On March 28, the Canadian Department of Finance (on behalf of the Government of Canada) unveiled its Annual Federal Budget.

The budget covered a variety of socio-economic points of interest including supporting the middle class, investing in health care and launching a new affordable dental care program, taxation updates, and debt management strategies among others.

Despite the broad range of topics, here we focus on the Federal Budget’s “Made-In-Canada Plan” of affordable energy and growing the clean/green economy.

Greening the Canadian Economy

In June 2021, the Government of Canada launched The Canadian Net-Zero Emissions Accountability Act in which the country pledged to achieve net-zero emissions by 2050—a lofty goal to say the least. “Net-zero” entails that the country’s economy will either emit no greenhouse gas (GHG) emissions OR is able to offset its emissions through actions such as planting trees or carbon capture technologies.

Canada is not the only country to pledge to net-zero, in fact, over 120 countries have committed to net-zero emissions by 2050, including all other G7 countries—a global acknowledgement of the urgency needed to combat climate change.

While this overarching goal sounds nice, there needs to be a concrete game plan in which the country will achieve these goals, while also balancing the maintenance of economic prosperity as we navigate through this high inflation/interest rate period of our lives.

Federal Budget’s Moves

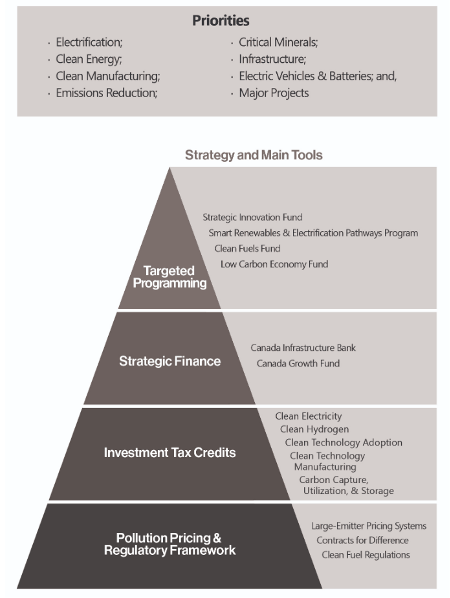

The country’s goal is anchored by a regulatory framework. This includes clean fuel regulations, a developing (yet fragmented) carbon market, and contracts for differences.

There also needs to be incentives for company’s to develop clean infrastructure and technologies, and Canada has layered a comprehensive system of investment tax credits on top of its regulatory framework. However, the Canadian government has a lot more work to do in order to compete with the U.S.’s Inflation Reduction Act of 2022, which provided massive incentives for green/clean tech.

Source: Government of Canada

With the 2023 budget, some highlights of initiatives aimed at greening the economy include:

- Investment tax credit for clean electricity (15% refundable tax credit for eligible investments)

- Clean electricity focus for the Canada Infrastructure Bank

- $3.0 billion (over 13 years) in support of clean electricity projects

- Investment tax credit for clean tech manufacturing (30% of capital costs for machinery used to manufacture or process key clean technologies)

- Implementing contracts for differences to help investment decision-makers have a more secure carbon price on which to base their investment decisions

- Investment tax credit for clean hydrogen (15%-40% of eligible project costs)

- Reduced tax rates for zero-emission technology manufacturers

- Expanded eligibility for the clean technology investment tax credit

- Enhancement of the carbon, capture, utilization, and storage investment tax credit

ETFs that have exposure to the greening economy

These expanded tax credits and overall greater governmental support should spur greater investment in the green economy. Canadian investors may be left wondering how they can gain investment exposure to the next wave of emerging companies that will lead the charge on Canada’s net-zero ambitions. The following ETFs provide exposure to securities that are related to the greening economy.

One of the most advantageous ways for Canadian investors to gain exposure is with Green Bonds. These are fixed income instruments whose purpose is to raise money for climate or environmentally-beneficial projects. Some examples of ETFs that Canadians can utilize to gain exposure to green bonds include:

- Wealthsimple North American Green Bond Index ETF (CAD-Hedged) (WSGB)

- CI Global Green Bond Fund (CGRB)

- Horizons S&P Green Bond Index ETF (HGGB)

On the equities side, there are ETFs which provide exposure to clean energy companies such as:

- BMO (TSX:BMO) Clean Energy Index ETF (ZCLN)

- Harvest Clean Energy ETF (NYSE:XLE) (HCLN)

- Purpose Global Climate Opportunities Fund (CLMT)

There are also more focused ETFs for gaining exposure to specific areas which may be spurred by additional government incentives. This includes investments in hydrogen and lithium:

- Horizons Global Hydrogen Index ETF (HYDR)

- Horizons Global Lithium Producers Index (HLIT)

Bottom line: While these ETFs are not entirely focused within Canada, the trend of government incentives bolstering green investment is certainly a global trend which is certain to play out in the coming decades. Investors would be wise to get ahead of this trend and consider allocating a portion of their portfolios to these green investments.

Data as of April 5, 2023.

This content was originally published by our partners at the Canadian ETF Marketplace.