This week will feature critical central bank meetings, with the Fed on Wednesday, the Bank of England on Thursday, and the Bank of Japan on Friday.

While the Fed will capture most of the focus in the U.S., the BOJ may be more significant, especially if they signal that more rate hikes are likely if the economy continues to develop as expected.

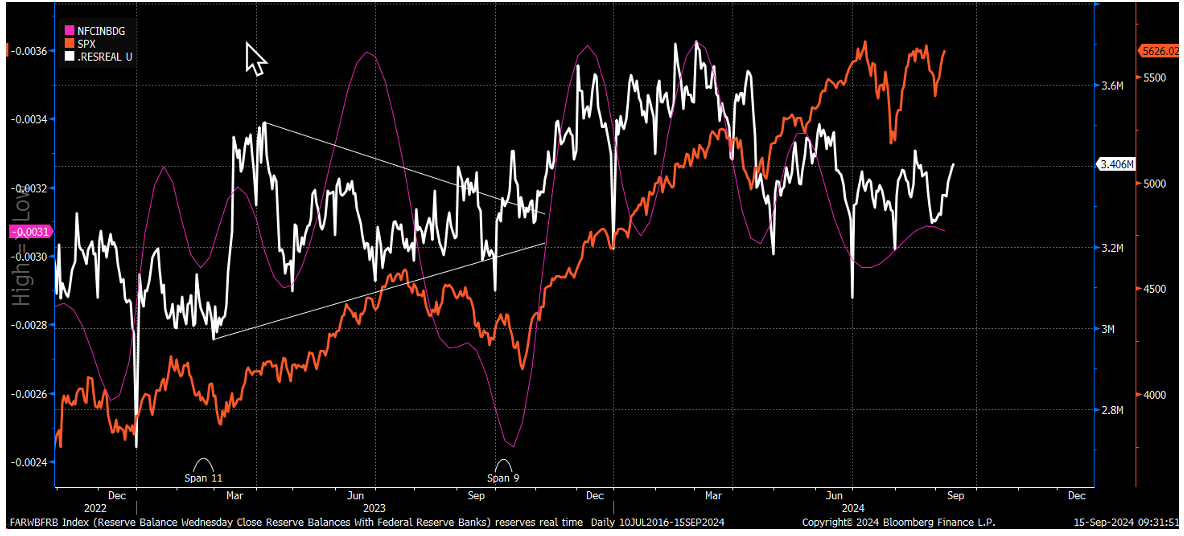

This week is also a tax week, so we’ll likely see the Treasury General Account (TGA) refill after last week’s drawdown. The TGA fell sharply ahead of this week’s gains, leading to an increase in reserve balances throughout the week. This added overall liquidity to the market while financial conditions for margins remained steady.

However, this week may bring a change, as the TGA could rise by as much as $200 billion—common around tax deadlines—which would unwind much of last week’s liquidity increase and more, potentially lowering reserves from $3.4 trillion to around $3.2 trillion.

When reserves decline, we see margin conditions tighten, negatively impacting liquidity. We are also entering the time of the month when government-sponsored entities start funneling cash into the reverse repo facility, further reducing reserves and tightening margin conditions.

Overall, liquidity conditions are expected to tighten between now and the end of September, driven by a rising TGA and, more importantly, quarter-end reverse repo activity. It’s possible that, by the end of the quarter, reserve balances could drop below $3 trillion for the first time since December 2022.

This could be especially important because we know that the yen carry trade has been unwinding for the most part. If the yen carry trade has been a source of liquidity for the market over the last several months, it could help explain why the stock market continued to rally despite reserve balances peaking in March 2024.

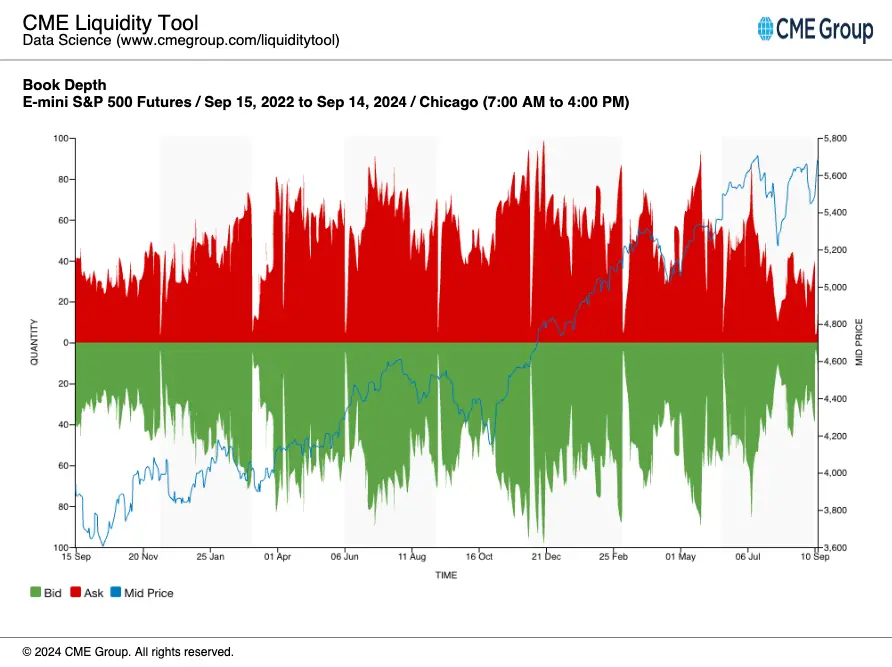

Given these dynamics, it seems likely that reserve balances may shrink further in the absence of funding from the yen carry trade, making it probable that we see reduced availability of things like margin. This could also explain the poor liquidity at the top of the book for S&P 500 E-mini over the past couple of weeks.

Sometimes, changes in liquidity coincide with the rolling of e-mini contracts, for example, from the September to December contracts. However, in this case, the overall top-of-book liquidity has deteriorated since the beginning of July.

This helps explain some of the erratic price action we saw last week, which didn’t make much sense. The sharp decline following the CPI release, followed by the surprising snap-back rally later that day, could be attributed to these liquidity dynamics.

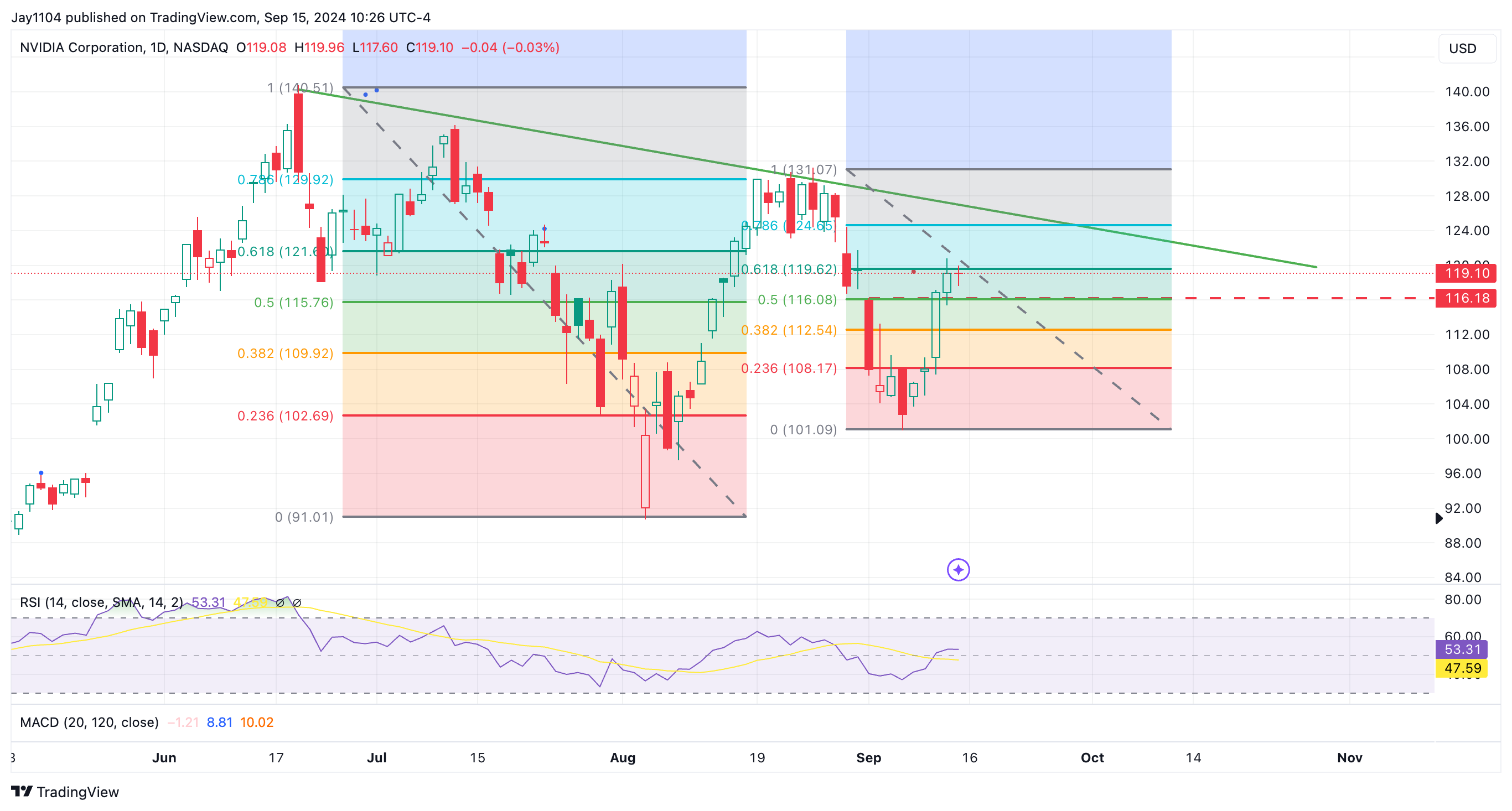

The SMH is likely the most important group to watch this week, as it’s now approaching the 61.8% retracement level and a downtrend. A similar pattern occurred with the decline starting on July 11, when the index retraced to 61.8%.

This area, around $238, will be crucial because if the SMH manages to break out and rally despite all these liquidity headwinds, it would be pretty surprising.

Nvidia (NASDAQ:NVDA) may already be giving us a clue. Despite the move higher in the SMH on Friday, Nvidia finished flat. Nvidia has also retraced to the 61.8% level, and as I’ve mentioned before, the key level with a lot of gamma this week is around $120, making it a strong resistance point. If Nvidia can’t break through $120 this week, I don’t think the market has much room to move higher.