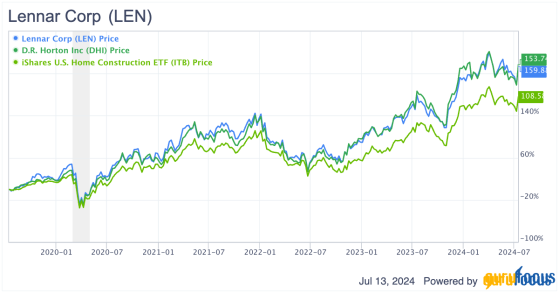

Lennar Corp. (NYSE:LEN) is the second-largest homebuilder in the United States, trailing only D.R. Horton (DHI). Over the past five years, the two companies have outperformed the industry. D.R. Horton only slightly outperformed Lennar over this period, but the difference is pretty negligible.

LEN Data by GuruFocus

Homebuilding industry is poised to growSingle-family housing starts have been steadily increasing since the Great Recession in 2009.

Source: Federal Reserve Bank of St. Louis

This increase is expected to continue, with housing starts surpassing 1 million by 2025. What about farther into the future?

The U.S. does not have enough housing. Pew Research estimates we are short between 4 million and 7 million homes. Its survey shows most Americans approve making the building of news homes easier to help grow the supply.

How does this help Lennar? The shortage is increasing demand for all kinds of housing, including the single-family units Lennar builds for its customers. As such, the company is in an excellent position to take advantage of this higher demand.

Operating segmentsThe vast majority of the revenue generated by Lennar is in homebuilding. It accounts for over 95% of the total company revenue.

In comparison, financial services only accounts for about 3% of revenue, but it has higher margins and is responsible for almost 10% of the company's pretax income.

Geographically, Lennar only operates in the United States, but it has helpfully broken down its homebuilding revenue by division.

Source: Lennar's 2023 annual report

Homebuilding segment is steadily growingHomebuilding revenue has been increasing over the last decade and is largely responsible for Lennar's growth. Gross margins have increased since 2018, but they have leveled off from their highs immediately following the pandemic.

Margins for homebuilders grow during periods of economic growth and contract when the economy starts to falter. Management expects the gross margin to remain just over 23% in 2024. However, recession fears have largely disappeared from a year ago and I would not be surprised if margins start to tick up again and exceed management guidance.

Geographic division growth is in the perfect spotLennar breaks out its homebuilding revenue and margins by geographic division. They moved some states around in 2018, so that is as far back as we can go to keep everything comparable.

Revenue is growing in each segment, but it is growing faster in the East and Texas regions. This lines up perfectly with its gross margins as those two segments have consistently higher gross margins than the West and Central regions.

Those regions' populations are also expected to grow faster in the future as well. Pew Research forecasts that Texas and Florida will grow much faster than the national average. That puts more consumers in markets that generate higher margins for Lennar.

More investment in financial services is helping marginsLet's take a break from the homebuilding side of the business and examine other segments. Multifamily is too small to really impact operations, so the remaining focus will be on financial services.

The revenue and operating margin for the division have increased dramatically over the past decade. In fiscal 2023, Lennar provided 81% of its homebuyers with mortgage financing. This amounted to almost 47,000 homebuyers compared to only 22,000 homebuyers in 2013.

Margins have also improved significantly, especially from 2019 to 2020. What caused the increase? Lennar started automating its mortgage loan origination process, which reduced origination costs by about 35%. The compnay also started seeing some economies of scale that allowed for lower costs due to higher volume.

Why is Lennar better than D.R. Horton?As mentioned earlier, Lennar is a very close second in size in the homebuilding industry to D.R. Horton. As of the time of writing, Lennar's market cap is only about 10% lower than D.R. Horton's. Both companies also have excellent GF scores:

So why am I more excited about Lennar than D.R. Horton? There are a few reasons.

First, D.R. Horton is losing in high-margin areas. Lennar is growing in its East and Texas divisions, as discussed earlier. These are the highest-margin divisions for Lennar, so having growth in these divisions is critical for its future prospects.

D.R. Horton is not doing the same. Its South Central division includes Arkansas, Oklahoma and Texas and has the second-highest pretax margin in the company. Unfortunately, its revenue from that division fell 7% from fiscal year 2022 to 2023.

Things aren't looking too great so far in 2024 either. For the six months ended on March 31, two of the highest-margin divisions have the lowest growth compared to a year earlier.

This is concerning for D.R. Horton and one of the reasons I like Lennar better.

Second, key metrics slightly favor Lennar. You would think D.R. Horton would have better valuation ratios than Lennar, but the opposite is true. Currently, D.R. Horton's price-book ratio is about 30% higher than Lennar's. Interestingly, these companies had very similar ratios until about five years ago, but they have diverged since then.

LEN Data by GuruFocus

Having a lower valuation ratio does not necessarily mean Lennar is a better investment. The company might have a lower price-book ratio because it is a riskier investment or is more volatile. Let's compare some other metrics between the companies to get a fuller picture.

D.R. Horton has a higher net margin and a lower PEG, while Lennar has a lower debt-equity ratio and a higher current ratio and shareholder's yield. Except price-book, all of these metrics for each company are better than the industry median. The beta is close enough for all three that it is not really worth saying one is better than the other.

The lower debt-equity ratio for Lennar is what really sells me on the company compared to D.R. Horton. A lower debt-equity ratio means Lennar has less leverage and is a less riskier investment than D.R. Horton. Throw in a comparable beta and Lennar, to me, looks like a better investment.

Finally, the CPI report showed inflation is cooling much faster than anticipated. On July 11, the Bureau of Labor Statistics released data for the consumer price index, which had a material impact on Lennar. The CPI, which is one measure for inflation, fell 0.10% from May to June and rose 3% compared to the prior year. Economists expected the CPI to rise 0.10% in June so inflation was lower than expected. This signals the Fed might lower rates in the near future now that inflation is approaching their target range.

For Lennar, this was huge news. Interest rates are very important to homebuilders as it lowers the financing costs for homebuyers, which allows them to purchase more homes. If you are a Lennar investor, this was very exciting news. The market agreed as the price rose almost 7% on the CPI release.

Lennar is still too good to pass up at this priceI won't lie. I liked Lennar a lot better when it was trading in the $140s. I had a price target around $167, which was about 17% higher than its price. However, following the CPI report the stock has increased to around $160, which is very close to my original price target.

After the inflation report, I am raising my price target to around $180, which is 13% higher than current price levels. This is 1.70 times its expected 2024 book value per share of $106.75. Historically, in periods of lower interest rates, Lennar trades around 1.80 times its book value per share. Why am I choosing this rate?

The market has been shot-faked before on rate cuts from the Fed and it might happen again. Using 1.70 times is more conservative and factors in the possibility the Fed might continue to keep rates higher for longer, despite the lower inflation rate.

Over the coming weeks, Lennar will probably fluctuate a bit as the market tries to guess what the Fed is going to do. As long-term investors, this presents a buying opportunity when the stock starts to creep downward. Any price below $160 is a steal for Lennar, but even prices in the mid-to-high $160s present a good buying opportunity.

At these price levels I would seriously consider adding some shares or starting a position if you do not have one already.

This content was originally published on Gurufocus.com