Did you know that the world’s first ETF was introduced in Canada back in 1990? Since then, a revolution that has democratized the investment market has taken hold—allowing investors from anywhere with any level of capital to take control of their portfolios, ending decades of dominance by mutual funds.

As of December 2022 and based on data from the Investment Funds Institute of Canada (IFIC), Canada’s ETF assets have ballooned to $314 billion of total assets under management, yet this figure still pales in comparison to the mutual fund industry in Canada, which, according to the IFIC, holds $1.8 trillion of assets under management.

Importance of low-cost funds in ETF investing

For most investors, information is easy to come by in today’s Google-centric society. ETFs simplify the process for investors by allowing them to gain broad-based exposure to an asset class, sector, factor or theme of their choice, at a low cost. This contrasts with when mutual funds had their heyday, a time when investors did not have as much information at their disposal and would rather trust an investment professional to manage their money for them, generally in a mutual fund wrapper.

The difference in costs between an ETF and a mutual fund is around 1%-2% based on historical trends. While it may not seem like much, this difference eats directly into potential returns meaning that in the long run these percentage points can compound and make a big impact down the road.

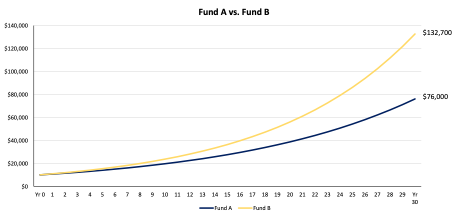

Consider $10,000 invested with a 10% return over 30 years. Fund A has $10,000 invested at a 3% fee and Fund B has $10,000 invested at a 1% fee. Thus, the net return for Fund A is 7% and the net return of Fund B is 9%.

Over 30 years, this translates to almost a two-fold difference between the level of capital accumulation. This is a significant factor that all Canadians need to understand about investment choices.

Why are ETFs able to charge lower fees?

One of the biggest selling points of ETFs in its long-standing battle with mutual funds is its lower fee structure. The gap is certainly narrowing, however, ETFs still maintain a solid edge over their actively-managed mutual fund counterpart. This owes to a number of structural factors, including:

- Investment Team Fees. Mutual funds inherently are more expensive as they must maintain a full research staff and administrative team to manage them.

- Admin Fees. Advertising, marketing and distribution costs are passed along to shareholders in a mutual fund in most cases. This makes a mutual fund more likely to use these funds to try and attract more capital.

- Capital Gains Tax. ETFs are bought and sold like a stock on the open market while mutual funds are bought into directly. Thus, when a mutual fund unitholder wants to divest their position, the mutual fund may sell a part of its portfolio for cash, which triggers a capital gains tax.

List of lowest-cost ETFs in Canada

So how can Canadians gain access to the lowest cost ETFs? Investors can use NEO ETF Market’s ETF Screener to filter for inexpensive ETFs in addition to overlaying screening tools.

There are a number of ETFs that have management fees lower than 5 basis points (0.05%).

Here are some of the lowest-cost ETFs in Canada right now:

Scotia Canadian Large Cap Equity Index Tracker ETF (NLB:SITC)(SITC)

- Expense Ratio: 0.03%

- AUM: $45 million

- 1mo Performance: +4.5%

Horizons S&P/TSX 60 Index ETF (TSX:HXT) (HXT)

- Expense Ratio: 0.04%

- AUM: $4,038 million

- 1mo Performance: +4.6%

Mackenzie Canadian Equity Index ETF (TSX:QCN) QCN

- Expense Ratio: 0.04%

- AUM: $1,103 million

- 1mo Performance: +5.8%

Data as of February 8, 2023.

This content was originally published by our partners at the Canadian ETF Marketplace.