XRP, a digital asset with a market capitalization of over $32 billion, has been making waves lately. Thanks to Grayscale's launch of an XRP Trust, the cryptocurrency is back in the spotlight. But what exactly is XRP? And what does an XRP Trust do? Plus, could we see XRP ETFs in the future? Let's dive in and find out.

What is XRP and How Does It Differ From Bitcoin and Ether

XRP is a digital currency created by Ripple Labs, designed to make sending money across borders faster and cheaper.

Think of it like a special tool that helps banks and businesses move money around the world quickly, almost like sending an email.

Unlike Bitcoin, which is more like digital gold and meant for anyone to use as money, XRP is focused on improving how traditional banks operate. It doesn’t require mining like Bitcoin; instead, all XRP coins were created at once (100 billion in total), and they are slowly released by Ripple to keep things stable. This makes XRP much quicker for transactions, often taking just a few seconds, compared to Bitcoin's longer processing times.

Here’s a quick comparison between XRP, Bitcoin and Ether.

Grayscale Launches XRP Trust

In September 2024, Grayscale Investments, a leading digital asset manager, introduced the Grayscale XRP Trust. This new investment vehicle offers investors a convenient and secure way to gain exposure to XRP, the cryptocurrency powering the Ripple network.

The trust's shares are designed to track the price of XRP, minus fees and expenses. By investing in the trust, investors can avoid the complexities of directly buying, storing, and safeguarding XRP. This makes it a more accessible option for those interested in the potential of XRP.

According to trust’s official page, the fees are set at 2.5%.

Can You Buy the Grayscale XRP Trust?

To buy the Grayscale XRP Trust, you must be an accredited investor, as the trust is currently only available to this group. The process involves submitting an application and a subscription agreement to Grayscale Investments, along with a minimum investment amount, typically starting at $50,000. Once your application is approved, you can fund your investment through a wire transfer. The trust offers a way to gain exposure to XRP by holding shares that represent your interest in the cryptocurrency.

Is there an XRP ETF?

While XRP ETFs haven't made their debut in the U.S. just yet, there's a strong possibility that Grayscale is eyeing a similar move to what they did with their Bitcoin and Ethereum Trusts. They might convert their XRP Trust into an ETF. However, getting the SEC's approval for this could be a bit of a wait.

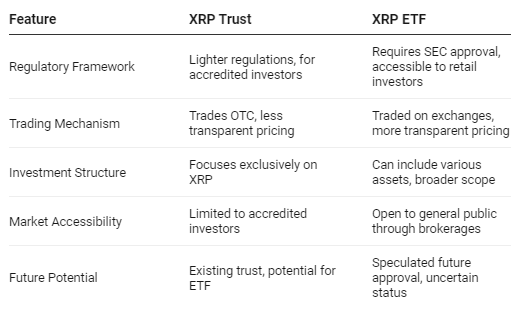

Difference between an XRP Trust and potential XRP ETF

Fortunately for European investors, CoinShares, 21Shares and ETC Group have introduced XRP ETPs.

- 21Shares Ripple XRP ETP - USD

- CoinShares Physical XRP - USD

- ETC Group Physical XRP ETC - USD

ETPs are essentially any investment product that trades on a stock exchange and tracks the performance of an underlying asset or basket of assets. This includes ETFs, ETCs, and other types of exchange-traded products like exchange-traded notes (ETNs).

Another Major Win for XRP with Robinhood (NASDAQ:HOOD) Listing

Adding more fuel XRP’s fire, the coin has secured a significant achievement with its recent listing on Robinhood, one of America's leading financial services platforms. This move is expected to enhance XRP's global visibility and potentially drive its price above $1.

Following the legal clarity provided by the Ripple-SEC court case, XRP has gained a more favorable outlook from various crypto companies.

The cryptocurrency will now reach new audiences in Europe through Robinhood's commission-free trading services, further expanding its adoption. Investors will have the ability to trade XRP without incurring high transaction fees, increasing accessibility.

Combined with Grayscale's efforts to provide access to XRP, this recent listing has significantly strengthened the coin's appeal. XRP's price has already increased by over 8% in the past week, reflecting growing investor interest.