JD.com (NASDAQ:JD) announced its unaudited financial results for Q3 of FY 2024 before the market opened on November 14, 2024. From an initial glance, the Q3 results looked very strong. Revenue growth accelerated to 5.1%, the fastest growth rate over the past two years. Non-GAAP operating margin reached 5.0% for the third quarter of 2024, compared to 4.5% for the Q3 of 2023. Non-GAAP net income increased 23.9% year-over-year. On top of the strong fundamental growth, JD has repurchased 8.1% of its total shares outstanding as of September 30, 2024. JDs results were better than analyst consensus for both top-line and bottom-line. However, JDs stock dropped more than 6.5% after the earnings release. The decline in stock price despite the positive earnings report was likely attributed to investors concern that the Q3 results include one-off items, which are not sustainable. Lets take a look at the details.

Detailed analysis of JDs segment results

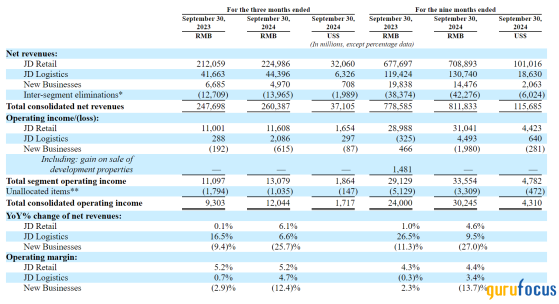

The following table is the breakdown of JDs revenue and operating income by segments for the third quarter.JD's Retail segment experienced strong year-on-year growth. During the earnings call, JDs management commented that the robust growth is mostly driven by the turnaround of electronics and home appliances and the robust growth of general merchandise. In addition, the growth in electronics and home appliances is due to the Chinese governments stimulus measures. During the third quarter, both the Chinese central government and local governments provided substantial subsidies to consumers for the purchase of electronics and home appliances, in order to stimulate domestic consumption. Subsidies are available through both online and offline channels. Regarding online subsidies, the primary platforms include JD.com and Alibaba (NYSE:BABA)'s T-Mall and Taobao. It is noteworthy that PDD Holdings' domestic e-commerce platform, Pinduoduo (NASDAQ:PDD), has chosen not to proactively participate in government subsidies. Given that electronics and home appliances contribute to roughly 40% of JD's revenue, JD is arguably the largest beneficiary of the stimulus measures because the government is paying for the subsidies. JDs management acknowledged that the governments trading program increased the traffic and visits on JD's platform.

However, analysts are concerned about the sustainability of JDs stimulus-driven. Both Goldman Sachs (NYSE:GS)' analyst Ronald Keung and Citigroups analyst Alicia Yap expressed their concerns to JDs management team on the earnings call. JDs CEO Sandy Xu assured them that the full potential of the policy has not yet been realized due to consumer awareness and production capacity limitations. In addition, the government plans to introduce more fiscal stimulus next year, expanding the trading program, which is expected to further support consumer spending and bolster key industries.

Personally, I am skeptical of JDs management's optimistic view for two reasons. Firstly, the government only has a limited budget. If the government expands the trading program to other categories, there will be fewer subsidies for the electronics and home appliances category, which will negatively impact JD.com. Secondly, it is reported that in many instances, JDs price is still higher than Pinduoduo even with the government subsidies. This does not bode well for JD.com. I think JD.com needs to improve its "price comparison" mechanisms and ensure that the prices of electronic and home appliance products are the lowest on its own platform.

While I have concerns over the sustainability of JD.com's growth in the electronics and home appliances category, I am encouraged by the significant margin improvement in the JD Logistics segment. Specifically, the margin has increased from 0.7% in the third quarter of 2023 to 4.7% in the third quarter of 2024. Management attributed the increase in operating margin to the economy of scale and improvement in operation efficiency without providing further details. This explanation makes sense because the majority of the cost of the JD Logistics segment is fixed in nature. Therefore, this segment has very high operating leverage and it is not surprising that when shipment volume increased on JD.com, the segment margin for JD Logistics improved significantly.

Another positive development for JD.com is the strong growth of 8% for the general merchandise revenue during the quarter. The robust growth is likely due to JDs expansion into other categories. Management specifically called out JDs expansion in the apparel and accessories business during the earnings call. Going forward, category expansion is likely to be an important driver for JDs revenue growth for two reasons. Firstly, a category expansion strategy can attract more consumers to JD.com. Secondly, by offering more products on its platform, JD.com can increase the ARPU (Average Revenue Per User) for JDs customers, especially those VIP members, who are more loyal to the platform.

Valuation and shareholder return policy

Below is a chart of JDs stock price over the past three years. Of all the valuation metrics, Ive found that the EV-to-Revenue ratio has the highest correlation with JDs stock price.https://userupload.gurufocus.com/1857319238096809984.png

JD.com's stock has experienced a decline for more than three consecutive years since the spring of 2021. This downward trend persisted until the Chinese government announced a significant policy change in late September. After the stimulus announcement, JDs stock price rallied during the last week of September and the first week of October, along with the broader Chinese equity market. This rally was fueled by investors' renewed optimism regarding the future prospects of China's economy. However, the rally was short-lived, as JD.com's stock has since experienced a notable decline, falling by almost 30%. At the current price, JD.com is trading at an EV-to-Revenue ratio of merely 0.28 times. This valuation level is close to the historical lower range of its EV-to-Revenue multiples, indicating potential undervaluation.

JDs current low valuation is a great opportunity for the company to aggressively buy back shares. JD announced a new $5 billion share repurchase program in August of 2024, after completing the previously announced $3 billion share repurchase program. JD has also paid out dividends in the amount of $0.76 per share. Overall, I think JDs capital allocation has improved dramatically from the past. This balanced approach to capital allocation provides more flexibility for JDs management to return cash to shareholders.

Conclusion

JDs Q3 FY 2024 revenue growth is mostly driven by the Chinese governments stimulus measures. While the stimulus measures have positively impacted JDs results in the near term, it is not clear whether they are sustainable. Meanwhile, JD.com has expanded into other categories and continued to improve its operating margin due to economy of scale and improvement in operating efficiency. Overall, JDs third-quarter results are mixed. In the next few quarters, we will find out whether investors' concerns are warranted.This content was originally published on Gurufocus.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.