Philip Morris International Inc (NYSE:PM) is planning for the future by steadily switching to smoke-free options like IQOS and ZYN. Gaining popularity, the business is taking advantage of changing customer tastes and government support for lower-risk products. People are confident in the company's growth, which is reflected in its high price. However, at current levels, the stock may not give new investors much upside.

Philip Morris International is a compelling long-term hold for those betting on the success of its innovation-led strategy, but caution is warranted for value-oriented buyers seeking immediate returns.

Financial Performance: Sustained Growth in Smoke-Free ProductsPhilip Morris International (NYSE:PM) recorded tremendous performance in Q3 2024 with revenues of $ 9.9 billion, this being an 8.4% growth from the same period in 2023. Much of this performance was attributable to the fact that the company was very focused on smoke-free products that now constitute 38% of total net revenue. A key factor in this success is IQOS, PMs core HnB (Heat-Not-Burn) product that shows further growth of market presence. The figures are not simply their revenues; they signify a main shift towards a future with low or no cigarettes.

Taking a deeper look into the bottom line, making use of the adjusted diluted EPS, we have $1.91, which means that it has been growing by 14.4% year on year in the same quarter. As a result, excluding currency impacts, the growth rate is they more compelling 18%. This robust EPS growth tells more about PMs operational performance, particularly its capacity to contain inflationary costs and compliance costs while reporting profits. That the company has invested in low risk products is clearly bearing fruits putting Philip Morris in a vantage position in the changing face of the tobacco industry.

In terms of volume there is a clear divide on product type and the corresponding market shares tell the story well enough. It reported a 1.3% growth in shipments of traditional cigarettes which suggested that the company continued to perform well in its legacy category despite a challenging environment in the international market. However, the real stand out of the quarter was the heated tobacco units (HTUs) which increased by a phenomenal 8.9%. This double-digit growth points to the good progress in the growth of smoke-free products within the key markets comprising of Japan and Europe. This seems to be an indicator that PM is capable of increasing HTU shipment at this size, meaning they are gaining market share within the continuously expanding reduced-risk products category.

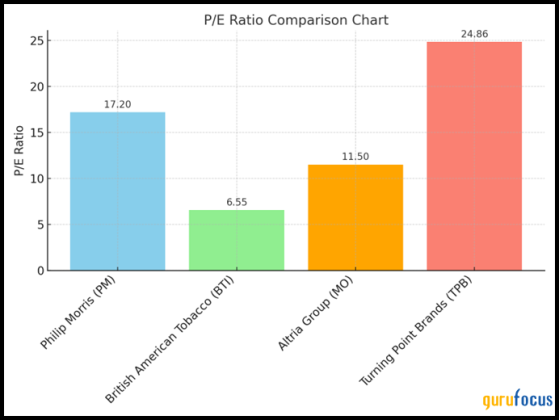

Valuation Analysis and Peer Comparisons: Philip Morris International Incs valuation metrics show investor optimism about its transformation. A closer look at its Price to Earnings (P/E), Price to Sales (P/S), and Enterprise Value to EBITDA (EV/EBITDA) ratios highlights the stocks premium pricing. This is especially true when compared to peers like British American Tobacco (LON:BATS) (BTI), Altria Group (NYSE:MO), and Turning Point Brands Inc (NYSE:TPB).

Philip Morris has a Price to Earning ratio of 17.2, which is a notable premium compared to BTIs 6.55 and MOs 11.5. This valuation is closer to TPBs 24.86, showing the markets optimism about its smoke-free initiatives and long-term growth potential. However, historical earnings growth of -1.24% over the past five years tempers this enthusiasm. It raises questions about whether the market might be overly optimistic about future growth prospects.

While Philip Morris's P/E multiple signals confidence, it also highlights the pressure on the company to execute its transformation strategy flawlessly. Any missteps could significantly impact investor sentiment.

Currently, the P/S of Philip Morris is 4.3 while for BTI it is 1.21 and for TPB it is 5.9. This premium implies that the investors are willing to part with more amount for every dollar of the revenue. This is because Philip Morris has been able to capitalize on its worldwide locations and quality product line. As a recap, this is another proof of the fact that BTI is deemed as a value stock since its P/S ratio ranks lower than the industry median.

On the other hand, the TPB has a much higher figure that places it more in the realm of a growth-oriented niche business. The observation of the P/S ratio of Philip Morris is mainstreaming the companys good standing in terms of revenue-generating potential, particularly in smoke-free products. However, it also places high expectations for continuing top-line growth as competition increases as well.

The EV/EBITDA ratio further illustrates Philip Morriss positioning. At 15.8, the company finds itself between TPBs 12.4 and MOs 17.6, while significantly outpacing BTIs 9.7. This metric underscores the companys operational efficiency and its ability to generate earnings before accounting for interest, taxes, depreciation, and amortization. However, the elevated EV/EBITDA ratio also signals that the stock is priced for perfection. Comparatively, BTIs lower EV/EBITDA suggests undervaluation, which could appeal to value-oriented investors. For Philip Morris, the premium valuation necessitates consistent performance and growth in its reduced-risk product category, as well as the ability to defend its market share from established competitors and new entrants.

PMs dividend yield of 5.4% is a notable draw for income investors. While it trails MOs 8.5% and BTIs 7.4%, its consistent dividend growth and robust cash flow generation make it a reliable choice for long-term holders. With $11 billion in operating cash flow and a payout ratio that supports reinvestment, PM strikes a balance between shareholder returns and growth funding.

Growth Prospects: Smoke-Free Momentum and Competitive PositioningPhilip Morris International Inc is not leaving room for complacency in changing the face of the tobacco industry through promotion of smoke-free innovations. Heated tobacco is another growth product that PM has established itself as leaders in, with IQOS currently controlling an estimated 77% of the global Heated Tobacco Market. Moreover, ZYN, which is its oral nicotine pouch brand, was able to show phenomenal growth with the international volumes growing by 70% in the last quarter. These numbers show that the company is well placed to capture more demand for lower risk products and to sustain growth in a shrinking cigarette market.

However this is not without challenges in the future. However, present rivals like British American Tobacco (BTI), which markets the glo heated tobacco device, and Altria Group (MO), which is adding more options to its vape line, are stepping up attempts here, add competitive intensity. IQOS faces a dual challenge: steadily maintaining its market share and at the same time expanding into a new market. In some markets such as U.S, regulatory limitations that ensued from the issue of patent infringement have limited the expansion of IQOS affectingPMs strategy.

Moreover, increased cost of inputs including tobacco leaves which have significantly risen by about 10% across the world within the last year may negatively impact PMs favour. This underlines the need for the company to further intensify efforts on strategic direction including innovation, operations efficiency and management of costs.

Thus, given the fact that a smoke-free generation is inevitably forthcoming, Philip Morris has positioned itself well to take full advantage of this massive social trend, success however shall require a series of adjustments and innovation expected to counteract emerging competitive threats, an ever-increasing number of regulations affecting manufacture and sales, and constantly escalating production costs.

Conclusion:Philip Morris International Inc has ensured it is at the heart of tobacco industry transformation through smoke-free products business that taps into growth. The reduced-risk solutions combined with a good dividend policy further enhances PMs position to be the sort of solution preferred by investors, who are in need of growth and steady revenue.

However, its premium valuation leaves limited room for error. This is especially true when compared to more attractively priced options like British American Tobacco or the high-yielding Altria Group.

This content was originally published on Gurufocus.com