Due to their strong growth, the shares of Lululemon Athletica (NASDAQ: NASDAQ:LULU) caused a sensation in markets for a prolonged time, especially during the pandemic. Nonetheless, 2024 was a challenging year for the company, and the share price experienced a decline of up to 54%, dropping from $505 to $233. Yet, the stock recovered significantly by over 60% and set a positive momentum for 2025.

Company Description

Lululemon is a Canadian company that trades on the Nasdaq and has a market cap of over $45.5 billion. It predominantly sells athleisure apparel with a strong focus on the female market, which, in the latest quarter, represented 65% of the revenue mix. Although it is a Canadian company, two-thirds of its sales are made in the United States, with additional exposure to Mainland China and other East Asian markets among its 729 stores.Financial Strengths

When analyzing Lululemon's financials, they have strong profitability and financial strength ratiosstarting with a gross margin of 58.85%, which has been expanding throughout the years and is higher than competitors such as Under Armour (NYSE:UAA) 46.83% and Nike (NYSE:NKE) 44.73%. At the same time, they have a substantial net income margin of 17.05%, even considering that they remain in the growth stage, and investments in brand recognition are a priority, especially in new markets such as China.LULU, UAA, NKE Data by GuruFocus

The company's net debt of $325.7 million remains insignificant compared to its market cap and common equity, giving it a strong financial position. At the same time, it has two revolving credit facilities: $400 million in the United States and $42.1 million in China, which allows it to alleviate its volatile cash position if needed.

What caused the company's share price to drop initially?

Several factors caused Lululemon's stock to drop considerably in H1 2024. The primary one was weak guidance in Q1 2024, which caused the stock to fall -15.8% on a single trading day, reflecting significantly lower revenue and EPS growth than a year ago.| Lululemon Athletica | Number of Stores Closed | Change in Same Store Sales % |

| 22-Oct | 2 | 14 |

| 23-Jan | 2 | 27 |

| 23-Apr | 3 | 14 |

| 23-Jul | 2 | 11 |

| 23-Oct | 1 | 13 |

| 24-Jan | 1 | 12 |

| 24-Apr | 5 | 6 |

| 24-Jul | 1 | 2 |

| 24-Oct | 0 | 4 |

Other reasons could include the decision to close five stores in a single quarter, a figure not registered at that level before, and a consistent downtrend in same-store sales growth. At some point, Lululemon consistently grew same-store sales by double digits, but now these have declined to single digits for the past three quarters.

Finally, the company had a controversy over its launched $98 leggings brand, Breezethrough. Due to its size adjustments, the brand received significant criticism on social media, which caused the company to remove Breezethrough from its catalog.

What has caused the stock to rebound?

Despite the headwinds, the stock has recovered significantly in H2 due to better-than-expected earnings. At the same time, the company recently raised its four-quarter guidance due to better-than-anticipated sales during the holiday season. According to the press release, the company now expects higher revenue, EPS, gross margins, and lower SG&A expenses.Lululemon's fiscal year ends in January, and its fourth-quarter earnings release, which includes holiday sales from the Americas and China, is scheduled for after market close. So far, the analysts' consensus is for Lulu to obtain a normalized EPS of $5.82 and $3.6 billion in revenue. This implies an earnings growth of 10.2% YoY and a revenue rise of 11.1%. Regarding the latter, it represents a decline compared to the growth experienced in previous years of 15.63%, 30.19%, 23.10%, and 23.76%.

Long-term Risks

The main risk of holding Lululemon's stock in the long term is the fragmented market in which it operates. Their top product, leggings, can be easily found in many stores for five times less the price. Therefore, maintaining a high perceived value for the Lulu brand is essential to preserving those gross margins.In addition, penetrating the Chinese market with athleisure wear might not be as culturally appropriate or have the same success as in North America, limiting its growth.

Valuation

Lululemon's stock trades at high multiples compared to its fundamentals. For example, it has a PE ratio of approximately 30x and a price-to-sales ratio of 4.9x. Nonetheless, from a historical perspective, these multiples are cheap and provide a valuation opportunity. However, it is essential to consider that the expected EPS growth rates are considerably lower than those Lulu achieved some years ago, so a discount to the historical valuation is justified. To confirm this, the PEG ratio is close to 1.1x, indicating that the stock is fairly valued compared to its expected growth.

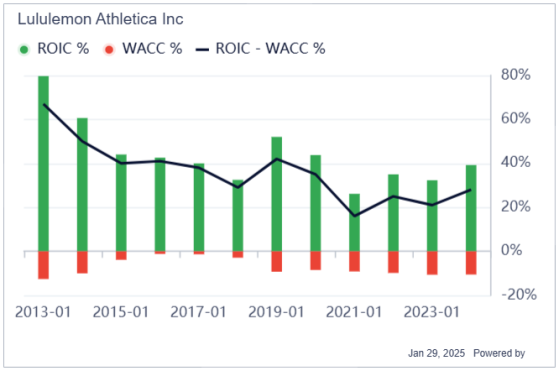

A key characteristic that has allowed Lulu's stock to trade at high multiples is its attractive economic profit. As exhibited, the spread between their return on investment capital ("ROIC") and WACC has been positive and above 20% for a prolonged time. Nonetheless, this situation is unlikely to persist due to the competitive industry and Lulu's lack of moat. For example, a more established competitor, such as Under Armour, hasn't been able to deliver consistent economic profits through the years.

Conclusion

Overall, the conditions for Lululemon's stock to experience a significant rise are limited, considering that expected growth rates have considerably decayed in core markets such as the Americas. Nonetheless, the company maintains a strong financial position, with high profitability metrics preferred by investors when the economy turns gray. With the stock trading at fair value, I am not bearish on the short-term outcome, but I see a lack of moat that will not allow them to maintain consistent economic profits in the long term.This content was originally published on Gurufocus.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.