‘Big bank take little bank' is a game in which two people compare wallets and whoever has more cash in their wallet takes the cash of the poorer wallet. This is seemingly the game that has unfolded with JP Morgan and First Republic Bank, as the former has purchased the latter according to the most recent FDIC press release.

Though JP Morgan Chase (NYSE:JPM) was among a consortium of banks that demonstrated their support of First Republic Bank by making a $5 billion uninsured deposit in the bank - $30 billion in total was received by First Republic – the financial institution saw its total deposits decline by roughly $72 billion in Q1-2023; making its actual loss amount $102 billion. Most of the deposits lost were core deposits, which means the bank had to replace these with higher-cost funding and borrowings.

Once is Chance, Twice is Coincidence, Third Time's a Pattern

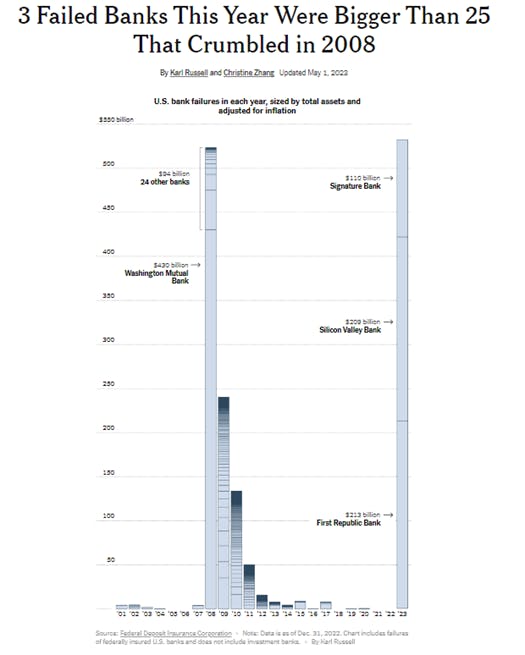

The closure of First Republic adds to the list of bank failures that have occurred thus far in the year. In taking a historical comparison, the bank failures of 2023, thus far, are greater than the collective bank failure that occurred in 2008.

Source: The New York Times (May 1, 2023)

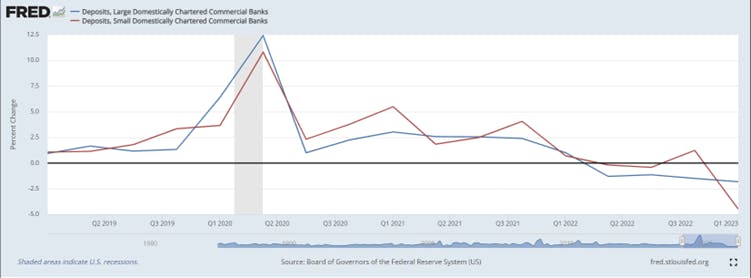

Though deposit flight is a common theme cited in the press release for these banks, in looking at the data from Federal Reserve, deposit flight has occurred for both large and small domestically charted banks, however in the case of the latter, there is greater volatility in recent deposit flow and the depth of decline in deposits over the past quarter has been more pervasive.

However, looking more closely provides a more clarifying view. In examining the Federal Reserve’s list of Large Commercial Banks, last updated as of December 2022, First Republic Bank and Silicon Valley Bank were the 14th and 16th , respectively, on the list – highlighting their size and importance to the U.S. financial system; despite them being considered ‘regional/mid-sized banks’.

Scale as a Safe Haven

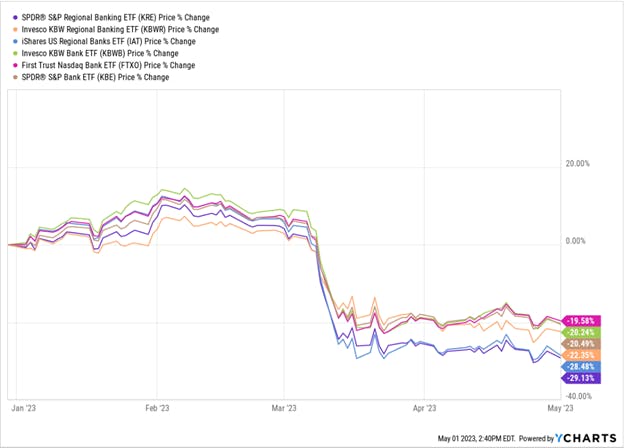

Since the failure of Signature Bank and Silicon Valley Bank, regional banking ETFs have taken a beating, with year-to-date performance being close to -30% for two of three prominent investment solutions that reflect said industry segment. In looking at ETFs that capture the performance of the broader banking sector, performance has also been negative for the same time period.

Not all bank-focused ETFs are the same. In March 2023, I wrote about the launch of Roundhill Big Bank ETF (Ticker: BIGB), an investment solution that will solely invest in the largest banks in America, namely, JP Morgan Chase & Co., Citigroup Inc (NYSE:C), Morgan Stanley (NYSE:MS), Wells Fargo (NYSE:WFC) & Co. and Bank of America Corp (NYSE:BAC). While the timing of the fund’s launch may have been fortuitous – as it was in the midst of Silicon Valley Bank’s failure - its value proposition within the current market environment is precinct.

JP Morgan Chase & Co is the largest bank in the U.S., as such as its scale and scope of operations is broad and all encompassing. As outlined in the FDIC press release, JP Morgan Chase & Co will be assuming all the deposits ($103.9 billion as of April 13th, 2023) and all assets ($229.1 billion as of April 13th, 2023) of First Republic Bank. Additionally, The FDIC and JPMorgan Chase & Co. will be entering a loss-share transaction on single-family, residential and commercial loans it purchased of the former First Republic Bank. The FDIC as receiver and JPMorgan Chase & Co., will share in the losses and potential recoveries on the loans covered by the loss–share agreement.

Simply put, JP Morgan Chase & Co. was able to acquire a sizable industry peer at a discount, thus strengthening its market positioning significantly.

For individuals and investors looking on, the developments of the banking sector in the last few months have been truly fast-moving and exceptional in nature. While no one can completely determine what new developments will occur within the sector, gravitating towards financial institutions that have systemic importance to U.S. financial ecosystems seems to be the safest approach.

As the developments in the U.S. banking sector continue to unfold, for investors looking for safety in the banking sector – Roundhill’s Big Bank ETF (BIGB) offers them the opportunity to invest in the largest banking institutions, that are most capable of weathering this turbulent period.

This content was originally published by our partners at ETF Central.