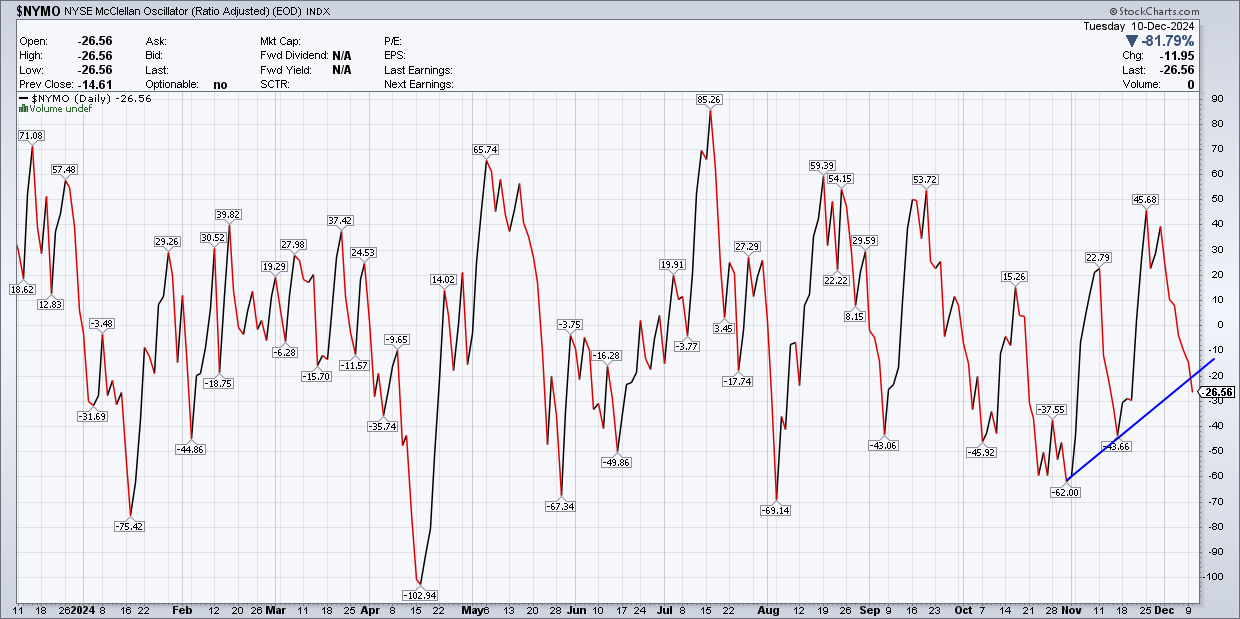

Stocks finished lower for a second consecutive day, with breadth continuing to show more losers than advancers. This trend actually began sometime last week. The NYSE McClellan Oscillator has broken lower at this point and appears to be indicating a potential trend change. While nothing is definitive yet, it is noteworthy and will continue to be monitored, as declining market internals can signal deteriorating liquidity conditions within the market.

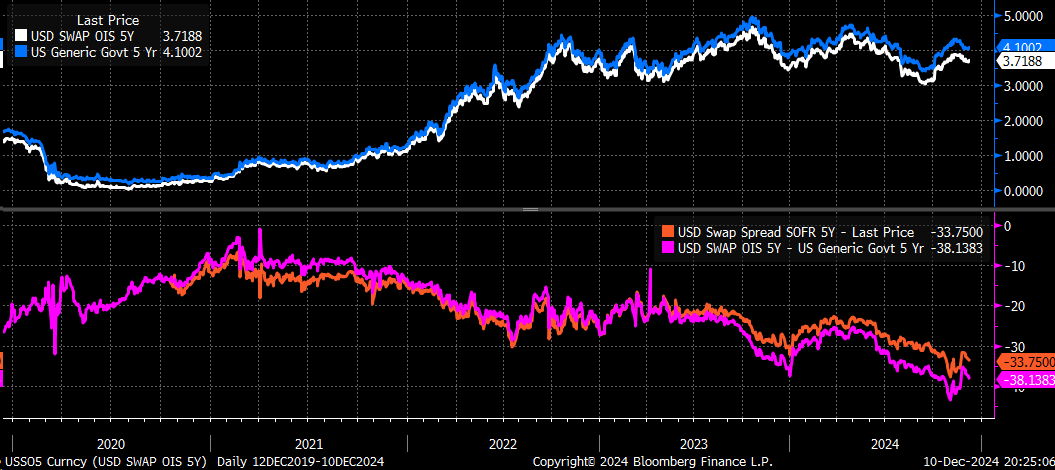

We have discussed liquidity issues before, and some unusual developments are happening in Europe. Over the past couple of weeks, the 5-year swap spread has essentially collapsed to its lowest levels on record. This spread measures the difference between a 5-year floating-rate ESTR OIS swap and a fixed-rate Germany 5-Year bund yield.

Based on my readings and research, this collapse appears to be driven by the effects of quantitative tightening (QT) and increased debt issuance in Germany. With fewer buyers in the market to absorb the additional debt, German bund yields have risen, pushing them to trade more in line with Euro OIS rates.

A similar trend is occurring in the U.S., with the 10-year SOFR swap trading at a deeper discount to United States 10-Year Treasury yields. Historically, these two rates traded much closer together. This divergence could be attributed to liquidity issues or balance sheet constraints, driven by the massive amount of Treasury issuances that have taken place recently.

These tighter spreads could again be a function of a liquidity absence somewhere within the market. This lack of liquidity could be creating distortions or, more broadly, rippling across the market. This may be driving the 5-year EUR/USD basis swap into positive territory. The chart below illustrates that these two metrics tend to trade inversely to one another.

From our perspective, these dynamics also appear to be driving credit spreads lower in the U.S. overall. Naturally, the U.S. equity market tends to interpret narrowing credit spreads as a signal that everything is fine. However, the underlying reasons for these spreads behaving this way are not necessarily positive and seem to stem from liquidity strains and the absence of liquidity as the effects of QT and increased debt issuance begin to take a toll.