September has just started and is already living up to its reputation of being the toughest month of the year for stocks.

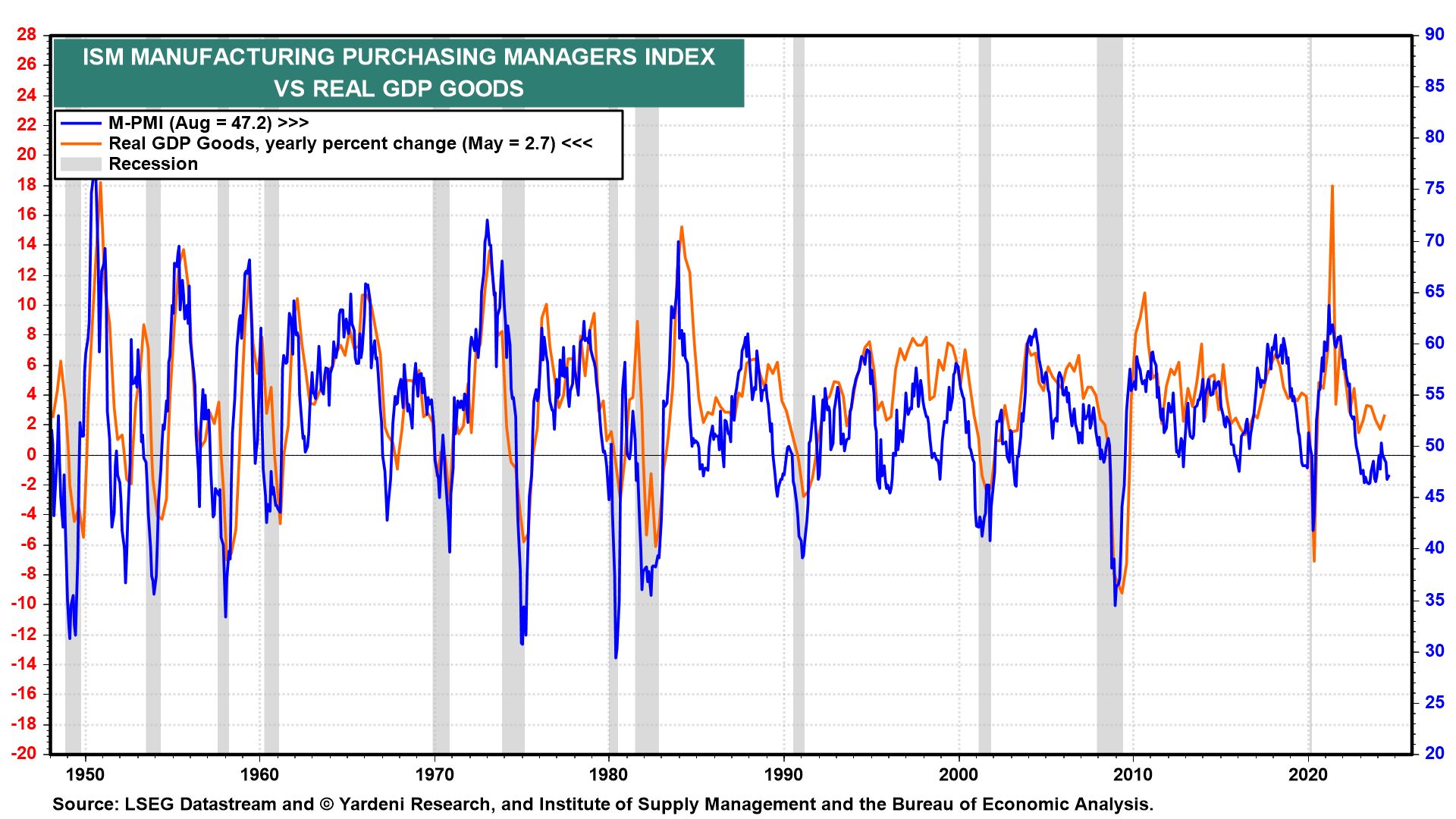

The stock market sold off after the open and August's weak M-PMI report was released later on, which pressured equities further.

Commodities prices fell alongside stocks, led by oil and copper.

Leading the way down in the S&P 500 were the semiconductor stocks, which have been especially volatile lately.

That's a bummer given that just yesterday, we wondered out loud what could possibly go wrong? We didn't have a good answer.

One account responded to our analysis by observing that he worries most when there doesn't seem to be much to worry about.

In any event, nothing really went wrong today other than the market dropped on news that was only mildly bearish and not at all surprising.

Investors might have decided to take some of their profits now and not wait for a Black Swan event to show up this month. Now we are back to thinking that stock prices could churn a while longer before resuming their climb.