J.P. Morgan Asset Management recently launched its latest active ETF, the JPMorgan (NYSE:JPM) Active China ETF (JCHI). The ETF is designed to provide investors with access to a "best ideas" portfolio of Chinese equities and focuses on an investment process driven by bottom-up stock selection, while being mindful of macro and policy considerations.

The ETF is managed by JPMorgan Asset Management (Asia Pacific) Limited, and comprehensively leverages the Greater China research team within J.P. Morgan's Emerging Markets and Asia Pacific (EMAP) Equities team which has an extensive local research footprint that seeks to identify high-conviction ideas.

China’s Importance & Influence

China is currently the world's second-largest economy, offering numerous opportunities for investors looking to diversify their portfolios and capitalize on the country's economic growth. In looking at the MSCI World Emerging Markets Index, China has the greatest country allocation (32.11%), as of February 2023. Earlier this year, the Chinese government began reopening the economy and removing restrictions put in place to stop the spread of COVID. One of the clearest signs of the nation’s reopening activity is the issuance of tourist visas for foreigners, an indication of their intention to actively boost the economy following the global pandemic.

The economic importance of China within the MSCI Emerging Market landscape is evident when looking at the data. As observed from the 10-year comparison chart, the performance of the MSCI Emerging Markets Index is strongly influenced by, and mirrors, the return profile of the MSCI China index.

JCHI’s Value Proposition & Composition

As an actively managed solution, JCHI’s approach to investing in the Chinese equities space will be very different from that of an index fund. With the reopening of the economy, China’s domestic economic activity could accelerate, owing to meaningful pent-up demand and accumulated savings during lockdown. As noted by Li Qiang, China’s premier, consumption will be the primary means by which the nation reinvigorates its economy, as he was quoted saying “The greatest potential of the Chinese economy lies in the consumption by the 1.4 billion people” in a meeting of the State Council, China’s cabinet.

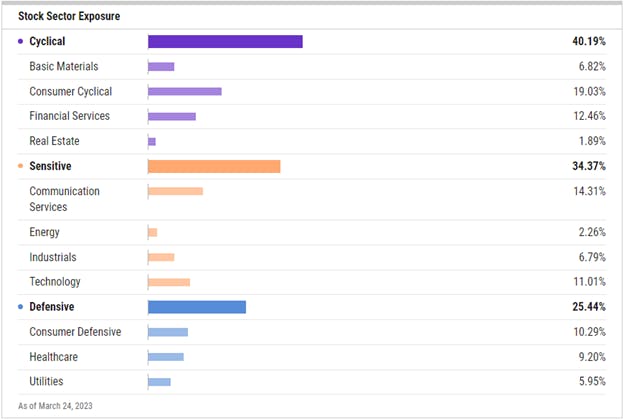

The theme of consumption is reflected in JCHI’s composition, as much of the ETF’s sector exposure is tilted towards cyclical areas of the economy. Technology and innovation are also important to the theme of consumption as many well-known firms, such as Tencent Holdings Ltd, Alibaba (NYSE:BABA) Group Holding and JD.com Inc are multi-functional businesses that utilize technology as a means of fulfilling consumer consumption and interests.

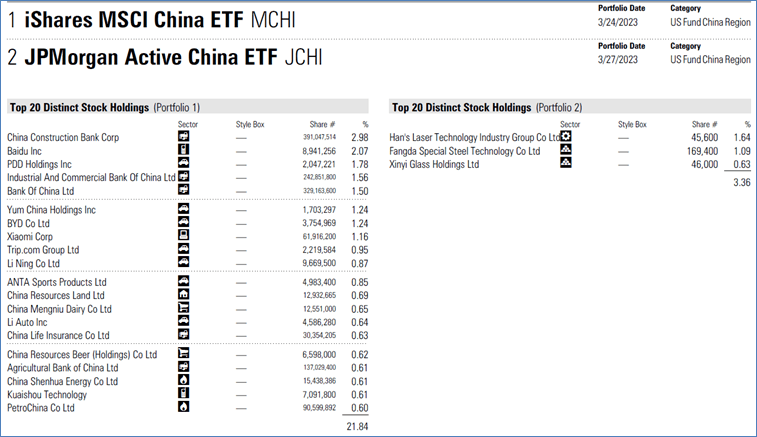

As noted earlier, JCHI will reflect the best ideas within the Chinese equities space, thus the portfolio management team will be deliberate in the businesses they choose to include within the portfolio. As indicated on the ETF’s product page, the number of holdings within the fund is 55, as of March 2023. While index-replicating ETFs like iShares MSCI China ETF will aim to capture the Chinese equities space in its entirety – the intentionality present within JCHI will be reflected in its holding’s composition. When comparing the current holdings of JCHI with the iShares MCHI China ETF, there are common notable names such as Tencent and Alibaba present, however, there are a few distinct differences, such as Fangda Special Steel Technology Co Ltd and Xinyi Glass Holdings Ltd. Though the difference between the ETFs is small, its presence highlights the measure of active management occurring within the investment solution.

JCHI: Conclusion

For investors looking to invest in the Chinese economy in an actively managed manner, JCHI provides investors with the opportunity to gain exposure to the re-opening of the market in a truly intentional manner. Though JCHI is J.P. Morgan Asset Management’s only Chinese equity-focused ETF currently, the firm has investment expertise in this market with three China equity-themed mutual funds featured in its product line-up. If investors wish to evaluate the efficacy of the firm’s investment strategy within this space, analyzing the performance of these mandates would fair be a fair starting point.

This content was originally published by our partners at ETF Central.