Mastercard Inc. (NYSE:MA) is currently the most attractive payment services investment if one is looking for stability, high growth, a robust moat and relatively low risk. I estimate that it is fairly valued when compared to Visa (NYSE:NYSE:V) and PayPal (NASDAQ:PYPL) on future fundamental growth rates and current valuation multiples.

In addition, I consider the company's emerging market position to be strong and, despite growing consolidation from regional payment providers in Asia posing a competitive threat, I am confident in management's strategy, brand cultivation and maintenance to continue to lead as one of the dominant payment companies in the world for the foreseeable future.

Operational analysisI am incredibly bullish on Mastercard as a long-term investment for its low volatility. This is supported by its diversified revenue streams and moat in payment solutions, which are only surpassed by Visa.

A significant driver of Mastercard's growth is its cross-border transactions at the moment, which are rising due to heightened international travel and e-commerce. In the second quarter, cross-border volumes grew by 17%, highlighting the importance of this segment. This is one of the core reasons why the company is currently expected to deliver stronger future growth than Visa because it is more strategically positioned with a focus on expansion in emerging markets right now. Mastercard's strategic investments in regions like Asia, the Middle East and Africa are a reason to be bullish, but Visa still holds a larger global market share despite being operational in fewer countries.

CompanyQ2 2024 Cross-Border Volume Growth %Countries Operational InFY25 Revenue Growth Estimate| Mastercard | 17% | Over 210 | 12% |

| Visa | 16% | Over 200 | 9.8% |

The threat from PayPal and Stripe is more nuanced, but it does deserve attention, especially as novel payment solutions like cryptocurrency become more widespread and Web3 technologies begin to transform online payment solutions. Stripe has notably experienced an incredible CAGR of 69.50% in revenue since 2017. The company specializes in facilitating online payments for internet businesses, making it a key competitor to Visa in the digital economy.

In addition, we are seeing major payment networks in Asia, like UnionPay, JCB and RuPay, consolidate market share in local markets and also begin to expand internationally. UnionPay is the largest card issuer in the world by number of cards, with over 9 billion cards in circulation. While China is its core market, it is now accepted in 183 countries and regions. JCB, originally from Japan, is now accepted in over 190 countries and regions. Finally, RuPay, which is India's domestic card network, has rapidly grown its market share in India, surpassing Visa in terms of the number of transactions in the country. RuPay is accepted in over 200 countries and territories worldwide.

The international markets are definitely competitive, but Mastercard has a strong position because it closely leads alongside Visa in brand recognition and trust, as well as in technological innovation. I consider reputation to be one of the hardest elements to develop in business and the strongest factor in long-term success once it has been cultivated. Mastercard's global brand provides it with power in emerging markets that may be unfamiliar with the less-renowned players.

On the note of technological advancement, Mastercard has recently realigned its organizational structure to include a dedicated data and AI group. This is going to support the company in enhancing operational security, as well as improve the customer experience. In addition, management has decided to invest in technologies like contactless payments, tokenization and biometric authentication to enhance security and convenience for consumers. This is far ahead of other smaller payment companies, so I believe management can continue to consolidate its moat by aggressively investing in seamless payment technology to drive customer acquisition and retention.

Financial analysisCurrently, I consider Mastercard to be fairly valued, as although its price-earnings ratio without non-recurring items and its price-sales ratio is higher than that of Visa and PayPal, its future growth rates in earnings per share and sales support this. I believe the market has been efficient here with both Visa and Mastercard, with PayPal the obvious outlier, as its earnings growth is anticipated to be very strong moving forward, but it is clearly undervalued on both ratios.

CompanyPE Ratio without NRIFuture 3Y EPS without NRI EstimatePS RatioFuture 3Y Revenue Estimate| Mastercard | 35.88 | 16.40% | 17.11 | 11.93% |

| Visa | 28.58 | 12.65% | 16.17 | 9.93% |

| PayPal | 17.1 | 14.18% | 2.53 | 7.53% |

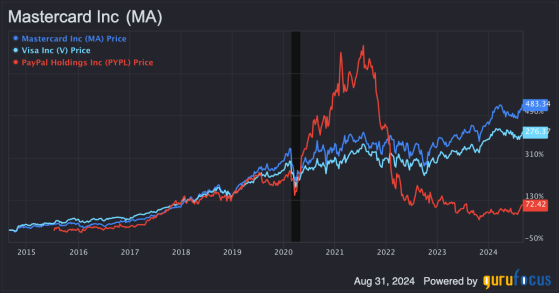

Historically, both Mastercard and Visa offer much more stability than PayPal, and I believe this is the big attraction of both companies as investments. We can also see that over the past decade, Mastercard has outperformed Visa in price growth. I believe this is a trend that will continue, particularly for the reasons outlined in my operational analysis above.

PayPal is currently viewed as a turnaround play, and a new management team is working diligently to reinvigorate the company for better future returns following the current undervaluation. However, this is not an ideal or low-risk place to invest, in my opinion. Instead, Mastercard offers diversification, moat, revenue and earnings stability, and global dependency to sustain strong investor sentiment through natural cycles of macroeconomic conditions. It also offers the competitive price growth that one may be looking for from the value returns of PayPal, but without the value trap risk.

One area of weakness for Mastercard at the moment is its gross margin, which is currently 76.42%, down from its 10-year median of 78.18%. In the second quarter, the company's operating expenses increased by 12%, which could be a result of inflationary pressures around the world. Furthermore, the company has seen an increase in payment network rebates and incentives, which grew by 14% in the second quarter, reducing net revenue and affecting the gross margin. Mastercard is providing these incentives to maintain and grow its customer base, but these current pressures are still a strain. Despite the negative impact on its gross margin, the company has managed to maintain a net margin of 46.45%, which is significantly up from its 10-year median of 40.65%. This shows strong operational efficiency and profitability strategies, which is arguably a reason to be bullish.

Risk analysisThere is currently a growing risk for Mastercard in the emergence of direct payment channels. Retailers like Target (NYSE:NYSE:TGT) have introduced their own payment methods, such as its Circle Card, to directly debit customer bank accounts. I believe there is a significant threat here that merchants who are advanced technologically and focused on profitability incentives will bypass Mastercard and Visa's card solutions to provide a more lucrative shopping process. This is because by using direct payment channels, merchants can save on interchange fees, which typically range from 1% to 3% of the transaction value.

I am also currently observing the rise of innovative fintech companies, like Revolut, Block (NYSE:SQ) and cryptocurrency exchanges, which are integrating digital wallets, peer-to-peer payment platforms and buy now, pay later services. In response to this threat, Visa is combatting fintech companies with its Visa Everywhere initiative, which is creating an ecosystem to embed new fintech solutions into its platform. This is crucial for Mastercard's management to focus on, too, as the company needs to consolidate its position in the evolving digital payments market, and network integration is arguably the most critical strategy for it to continue to secure its moat. Mastercard has its Start Path program to support early-stage fintech startups by offering them access to Mastercard's capabilities and introducing them to funding.

Lastly, the cyberthreat landscape is evolving, and as fields like quantum computing and artificial intelligence become more pronounced, so will the tactics of cybercriminals. Cybercriminals are using AI to create sophisticated impersonations of customers and executives, so Mastercard needs to be particularly well-secured against fraud in the future. This ties in with the growing capability for automated attacks, for example, using AI to carry out Bank Identification Number attacks, which is a process where criminals use automated software to test various credit card numbers simultaneously. In addition, quantum computing poses a future threat to current encryption standards, as it could potentially break RSA cryptography, making digital transactions insecure. This is why management is preparing for quantum-resistant cryptography. However, the whole evolving field and Mastercard's need to keep up with advanced threats is costly. In tandem with other digital payment providers, it could inhibit earnings growth related to security costs for extended periods.

ConclusionI consider Mastercard to be a low-risk, high-growth investment. It offers low volatility, which is similar to that of Visa, but it is currently anticipated to beat Visa in future growth rates based on the Wall Street consensus. It has also managed to beat Visa in price growth over the past decade.

I am particularly bullish on Mastercard for its position in emerging markets, which I expect to be a core growth driver for it moving forward. Despite novel threats in fintech, the company is positioning itself well to capitalize on partnerships with new companies and management is taking a proactive approach to secure its moat from the evolving digital threat landscape. Based on its high growth rates and valuation multiples compared to peers, I consider Mastercard fairly valued and, as a result, rate it a buy amid continued low-volatility growth that I expect over the next five to 10 years.

This content was originally published on Gurufocus.com