It’s been a tough environment for the Utilities Sector.

The ETF Utilities Select Sector SPDR® Fund (NYSE:XLU) has underperformed for months and really stunk it up in recent weeks.

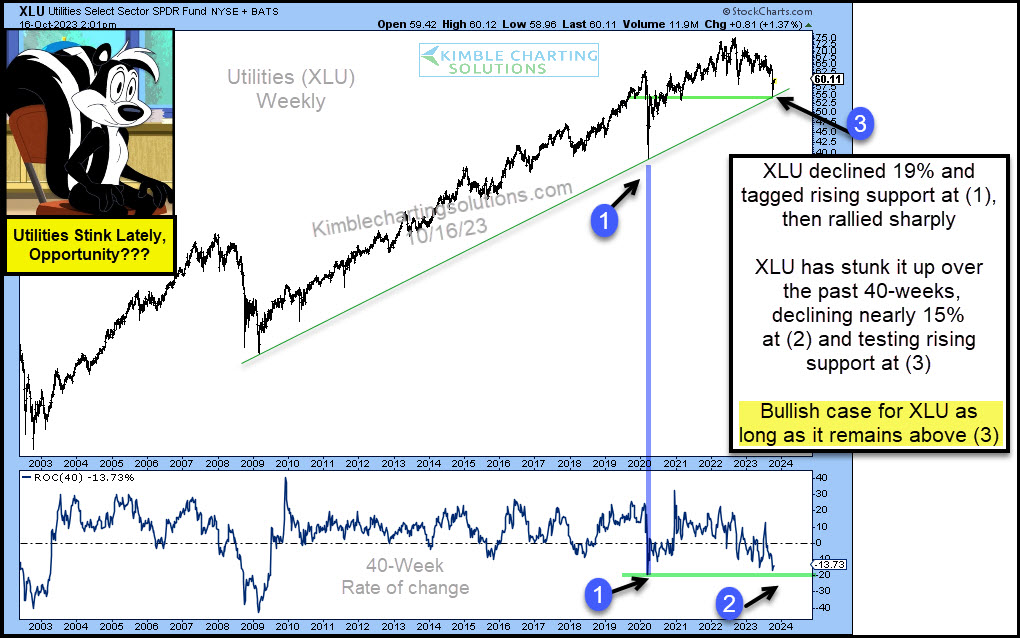

Looking at the chart below, you can see that XLU declined 19% in 2020, tagging its uptrend line at (1) before rallying sharply. Fast forward to today and we can see that XLU declined nearly 15% at (2) while testing its rising trend line and lateral support at (3).

The decline looks to be a bullish setup as long as XLU stays above support at (3). Are stinky Utilities ready to reverse higher?

If Utilities break through support on the downside, $XLU sends a negative message to the S&P 500.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI