Key Points:

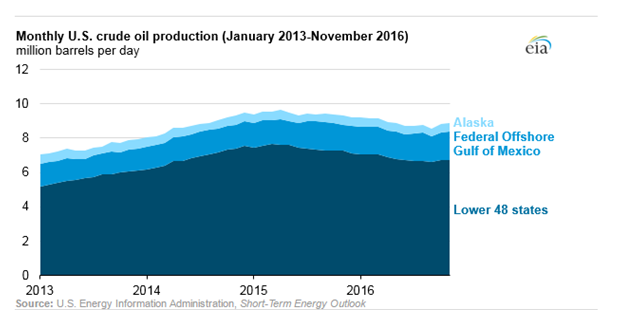

- U.S. crude oil production and drilling activity increases.

- OPEC agreement on production caps starts to falter.

- The $50.00 handle likely to be the key battleground in the weeks ahead.

This week could potentially be a harbinger of what is coming for energy markets as world crude oil prices crashed below the $50.00 a barrel mark for the first time since December. Much of the declines have been due to surprise inventory builds at Cushing as the U.S. market continues to produce significant levels of the commodity. Subsequently, there is renewed speculation that the current production levels could drive crude oil prices significantly lower in the wake of additional U.S. production activity.

The start of Friday morning’s session has been relatively rough for the commodity with West Texas Intermediate prices having swung both ways during the session. However, crude prices did manage to claw their way fractionally higher, to around the $49.50 a barrel mark by around midday. Regardless, the bearish mood remains pervasive over the market and the $50.00 handle could pose a bridge too far in the days ahead.

Unfortunately, market confidence has been shaken by the decline and surprise U.S. inventory build given that prices had settled relatively comfortably above the $50.00 mark for some time. However, the market had largely disregarded the increased drilling activity that was seen to be ramping up over the past weeks and months. Domestic production activity has been on the rise for some time and many of the ongoing shale projects have been picked for expansion.

Subsequently, there is little reason to currently remain bullish for crude oil prices given the product overhang that is presently in storage. The latest EIA figures show current inventory figures falling around the 528 million barrel mark which represents a significant excess to be cleared through the supply chain, especially given the limited refining capacity and flat domestic demand.

Ultimately, the recent collapse back below the $50.00 handle doesn’t surprise many that have been sceptical over the recent OPEC production caps. The reality for the new oil order is one where rebalancing clearly still needs to complete. The recent OPEC agreement on production caps was never intended to be a long term solution to oversupply and the current U.S. production boon suggests that it has done little but cede further market share. Subsequently, expect the cracks to start appearing within OPEC over the medium term as certain members find the current arrangement relatively unpalatable and ineffective.