the Port of Houston is regarded as a top ranked U.S. port in foreign waterborne tonnage (2022: 220.5 million short tons) and the second ranked U.S. port in terms of total foreign cargo value (2022: $240.1 billion). By having a strong and versatile infrastructure network, tangential industries such as Manufacturing are also able to thrive. It is therefore no coincidence that Texas is the second largest manufacturing state, with 17,637 manufacturers employing 1,088,582 workers as of 2022. This is noteworthy, as Texas has been the state with the highest value of exports since 2011.

Finally, no business can grow without the requisite talent and expertise in its workforce. There is a growing technology and innovation talent pool in Texas that is an additive element for companies choosing to relocate there. The city of Austin has a thriving technology hub and the University of Austin is regarded as having one of the best engineering programs in the nation, supplying a steady stream of talented graduates to the workforce.

Furthering the state’s scientific reputation is the Texas Medical Centre located in Houston. It is the largest medical complex in the world and at the forefront of advancing life sciences, while Dallas-Fort Worth features a robust network of aerospace and information technology companies. This abundance of skilled professionals has made areas like Austin, Houston, and the Dallas-Fort Worth Metroplex a prime consideration for companies looking to relocate.

Capitalizing on the economic attractiveness of the state

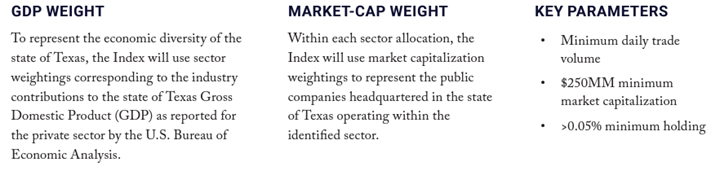

While the notion of an ETF’s investment strategy being primarily based on where publicly listed companies choose to be headquartered sounds simple, the underlying rationale and approach have merit. The Texas Equity Index ETF will mirror the Texas Capital Texas Equity Index. The methodology of the index is to use sector weightings corresponding to the industry contributions to the state of Texas Gross Domestic Product (GDP) as reported for the private sector by the U.S. Bureau of Economic Analysis. Within each sector allocation, the index will use market-capitalization weightings among the public companies headquartered in the state of Texas operating within the identified sector. The fund includes more than 200 publicly listed, Texas-headquartered companies.

The parameters of the index are as such:

Investing in Texas and its growth

As data from the 2022 YTexas Relocation Tracker report shows, in 2021, 62 corporations relocated their headquarters to Texas. These companies relocated from 17 states and three countries. For investors interested in the Texas Equity Index ETF, the success of the mandate is highly predicated on the economic, technical and societal developments currently occurring within the state of Texas, continuing into the future in a progressive manner, so that firms will continue to move there or that new enterprises will arise over time and achieve industry leadership.

For investors that believe that the current trend will continue into the future, this solution is an excellent avenue to gain exposure to a diverse offering of companies, whereas individuals that may take an alternative viewpoint on this trend can view this mandate as a unique thematic component of their portfolio that has the potential to provide strong returns in the near and medium-term investment timeframe.