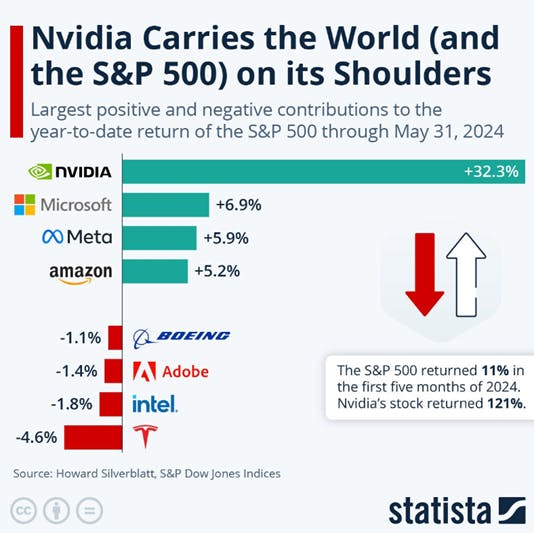

While Nvidia (NASDAQ:NVDA) Corporation (Ticker: NVDA) isn’t the largest firm in the S&P 500 Index, it is certainly the most important. As of May 2024, the S&P 500 Index’s year-to-date performance has been 11%, while NVDA’s performance has been eleven times that, returning 121% for the same period. Simply put, NVDA has been the leading contributor to U.S. equity performance thus far.

Against the backdrop of a market environment that has seen large investments and commitments by firms in Artificial Intelligence (AI), the importance of Nvidia continues to rise, as they are an essential stakeholder in AI development. For investors looking to gain exposure to NVDA, there are differing avenues through which they can access the company.

The Broad Market Approach:

With a market capitalization exceeding $3 trillion, NVDA is currently the third-largest firm globally. As such, it is a holding within any broad-market U.S. Equity ETF. Investors who utilize broad-market U.S. equity solutions, such as the iShares Core S&P 500 Index ETF (CAD-Hedged) (Ticker: XSP) and Vanguard S&P 500 Index ETF (Ticker: VFV), have exposure to the firm; however, the degree of the exposure is predicated on its current weighting in the index.

The Momentum Investing Approach:

Momentum investing is a strategy that seeks to capitalize on the continuation of existing market trends. It involves buying securities that have had high returns over a recent period and selling those that have had poor returns.

This strategy is predicated on the belief that these trends will continue in the short to medium term. The increased fervor about AI and the superb performance of NVDA makes it an ideal holding for a momentum factor-focused investment solution.

The Fidelity U.S. Momentum ETF (Ticker: FCMO) has exposure to companies that exhibit positive momentum signals and have the potential to outperform over the medium term. As of June 13th, 2024, NVDA is the second-largest holding within the ETF.

The Industry Investing Approach:

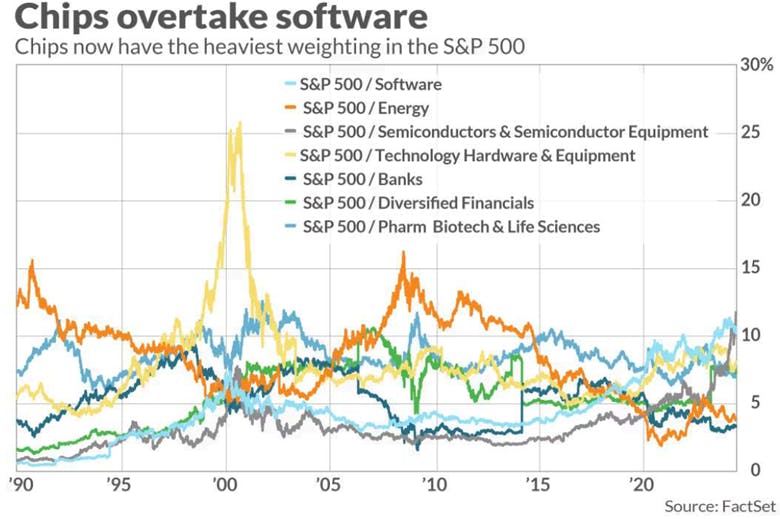

As recently reported by Market Watch, chips/semiconductor stocks now outweigh software stocks in the S&P 500 and have the largest overall sector weighting. The changing of the guard reflects Wall Street’s optimism about the semiconductor sector’s ability to capitalize financially on artificial intelligence and concerns about customer budget pressures within the software industry.

For investors desiring to gain exposure to the entire semiconductor industry, the Global X Semiconductor Index ETF (Tickers: CHPS/CHPS.U) provides direct exposure to some of the largest global companies that design, manufacture, and distribute semiconductors, including the large Asian foundry manufacturers.

Currently, CHPS replicates the performance of the Solactive Capped Global Semiconductor Index. As of June 7th, 2024, NVDA has an exposure of 12.42% within the fund.

Alternatively, from a sector-focused perspective, the RBC Global Technology Fund (Ticker: NLB:RTEC) is also worthy of consideration, as it is an actively managed fund that provides exposure to the global Information Technology sector. As of April 30th, Nvidia is the top holding within the fund, with an allocation of 10.5%.

The Single-Stock Approach:

For investors who desire to have a pure-play exposure to Nvidia, Purpose Investment’s Nvidia Yield Shares Purpose ETF (Ticker: YNVD) provides participation in the long-term growth opportunity of Nvidia shares.

The ETF is a part of the Purpose Investments Yield Share suite, which allows investors to earn an attractive monthly yield on specific companies. Presently, the suite provides investors with specific exposure to notable U.S. companies.

Investors who desire to gain exposure to Nvidia through an ETF have diverse options, as the company’s prominence has placed it in a dominant and desirable position.

This content was originally published by our partners at the Canadian ETF Marketplace.