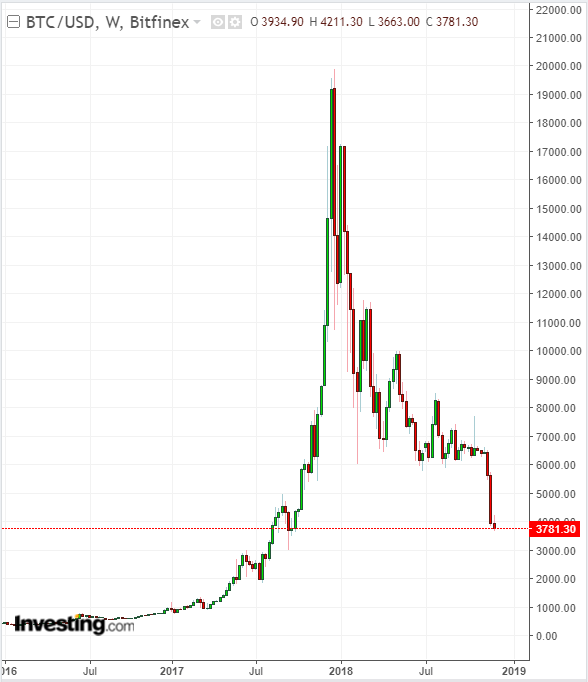

This time last year, all markets could focus on was the breathtaking spike in cryptocurrency markets. Now, investors are watching breathlessly to see if Bitcoin will break below $3K and possibly sink further, taking alt-currency peers along for the downward spiral.

What a difference a year can make.

As the value of digital currencies continues to sink, a less visible aspect of the asset class's decline is also taking place. The business model for cryptocurrency mining is changing rapidly as well. Could there be a correlation between mining output and depressed prices?

Grim News For Miners And Equipment Suppliers

Recent reports regarding crypto miners have also been grim. On Monday, November 19, news broke that US-based mining firm Giga Watt filed for bankruptcy.

Earlier in November, NVIDIA (NASDAQ:NVDA) shares were hammered, falling almost 19%, after the chipmaker missed Q3 revenue expectations and lowered its forward guidance because of unsold inventory resulting from the evaporation of the cryptocurrency mining boom.

One economist pointed out the following on Twitter:

As I warned before, #BTC #BTCUSD crash, coupled w rising electricity tariffs on miners will force #Bitcoin Whales to dump their Mine-&-Hold BTCs to cash out. Norway, China, U.S. - all are rising electricity tariffs on miners &/or cutting subsidies, bankrupting scores of miners. +

+ With markets for their fixed ‘capital’ (mining rigs) being utterly illiquid, prices of used mining rigs have collapsed, leaving miners only one option: sell their BTC hoards & run for the hills.

The price declines make sense says Frank Wagner, Frank Wagner, CEO and co-founder of INVAO. Crypto prices are influenced by supply and demand:

“With mining on the decrease, fewer miners will be selling off coins. It is likely that this will decrease downside selling pressure in the market, and therefore may increase asset value.”

David Tabachnikov, co-founder and Blockchain Innovator at Jerusalem Chain says that as the economic incentive goes down, so does the amount of miners. However, there's still a structure in place that maintains economic incentives, albeit only for some miner, regardless of prices:

“With Bitcoin, the difficulty level is reevaluated roughly every 2 weeks. In 1-2 months the price of mining will fall down and adjust to the market price. And with it - the cost of mining. Let's say that the price drops below $3000. Miners from Germany or the US will probably drop out. But we didn't have that many miners from there in the first place. Large companies that went into debt to expand will go bankrupt. But the smaller miners in Belarus, Kuwait, Trinidad or Venezuela, where the cost of mining is less than $2000, will stay.”

Tabachnikov believes that miners who invested in GPUs, graphics processing units, which are a more generic hardware, rather than Bitcoin-specific ASICs, will adjust their activities to other blockchains, such as Ethereum or EOS, where the cost of mining is lower. He thinks they'll probably sell off whatever cryptocurrency is not profitable, thus driving the price even lower. “But miners that invested in ASICs—which can only mine Bitcoin—will hold on to it as long as possible,” he adds.

Shifting Approaches to Mining

Mining techniques are also coming into question. "Proof of Work (PoW) mining is a fundamentally irrational economic proposition," says Seth Patinkin CEO of Ampersand Markets. The PoW protocol requires that each mining transaction or block is verified, making it expensive to carry out. Plus says Patinkin, "the now-proven unsustainable incentive structure is causing the integrity of PoW blockchains to darken, and seriously calls into question the utility of Bitcoin as a form of payment.”

When a stock craters, explains Patinkin, shares can find support because the assets of the company imply a limit on the market capitalization, even if it's lower. This is not true for the crypto majors which generally have no physical back-stop. They've been in the crosshairs of a fatal long squeeze.

“The health of the crypto ecosystem (crypto prices) largely relies on the engagement of PoW miners who have been decimated by the recent deterioration of the price structure.”

However, some crypto watchers are rejecting the notion there's a connection between crypto mining and sinking prices. Alex Mashinsky, CEO of Celsius says:

“The problems mining companies are facing do not impact BTC prices. The total production of new BTC coins will stay the same even if half of them go out of business. There would just be more BTC left for each of the remaining companies.”

According to Mashinsky, what's driving the selling pressure is a continuous flood of bad news coupled with delays by larger institutions and mainstream exchanges such as ICE (NYSE:ICE) in launching crypto-focused services. It's his view there are currently a variety of factors driving the downturn, making it impossible to zero in on a single catalyst:

“You also have over 400 crypto hedge funds facing liquidations and withdrawals from their LPs. Some are down 50%. On top of that exchanges such as BitMex, which allowed leverage of up to 100x, are seeing accelerated selling as they were forced to liquidate some of the larger leveraged long BTC positions.”

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI