Many new and seasoned investors alike seemingly endorse the strategy of investing only in an S&P 500 index fund and letting it ride. Even Investopedia has a page titled "Put $10,000 in the S&P 500 ETF and Wait 20 Years." Buffett likes the S&P 500 too, having endorsed it for his estate.

Canadian investors have a plethora of ETFs to invest in the S&P 500 with. In Canada, S&P 500 index ETFs are some of the largest funds by assets under management (AUM). They also tend to charge rock-bottom expense ratios due to the efficiency and low turnover of the index.

However, making the S&P 500 ETF the sole holding in a portfolio may leave investors exposed to greater risks than they are comfortable with. There are many reasons why this strategy, despite being simple and attractive, may not be optimal for many Canadian investors. Let's dive into it.

Why the S&P 500?

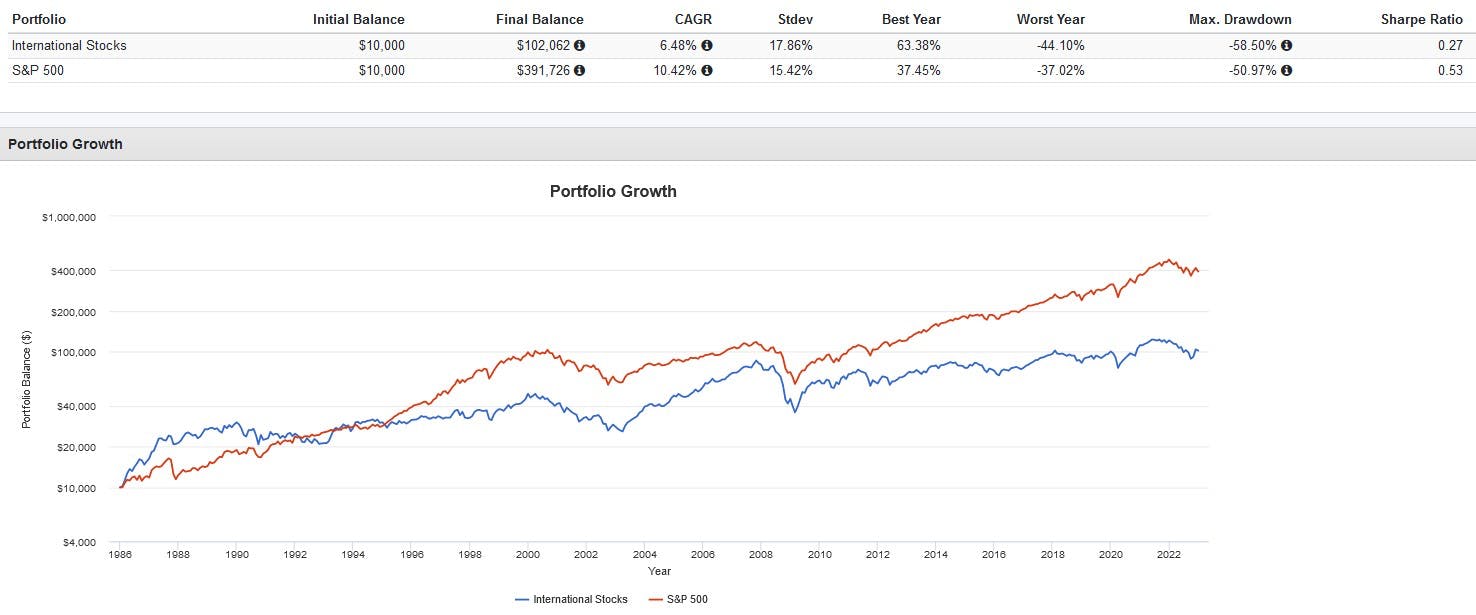

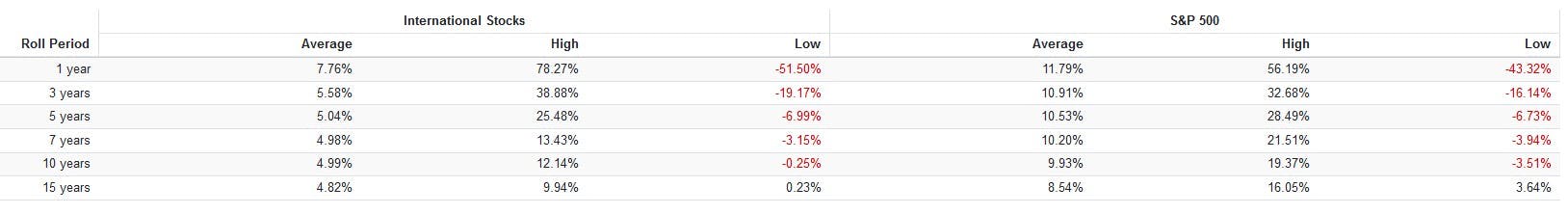

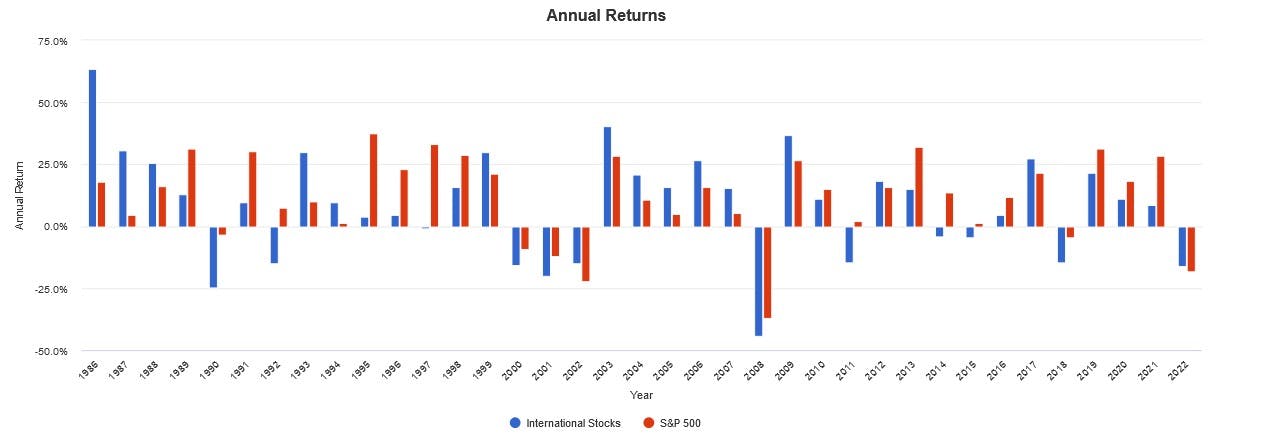

Many of the arguments for the S&P 500 center around its historically high returns. Thanks to the outperformance of the U.S. stock market, especially large-cap U.S. stocks, the S&P 500 has beaten international stock indexes on both a trailing and rolling basis since 1966.

When it comes to implementation, the low cost of S&P 500 ETFs also works in its favor. Consider the 2016 SPIVA U.S. Scorecard from S&P Global which found that over a 10-year investment horizon, 85.36% of large-cap fund managers lagged the S&P 500.

Given that the S&P 500 is regarded as the benchmark to beat for equity returns, and that the majority of funds have failed to outperform it, then it stands to reason that an investor seeking the most straightforward investment choice with the lowest tracking error would pick it.

And that is the crux of the argument for going all-in on the S&P 500. It's universally recognized, easy to invest in, and is used as the yardstick for measuring equity performance. If your goal as a passive investor is to receive the market's average return, then why not the &SP 500?

Why not the S&P 500

Using backtests to demonstrate the superiority of the S&P 500 is a folly, mainly because it does not account for likely investor actions during this holding period. It's easy to look back and rationalize holding through a decade of underperformance in hindsight, but what about actually experiencing it?

We know investors are great at chasing recent performance and falling prey to the hot hand fallacy. Take a look at this chart below. How many S&P 500 investors do you think would have stuck with their investment from 2002 – 2007 when international stocks outperformed every year?

By only investing in the S&P 500, you're consciously excluding over 40% of the world's investable market. You're betting your portfolio on the returns of large-cap U.S. equities. Does no one remember how Japan's once booming stock market more or less returned flat from 1991 to 2021?

It's not all-or-nothing

The S&P 500 is a wonderful way to track large-cap U.S. stocks at a low cost. But it isn't the stock market, no matter how many pundits endorse it and how many fund managers use it as a yardstick for their own performance. It's simply a component of a globally diversified portfolio.

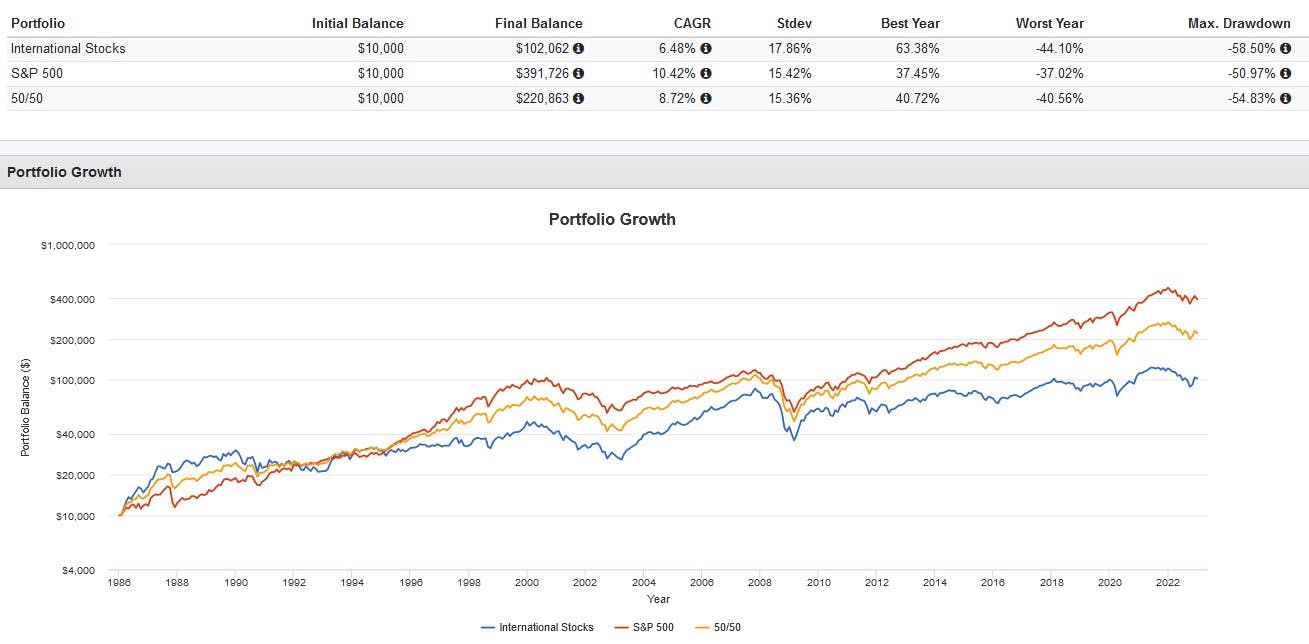

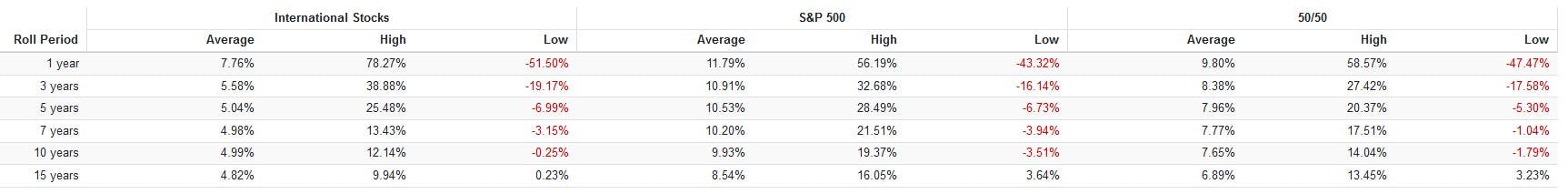

I think a simple way to use the S&P 500 is as half of an investor's equity allocation. The other half can be filled with international market-cap weighted stocks. Not surprisingly, this approach has produced returns and risks halfway between U.S. and international stocks.

With this approach, investors no longer have to bet their portfolio on the S&P 500 outperforming, or international stocks outperforming. You won't outperform, but the chance of underperforming is much lower as well. You can avoid the long periods of stagnation and volatility that cause investors to capitulate.

As John Bogle noted in The Little Book of Common-Sense Investing: “Gunning for average is your best shot at finishing above average."