Stocks finished last week higher, but as I noted on Thursday, we entered the period when option expiration takes over.

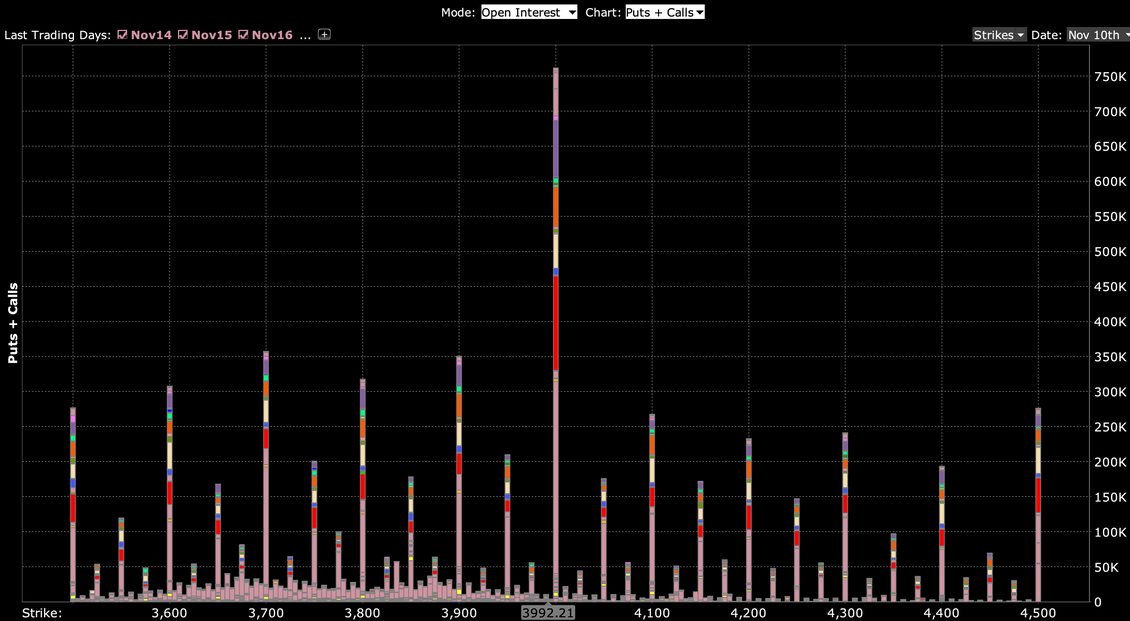

It is usually when the market gets pinned down due to those significant gamma levels. For the S&P 500, that big option gamma level is at 4,000, which is easy to see when taking all open interest levels across all strikes.

But what is also clear is that the level with the most significant number of open calls for this Friday’s OPEX is around 4,100, which means that unless that open interest level rolls higher, 4,100 is likely to be the extent to which the S&P 500 could rally this week. Once the index gets up to that 4,100 level, call option holders will likely start selling their call options, which would put a lid on things as market makers unwind long S&P 500 future hedges.

It would suggest that as we approach Friday, the S&P 500 is likely to trade in a band between, say, 3950 to 4050 to start with. If the index can get above 4,050, then 4,100 would be the extent I think we could see.

VIX

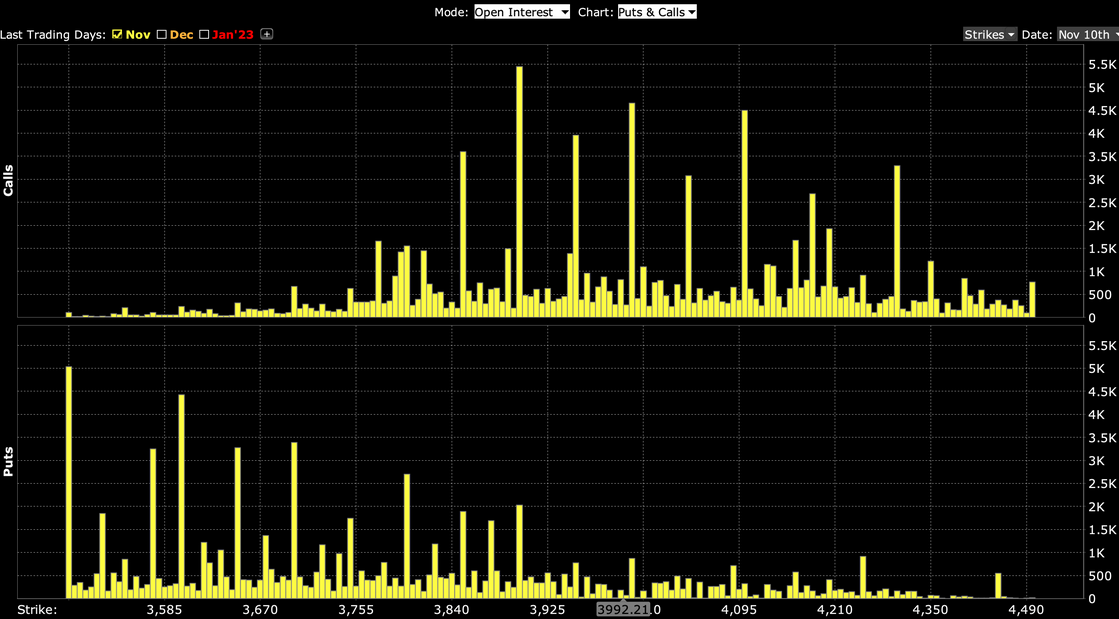

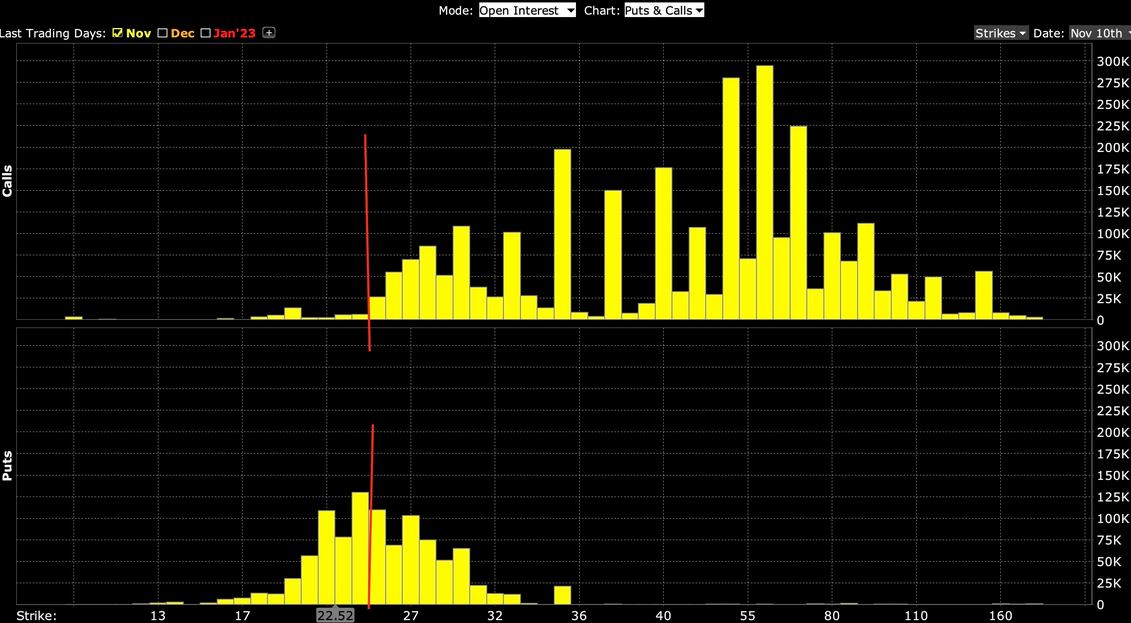

However, by Wednesday or Thursday of this week, that could begin to change because the VIX options expiration is Wednesday. It seems probable for the VIX to stay in the 22 or lower area, as that would wipe out nearly all of the calls that are due to expire this Wednesday. Those calls will start to lose value very quickly, and outside of an unforeseen event, as they lose value, hedges for the VIX will likely be sold, suppressing volatility. But with the expiration on Wednesday morning, we could start to see the VIX drift higher again.

Financial Conditions

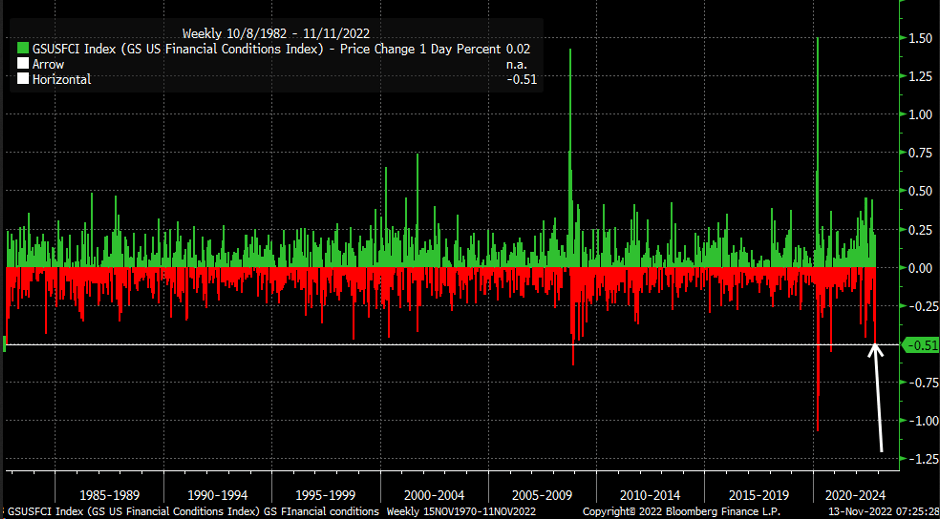

This morning could be the day when things shift because that is when Fed Vice-Chair Lael Brainard and the leader of the Doves, spreads her wings, takes flight, and gives her outlook on the economy. Based on the GS financial conditions index, which saw one of the most considerable easing of financial conditions in nearly 40 years, you would think she would try to push back on the market.

Now she could do one of two things: if the Fed is united, she should go out there and push back against the market and hammer home the fact that inflation is too high and the risk of not doing enough outweighs the risk of over-tightening. Or she can go out there and start talking about how things are two-sided and how they need to worry about over-tightening.

I hope the Fed is united and Powell and Brainard have a long discussion ahead of time. Because if she sticks with the dovish tone, financial conditions will continue to ease, which means the S&P 500 will probably test 4,100. Unfortunately, Powell is nowhere on the calendar anytime soon, and the Fed minutes are on November 23, which is plenty of time for things to get out of control.

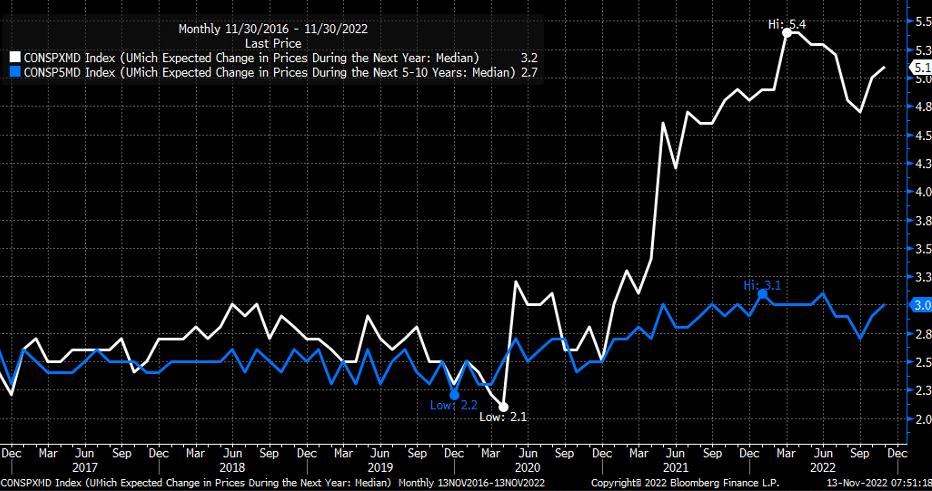

Brainard does need to push back, especially following the news on Friday that the University of Michigan saw 1-year and 5-10 inflation expectations rise. Powell made a point of this at the June FOMC meeting.

US Dollar

The biggest reason financial conditions have eased is that the dollar has been hit hard and has fallen sharply. The dollar isn’t oversold yet, but it is getting close, and support at 104.25 needs to hold. I think support can hold for now.

Oil

The falling dollar certainly creates problems; the number one problem is that it helps to push the prices of commodities up. You know, like oil. Oil looks bullish here, and if the dollar falls, there is good reason to think oil rises. On top of that, there is an ascending triangle, with a rising RSI, which probably suggests oil rises towards $100.

Copper

Things like copper can also break out when the dollar falls. On top of that, there is hope the Chinese economy can turn the corner.

Inflation

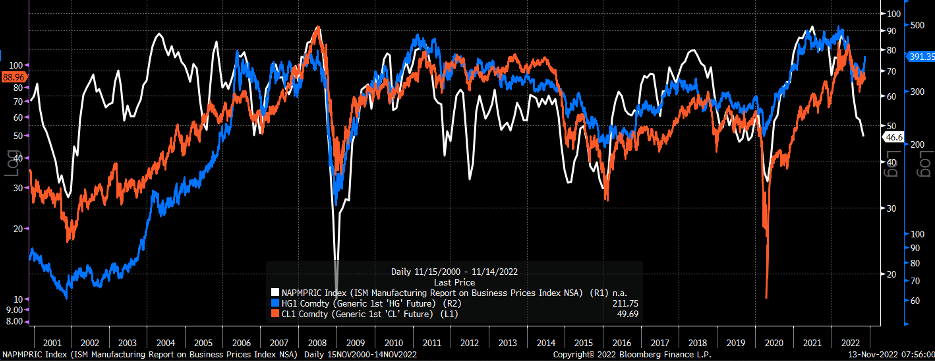

Price changes for copper and oil significantly impact the ISM manufacturing index prices paid index, which can tell us a lot about inflation’s direction.

Liquidity

This is precisely why the Fed can’t pivot or pause and will need to hold rates high for a long-time. Because there is still too much liquidity in the system, as supported by the reverse repo facility, which still has $2.2 trillion worth going through every day.

Exxon

If oil can head back to $100, then Exxon (NYSE:XOM) certainly has the potential to run to $120.

Caterpillar

It is probably also why Caterpillar (NYSE:CAT) has been on the rise again, and maybe it continues to push higher toward $245.