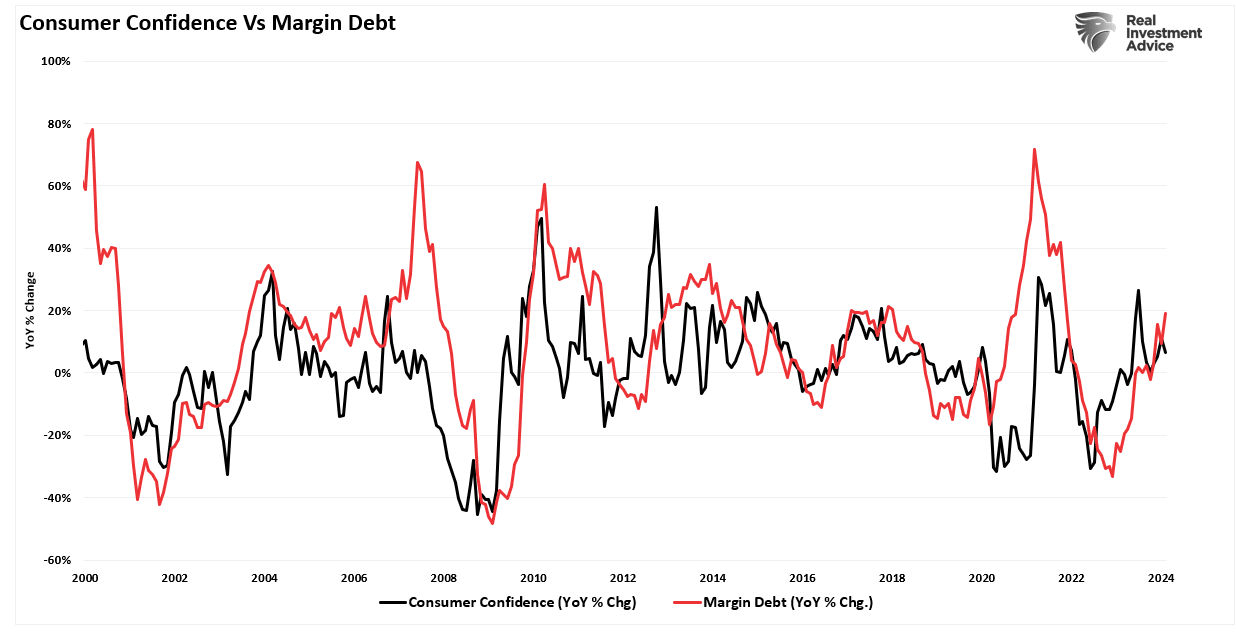

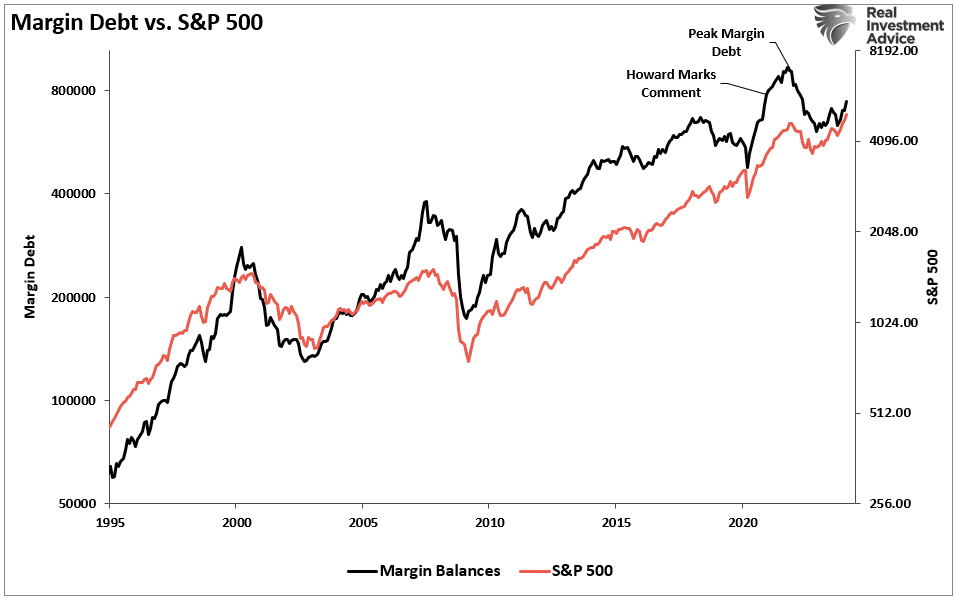

In the most recent report from FINRA, margin debt levels have surged as bullish investors leverage their bets in the equity market. The increase in leverage is not surprising, as it represents increased risk-taking by investors in the stock market.

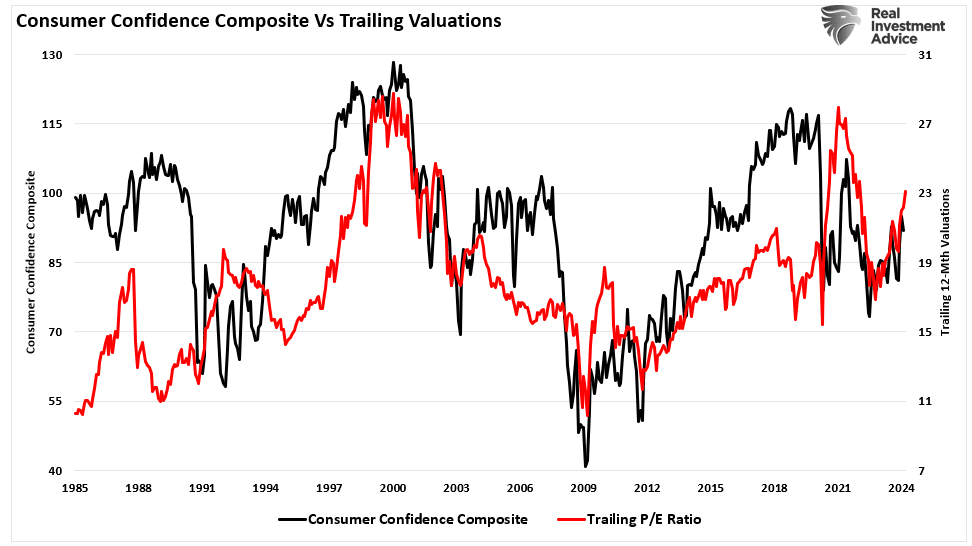

We previously discussed that valuations, in the short term, reflect investor optimism. In other words, as prices increase, investors rationalize why paying more for current earnings is rational.

“Valuation metrics are just that – a measure of current valuation. More importantly, when valuation metrics are excessive, it is a better measure of ‘investor psychology’ and the manifestation of the ‘greater fool theory.’ As shown, there is a high correlation between our composite consumer confidence index and trailing 1-year S&P 500 valuations.”

The same holds for margin debt. Unsurprisingly, as consumer confidence improves, so does the speculative demand for equities. As stock markets improve, the “fear of missing out” becomes more prevalent. Such boosts demand for equities, and as prices rise, investors take on more risk by adding leverage.

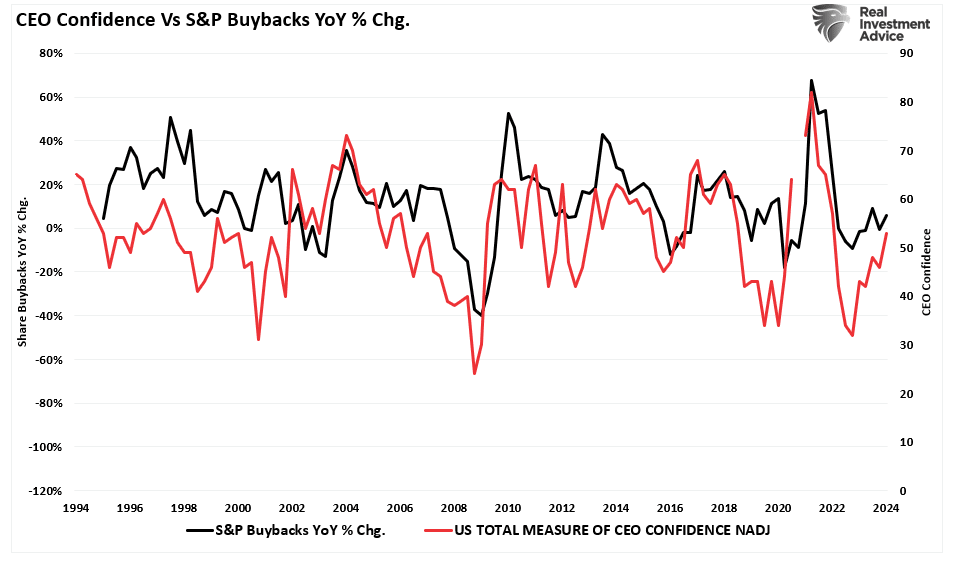

Adding to that exuberance is the increased demand for share repurchases, which has been a primary source of “buying” since 2000.

As CEO confidence improves, a byproduct of increased consumer confidence, they increase the demand for share repurchases. As buybacks boost asset prices, investors take on more leverage and increase exposure as a virtual spiral develops.

However, should investors be afraid of rising margin debt?

A Byproduct Of Exuberance

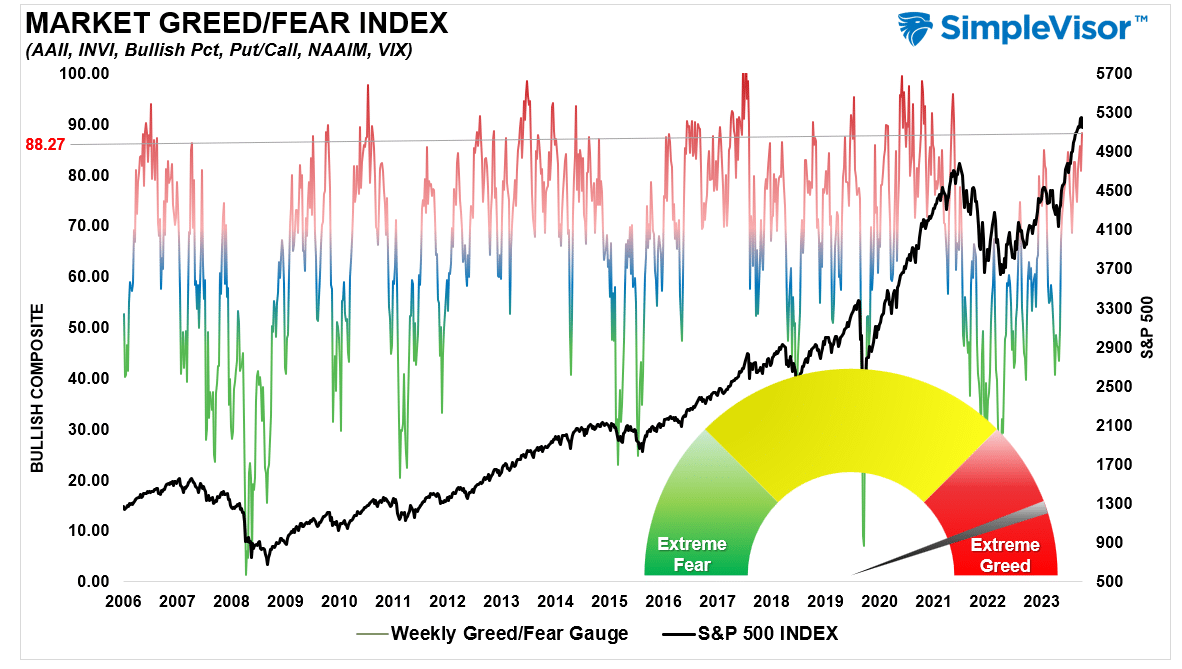

Before we dig further into what margin debt tells us, let’s begin with where we are currently. There is clear evidence that investors are once again highly exuberant.

The “Fear Greed” index below differs from the CNN measure in that our model measures positioning in the market by how much professional and retail investors are exposed to equity risk.

Currently, that exposure is at levels associated with investors being “all in” the equity “pool.”

As Howard Marks noted in a December 2020 Bloomberg interview:

“Fear of missing out has taken over from the fear of losing money. If people are risk-tolerant and afraid of being out of the market, they buy aggressively, in which case you can’t find any bargains.

That’s where we are now. That’s what the Fed engineered by putting rates at zero…we are back to where we were a year ago—uncertainty, prospective returns that are even lower than they were a year ago, and higher asset prices than a year ago.

People are back to having to take on more risk to get return. At Oaktree, we are back to a cautious approach. This is not the kind of environment in which you would be buying with both hands.

The prospective returns are low on everything.”

Of course, in 2021, that market continued its low volatility grind higher as investors took on increasing margin debt levels to chase higher equities. However, this is the crucial point about margin debt.

Margin debt is not a technical indicator for trading markets. What it represents is the amount of speculation occurring in the market. In other words, margin debt is the “gasoline,” which drives markets higher as the leverage provides for the additional purchasing power of assets. However, leverage also works in reverse, as it supplies the accelerant for more significant declines as lenders “force” the sale of assets to cover credit lines without regard to the borrower’s position.

The last sentence is the most important. The issue with margin debt is that the unwinding of leverage is NOT at the investor’s discretion. That process is at the discretion of the broker-dealers that extended that leverage in the first place.

(In other words, if you don’t sell to cover, the broker-dealer will do it for you.) When lenders fear they may not recoup their credit lines, they force the borrower to put in more cash or sell assets to cover the debt. The problem is that “margin calls” generally happen simultaneously, as falling asset prices impact all lenders simultaneously.

Margin debt is NOT an issue – until it is.

As shown, Howard was eventually right. In 2022, the decline wiped out all of the previous year’s gains and then some.

So, where are we currently?

Margin Debt Confirms The Exuberance

As noted, margin debt supports the advance when markets are rising and investors are taking on additional leverage to increase buying power. Therefore, the recent rise in margin debt is unsurprising as investor exuberance climbs.

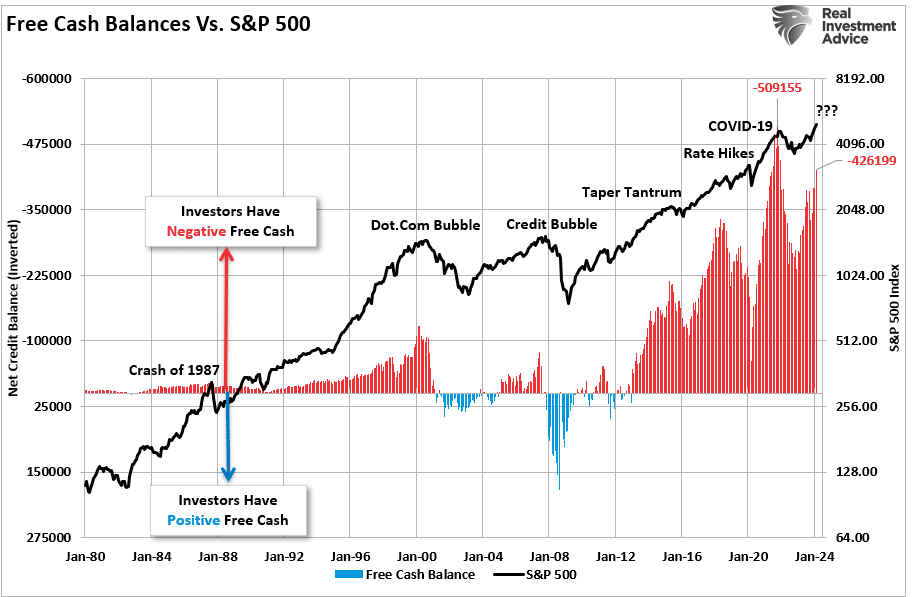

The chart shows the relationship between cash balances and the market. I have inverted free cash balances, so the relationship between increases in margin debt and the market is better represented. (Free cash balances are the difference between margin balances less cash and credit balances in margin accounts.)

Note that during the 1987 correction, the 2015-2016 “Brexit/Taper Tantrum,” the 2018 “Rate Hike Mistake,” and the “COVID Dip,” the market never broke its uptrend, AND cash balances never turned positive.

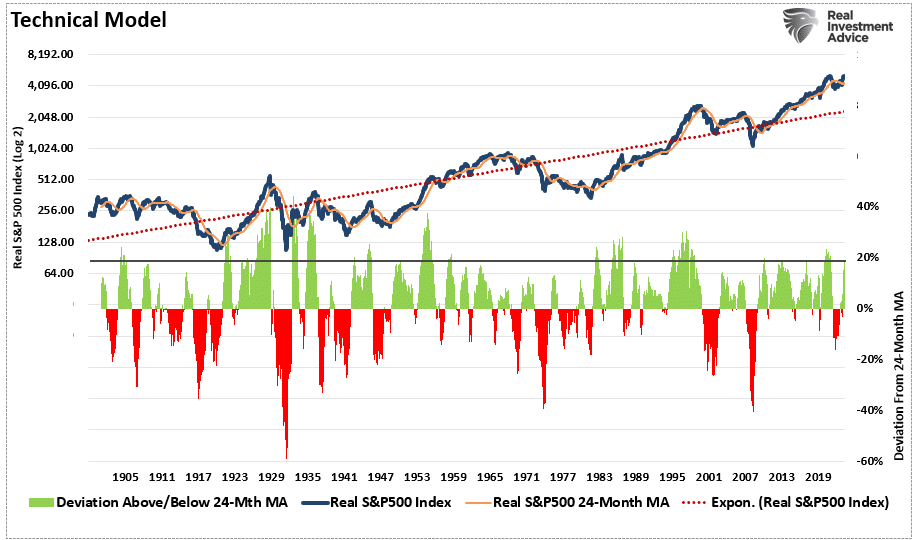

Both a break of the rising bullish trend and positive free cash balances were the 2000 and 2008 bear market hallmarks. With negative cash balances shy of another all-time high, the next downturn could be another “correction.” However, if, or when, the long-term bullish trend is broken, the unwinding of margin debt will add “fuel to the fire.”

While the immediate response to this analysis will be, “But Lance, margin debt isn’t as high as it was previously,” there are many differences between today and 2021. The lack of stimulus payments, zero interest rates, and $120 billion in monthly “Quantitative Easing” are just a few. However, some glaring similarities exist, including the surge in negative cash balances and extreme deviations from long-term means.

In the short term, exuberance is infectious. The more the market rallies, the more risk investors want to take on. The issue with margin debt is that when an event eventually occurs, it creates a rush to liquidate holdings. Since margin debt is a function of the value of the underlying “collateral,” the forced sale of assets will reduce the value of the collateral. The decline in value then triggers further margin calls, triggering more selling, forcing more margin calls, and so forth.

Margin debt levels, like valuations, are not useful as a market-timing device. However, they are a valuable indicator of market exuberance.

While it may “feel” like the market “just won’t go down,” it is worth remembering Warren Buffett’s sage words.

“The market is a lot like sex, it feels best at the end.”