Key Points:

- Despite recent bearishness, the USD/CAD could see some buying pressure this week.

- Technicals are strongly in favour of a pause in selling pressure.

- Gains could extend to the 1.3687 handle.

It is becoming apparent that the Loonie has potentially entered a near to medium-term downtrend over the past few sessions which could mean that the April rally is finally at its end. As a result of this, there is a temptation to have an overly bearish outlook for the pair in the week to come. However, upon taking a closer look at some of the technicals, the forecast is much less clear and we may actually have some acute bullishness or a ranging phase on our hands instead.

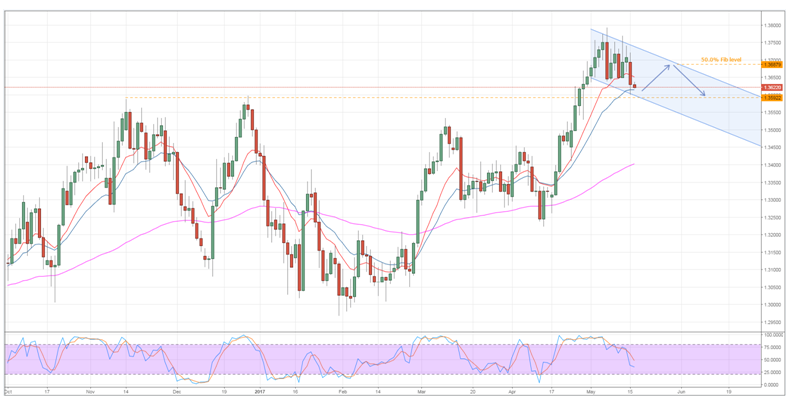

Firstly, closer inspection of the price action from the last week or so suggests that we have a bearish channel shaping up,as opposed to a simple downtrend. Indeed, the pair’s volatile descent is illustrating that there are some fairly rigid constraints to its decline. What’s more, last session’s slip has brought the USD/CAD into conflict with the downside of these two constraints which could mean we are actually going to have a brief pause in bearish momentum.

Unfortunately, this boundary has only been tested lightly since the pair’s momentum ostensibly shifted which could cast some doubt on the likelihood of it remaining intact should the bears opt to make another push. In response to this, one could argue that the intersection of a historical reversal point around the 1.3592 handle provides a notable degree of reinforcement for support which significantly caps downside risks for the week ahead.

However, the channel and historical reversal point are not the only things hinting that the pair is set to make an about face this week. For instance, the EMA bias is incredibly bullish and is likely to be exerting some upward pressure on the pair. Moreover, stochastics are no longer overbought which leaves the Loonie with substantial freedom to move in either direction. Finally, the Bollinger Bands® are highly divergent which will seriously mitigate the chances of us seeing another breakout in the immediate future.

Ultimately, from a technical perspective, there is a strong argument suggesting that we are about to see a pause in bearish momentum or have a rally back to the 1.3687 mark. Of course, this excludes the fundamental factors that one may need to take into consideration which could still prove to be highly bearish moving ahead. Regardless, things may not be as dire for the Loonie as it at first appears so don’t rule it out just yet.