Exiting the calendar year 2022, the negative performance of both equity and fixed income markets made the strong case for alternative assets, as such throughout 2023 there were a noticeable number of alternative investment solutions that were brought to market, many of them focusing on private markets. While the breadth of opportunities present in the private markets landscape is varied, arguably the most familiar to many is private equity. This article will provide a brief overview of private equity asset classes and turnkey ETF solutions that investors can utilize to gain exposure to private equity markets.

Private Equity Overview

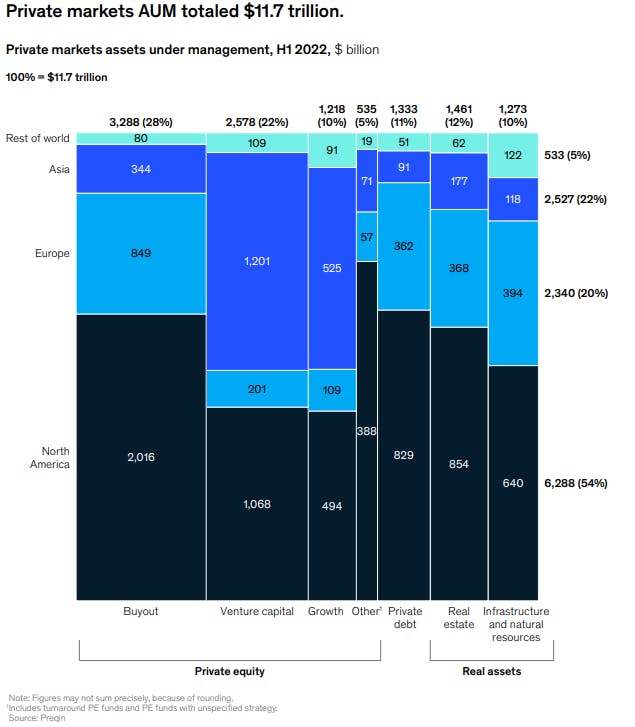

Private equity describes investments that represent an equity interest in a privately held company - which includes millions of businesses – ranging from small to medium-sized enterprises to start-ups, along with some more established companies that have not yet gone public or choose to remain private. As noted in McKinsey & Company’s Global Private Markets Review 2023, private equity is categorized as the largest asset class among private markets and has exhibited the best performance over the long run.

Accessing Private Equity via ETF

Historically, institutions have been the main investors in private equity. While retail investors may have been interested in gaining access to the asset class, it has been difficult to do so; but there is a novel investment solution that Canadian investors can utilize to gain private equity exposure. National Bank’s NBI Global Private Equity ETF (Ticker: NGPE) is a pure-play solution that provides investors with exposure to the largest, globally listed private equity companies and vehicles. In looking at the fund’s holding, many of the well-known firms operating in the private equity sector – KKR & Co Inc., Blackstone (NYSE:BX) Inc., The Carlyle Group (NASDAQ:CG) Inc. – are present.

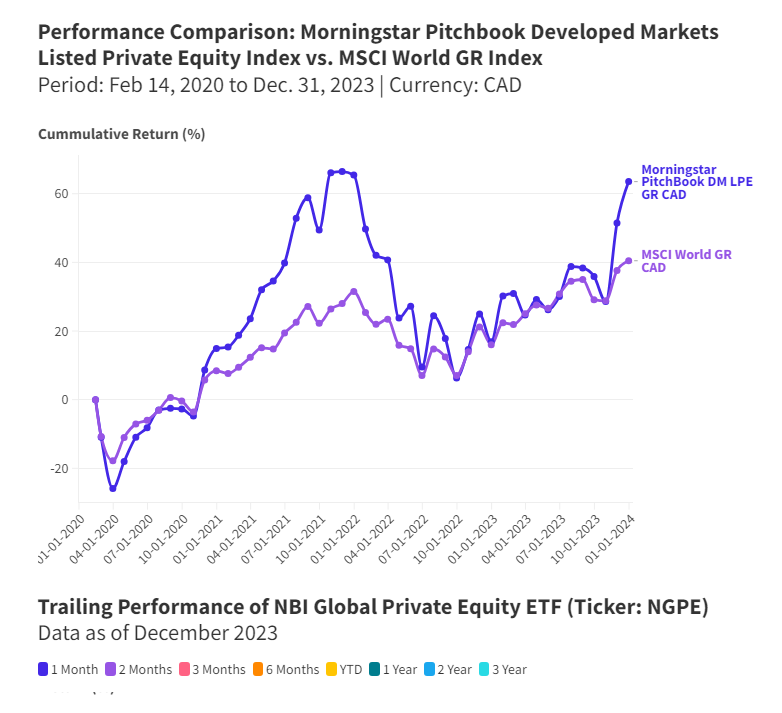

NGPE tracks the performance of the Morningstar® Pitchbook Developed Markets Listed Private Equity Index, which reflects the performance of public companies with significant private equity exposure, listed in developed markets countries. In looking at the performance of the NGPE benchmark index relative to the MSCI World GR Index, the efficacy of the former’s investment thesis is showcased in its long-run performance thus far.

Benefits of Private Equity

Private equity has emerged as a powerful and dynamic investment strategy that offers unique advantages to investors seeking growth and diversification beyond traditional asset classes. The asset class’s potential for superior returns and alpha generation stems from the ability of private equity firms to invest in companies during their early or growth stages, providing them with the capital needed for expansion. This direct involvement in a company's development can lead to substantial returns, as successful companies go public or are acquired at higher valuations. This ability to generate alpha, or excess returns over a benchmark, is a key factor that draws investors to private equity.

Private equity investment is normally long-tenured in nature. This extended timeframe allows fund managers to implement strategic initiatives, operational improvements, and growth strategies that may take several years to materialize. The patient capital approach aligns with the nature of certain businesses, fostering sustainable growth and creating value over time. Finally, Private equity provides investors with an opportunity to diversify their portfolios beyond traditional asset classes such as stocks and bonds. The performance of private equity investments often has a low correlation with public markets, offering a valuable source of diversification that can reduce the overall volatility of an investment portfolio.

NGPE provide investors with the opportunity to gain private equity exposure within their portfolio. For individuals seeking to add alternative exposure to their traditional portfolios, this solution seamlessly provides them with this privilege.

This content was originally published by our partners at the Canadian ETF Marketplace.