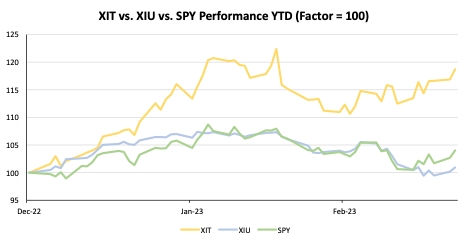

Canada’s tech space is frequently overshadowed by that of our neighbor south of the border. With the U.S. home to many of the world’s most powerful and influential technology companies, investors seeking tech exposure would be forgiven for overlooking the potential of the domestic market. However, the Canadian tech sector has been no slouch in delivering returns this year, with the iShares S&P/TSX Capped Information Technology Index ETF (TSX:XIT) (XIT) producing a solid 16.9% YTD. For context, the overall S&P/TSX Index has returned +1.0% YTD, with the S&P 500 Index up 4.7% YTD.

Source: Yahoo Finance

What’s going on with Canadian tech?

There are a number of potential reasons to explain this boost to domestic tech stocks:

- Deployment of risk capital. Following a weak and uncertain 2022, many active investors parked their capital in cash and short-term bonds. As we roll through a quarter of 2023, investors are likely beginning to see a peak to the rate hike cycle thus putting their capital to work in one of the most heavily hit sectors of 2022—the tech space.

- Boost from dual engines. The S&P/TSX Tech index is certainly not as diverse as other indices and is effectively driven by the dual engines of: 1) Shopify (TSX:SHOP); and 2) Constellation Software Inc. (TSX:CSU) —which together make up a staggering 50% of XIT’s market value.

- Private markets drying up. As reported in an article by Reuters, SVB’s stunning collapse is having ripple effects not only on the U.S.’s private capital markets but potentially Canada’s as well given that SVB was also a capital raiser for Canadian tech start-ups. Many start-ups may face tough times raising capital which leaves the other logical alternative: the public market. The public tech space could see an influx of capital as a result of these developments.

To be sure, it is worth pointing out that it is not only Canadian tech that has been an outperformer this year as other countries’ tech sectors have also delivered strong returns. iShares Global Tech ETF (NYSE:IXN) which captures the performance of publicly-traded tech companies is up 17.1% YTD and the NASDAQ 100, an index used as a proxy for the U.S. tech space is up 17.3%.

The Dual Engines of Canadian Tech

As mentioned, Shopify and Constellation Software Inc. make up around 50% of XIT’s market value. Thus, the fortunes of XIT’s performance falls on these two companies. This year, both have had stellar performance, with Shopify rallying around 28.6% YTD and Constellation rising 10.7% in value YTD.

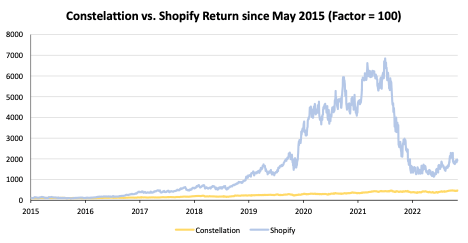

While both these companies are tech companies, they have some very stark differences. One only needs to peek at the stock chart for both of these companies to see the contrast in their histories.

Shopify went public in May 2015 at around $3.50/share and had a meteoric rise, peaking in November 2021 at $214/share (an eye-popping 61x increase in six-and-a-half years) before falling to around $60/share on March 21, 2023. Constellation on the other hand has been a steady compounder of capital after going public in the fall of 2007. Its share price increased from around $25/share to (an also eye-popping) $2,380/share as of March 21, 2023, with no large share price collapses along the way.

Shopify is an e-commerce platform that operates as a software-as-a-service (SaaS) sales platform charging users for a subscription plan to start their own online business, filled with product sourcing, sales, inventory tracking, payment processing, customer management etc. However, this company is far from profitable, turning an operating loss of around -$822 million in 2022 and a net income loss of -$3.5 billion!

Constellation is a diversified software company that essentially is an acquirer of software companies. Constellation has showcased its ability to deliver value to shareholders via consistent successful transactions having acquired over 500 businesses since being founded. Unlike Shopify, Constellation is highly profitable, having generated $1 billion of operating income and $484 million of net income in the last 12 months.

Worth it to chase the rally?

ETFs are typically known for their lower cost, liquidity and diversification characteristics. While XIT delivers on the first two, its concentration in two stocks make it a somewhat risky play for Canadians. However, if an investor has faith in the outlook for Shopify, Constellation and other Canadian tech names (CGI Inc (TSX:GIBa)., 19%; Open Text (TSX:OTEX) Corp, 10%; and Descartes Systems (TSX:DSG) Group, 7% of XIT respectively) then XIE could be a solid choice for those seeking exposure to the Canadian tech space.

This content was originally published by our partners at the Canadian ETF Marketplace.