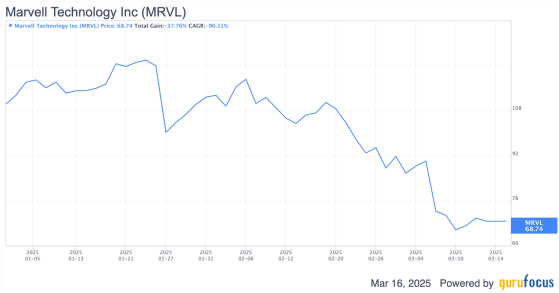

Marvell Technology (NASDAQ:MRVL), Inc. is a $60-billion market cap semiconductor company that designs, develops, and markets a wide range of integrated circuits and solutions for building data infrastructure. Essentially, its products are used in various end markets that heavily focus on data centers. Despite posting 4Q FY2025 revenue and non-GAAP EPS figures that beat Street estimatesand with 1Q FY2026 guidance coming in slightly above consensusthe stock fell 20%. Normally, such results would trigger a positive reaction, but the selloff coincided with weak sentiment driven by U.S. trade policy uncertainty and NVIDIA’s recent underwhelming earnings. As a result, Marvell’s YTD losses have almost reached 38%. In my view, this heavy downturn is an overblown market reaction.

MRVL Data by GuruFocus

Although the stock isn’t at deep bargain levels yet, its valuation multiples have compressed significantly on a forward basis. Even though Marvell appears richly priced by forward P/E standards, I believe the company’s growth prospects remain strong, especially since its PEG multiple is now below 1x for the next couple of years. This suggests that Marvell doesn’t deserve such a pessimistic reaction. I expect that as the secular AI innovation trend continues to drive higher demand for data center solutionsparticularly as the firm ramps up volume shipments for XPUs to its hyperscaler customersthe stock will likely rebound in the next few months. Let me explain my rationale further in this article.

Growth Driven by AIMarvell’s growth momentum remains robust. Total revenue increased 27.4% YoY in 4Q FY2025, largely driven by a stellar 78.5% YoY rise in Data Center revenue. With management’s guidance for 1Q FY2026 predicting a 61.5% YoY increase in Data Center revenue, I don’t expect a sharp slowdown from here. It’s clear that the primary driver of Marvell’s top line is Data Center revenue, which now represents 75% of total revenuea mix that I believe is a strong indicator of future trends. Moreover, more than half of that Data Center revenue is fueled by AI. The company generated $2.5 billion in AI-related revenue in FY2025, significantly beating its initial guidance of $1.5 billion from April 2024’s AI Day, and management expects FY2026 AI revenue to be well above $2.5 billion, with the street consensus at $3 billion. This more than $2.5 billion level suggests that the data center market will likely continue to grow strongly in eFY26, even if there is some chatter about a potential drop in AI compute demand.

Custom ASICs and Partnership OpportunitiesThe expected growth is primarily driven by ramping up volume shipments for XPUs across hyperscaler customers. Despite near-term uncertainty, such as news that Microsoft (NASDAQ:MSFT) canceled some data center leases, I see that as mere noise; hyperscalers will likely keep investing heavily in compute capacity over the coming years. Marvell has experienced accelerated growth in its custom ASIC business in a manner similar to Broadcom (NASDAQ:AVGO)’s market dynamics, largely due to partnerships with major hyperscalers. A key partnership is with Meta (NASDAQ:META) Platforms, where Marvell signed a deal in 4Q FY2025 to provide custom ASICs, firmware, and software. This deal could be a major revenue driver as Meta expands its data center footprint, with management at Meta suggesting a capital outlay of $60-65 billion for eFY2026 as they develop Llama 4 and grow their AI platform. In addition, Marvell has already reported volume production from its custom AI silicon programs with established customers like Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL), expected to be top-line accretive in FY2026 and FY2027. The long-term benefit of these partnerships is the potential for multi-generational releases, which provides some recession protection because these hyperscaler capital outlays, particularly in AI, are unlikely to be reversed given the intense competition and their robust spending capabilities.

I believe it’s clear that while Nvidia (NASDAQ:NVDA) maintains a dominant position in the merchant business due to the flexibility of its chipsas highlighted by CEO Jensen Huangthe real growth driver for Marvell is the hyperscalers’ need for customized solutions. Even players in the Chinese AI space acknowledge the efficiency gains driven by innovations like those from DeepSeek. This ongoing drive for algorithmic improvements that lower costs should benefit custom AI compute, helping Marvell sustain and even grow its market share. Although Broadcom is a formidable rival, I see Marvell’s profitable business model and pricing flexibility as key advantages in competing on a more appealing price/value basis with hyperscalers. Marvell has already secured design wins for custom NICs and follow-on custom CXL memory solutions with major hyperscalers such as Meta Platforms, setting the stage for remarkable operational tailwinds in the next 1-2 years as momentum builds in the custom silicon space.

Margin Trends and Operating LeverageThe focus on data centers has temporarily resulted in lower-margin sales volumesMarvell’s adjusted gross margin for Q4 FY2025 was about 60.1%, a slight drop from the 63.9% reported in Q4 FY2024, largely due to high custom silicon volumes within the data center segment. However, I view a 60.1% margin as acceptable since it falls within Marvell’s target range, even if it leaves a limited margin of safety. The company continues to maintain a resilient margin outlook; while its non-GAAP gross margin has normalized without a significant decline, its non-GAAP operating income margin expanded notably in Q4 FY2025, and the outlook for 1Q FY2026 suggests margins will remain relatively flat compared to the previous quarter. This indicates that Marvell is benefiting from strong operating leverage, which helps offset any lower-margin inflows as the data center business scales. Management reiterated a long-term target for non-GAAP operating income margins of 38% to 40% (up from 33.7% in the latest quarter), which is a key anchor for me because it shows the company’s optimism about scaling its custom AI compute and high-speed networking business. I expect margins to continue improving in eFY2026 as production volume ramps up for its hyperscaler customers’ XPU products.

Multiple Valuation Discount From a fundamental perspective, I believe shares are significantly undervalued, especially when considering their historical trading premiums. The stock was trading at a 40x 1-year forward P/E ratio before the slump (when the stock price was above $60 a few weeks ago). Now, the picture is different because Marvell is trading at just 25x next-year’s earnings, and what’s more important, the PEG ratios for the next few years are well below 1x. When comparing the 3-year forward P/E ratio of 14.5x with its direct chip peers, only Qualcomm (NASDAQ:QCOM) trades cheaper at 12.9x, whereas Broadcom, Analog Devices (NASDAQ:ADI), and Nvidia trade significantly higher at 21.7x, 19.3x, and 18.6x respectively, while AMD (NASDAQ:AMD) and Intel (NASDAQ:INTC) trade relatively in line with Marvell.

[Alpha Spread]

I think that this multiple should realistically come back to at least about 17x; firstly, because it has traded significantly above that in the past few quarters, and secondly, because it is directly comparable to Broadcom, which specializes in custom ASICs and should see similar growth, if not more, as Marvell is at a lower base due to its smaller size. I believe this valuation gap between Broadcom and Marvell should tighten. Given my 17x multiple assumption, we would be looking at a target price of about $81 with a margin of safety of roughly 17%, which I think is plenty given the conservative multiple expansion assumption.

DCF Model I’ve also taken a comprehensive DCF approach to form my expectations for the company. In this DCF model for Marvell, I assumed a 5-year growth forecast period, with a 10% discount rate and a 5% terminal growth rate.

[Alpha Spread]

In terms of the top line, I expect it to grow from roughly $8.15 billion in Year 1 to $14 billion by Year 5, driven primarily by the firm’s data center business. Given the capital outlays from hyperscalers like Meta, Amazon, and Alphabetespecially for custom ASICs, NICs, and CXL memory solutionsI expect Marvell’s revenue mix to remain tilted toward data center products, fueling ongoing top-line momentum. On the margin front, the model assumes net margins will improve from the high 20s into the mid-30s by the end of the forecast period, reflecting better operating leverage as data center volumes ramp up, and this aligns with management’s longer-term operating income margin target of 3840%. Both the revenue growth trajectory and margin expansion are broadly in line with Wall Street expectations. Finally, I expect net CapEx to rise from around $328 million to $946 million by Year 5 as the firm invests in advanced-node manufacturing and design work for next-generation AI compute. However, Marvell’s scale and partnerships should allow it to absorb these costs without compromising margin expansion.

Based on these assumptions, the DCF model yields a target price of $87, implying 22% upside from current levels, which I believe further enhances my bullish thesis.

Concluding ThoughtsIn conclusion, I believe Marvell’s nearly 30% decline is overdone, especially given its strong 4Q earnings and impressive forward outlook. The recent selloff appears to be driven more by a broad shift in market sentiment than by any real weakness in the business. Valuation multiples have compressed significantly, creating an attractive buying opportunity for a company that is still in a high-growth phase. I see no clear signs that demand in its end markets is crashingin fact, Marvell has firmly positioned itself as a pure play in the data center space. Given that this segment is poised to expand further over the next few years, I expect Marvell’s multiples to eventually rise back to or even exceed past levels. For these reasons, I remain bullish on Marvell at its current levels.

This content was originally published on Gurufocus.com