Stocks ended the day mostly flat, resembling a pause. It wouldn’t be surprising to see the market trade lower today, ahead of the payroll report, which is due tomorrow.

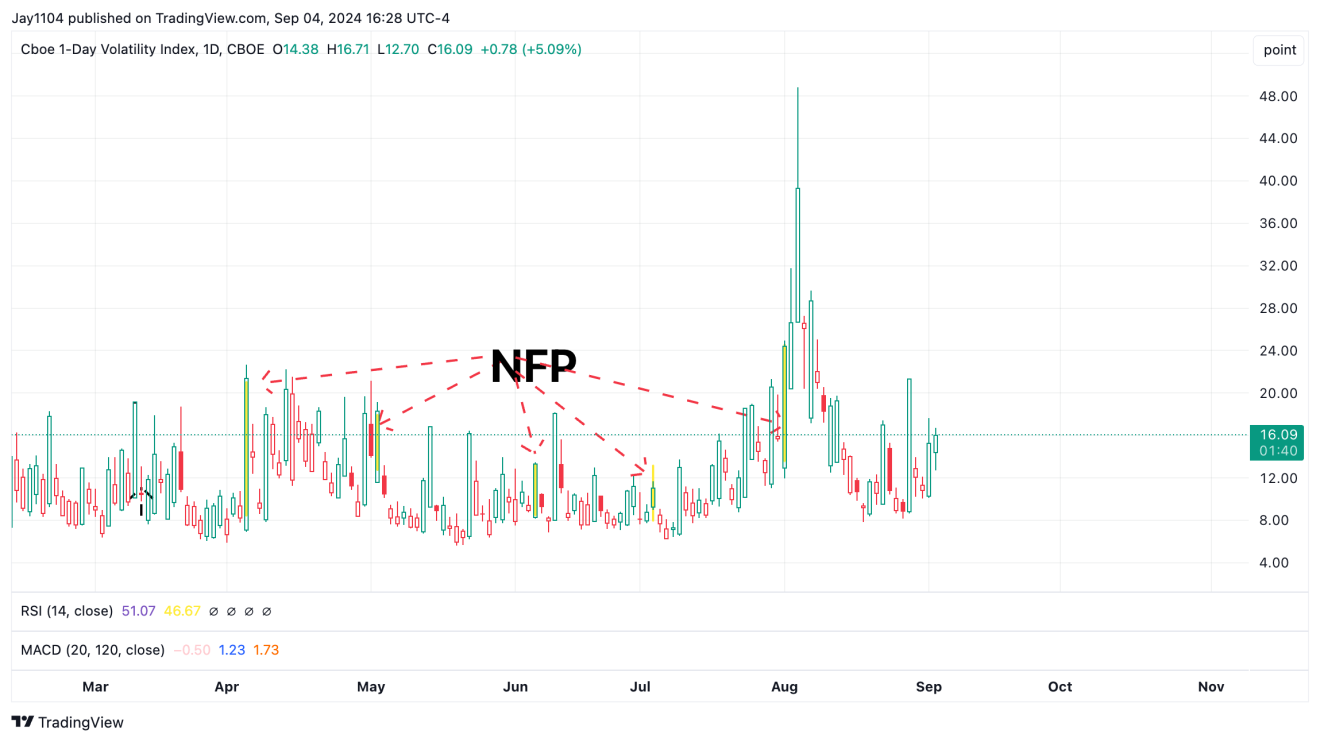

Implied volatility will likely increase leading up to the report, then drop sharply once it’s out.

The VIX 1-Day is already at 16, and a move above 20 isn’t out of the question, considering the significance of this report, especially with the recent rise in the unemployment rate over the past few months.

While the S&P 500 and the VIX 1-Day can rise together, this environment may not currently support that scenario.

With volatility on the rise, let's consider how the market is positioning itself ahead of a big jobs report tomorrow.

Yield Curve Disinverts

The yield curve continues to steepen, with the 2-year and 10-year yields returning to even at 0%, testing the resistance level established on August 5.

Small Caps Remain Vulnerable

The small-cap IWM ETF seems to be on the cusp of breaking significant support.

USD/JPY Lurks at Support

In the meantime, USD/JPY is resting on support at 143.50 and waiting for a signal about what will happen next.

A weak non-farm payroll print or rising unemployment would lead to the curve steepening materially, the Yen strengthening, and a significant breakdown in small caps, given how sensitive they are to a weaker economy.

So, I do not find it odd that the market has positioned itself like this.

Well, see how things go today, but the setup is very clear now; the market is waiting for confirmation to put things into motion.