A lot of investors are searching for Dividend Aristocrats, which are recognized for paying consistently increasing dividends. These companies are well known for their ability to provide shareholders with predictable, rising dividends and potential long-term capital appreciation.

In this analysis, we will examine McCormick (NYSE:MKC) & Co. Inc. (NYSE:MKC), one of the famous Dividend Aristocrats. McCormick boasts of an extensive track record of financial stability as well as shareholder returns, having an uninterrupted history of dividend payments since 1925. The company, which has increased its dividend payments for 38 consecutive years, underscores its commitment to gratifying investors with rising dividends. We will take a look at McCormick's financial performance, growth prospects as well as strategic factors contributing to its impressive dividend record.

Key segments and market insightsMcCormick operates in two primary business segments: consumer and flavor solutions. The more profitable consumer segment contributed 57% to consolidated 2023 sales and 73% of operating earnings. Consumer brands such as McCormick, French's and Frank's RedHot provide a broad range of spices and seasonings from sauces and condiments, reaching consumers in more than 170 countries.

The flavor solutions segment, on the other hand, accounts for 43% of total sales and 27% of operating earnings, serving food producers as well as foodservice clients. Thus, for this business segment, it is important for the company to keep sustainable customer relationships. McCormick's strategic raw material procurement, client price changes as well as cost-saving strategies minimize the volatility of agricultural raw material rates. As the company depends on third-party transportation providers, it faces challenges like shortages of skilled labor and soaring fuel costs, increasing its operating expenses.

With a large customer base, including significant sales to Walmart (NYSE:NYSE:WMT) (12% of consolidated sales) and PepsiCo (NASDAQ:PEP) (13% of consolidated sales), McCormick continues to lead through innovation and brand marketing. In the flavor solutions segment, the company has significant customer concentration. The top three customers represented between 47% and 49% of global flavor solutions sales.

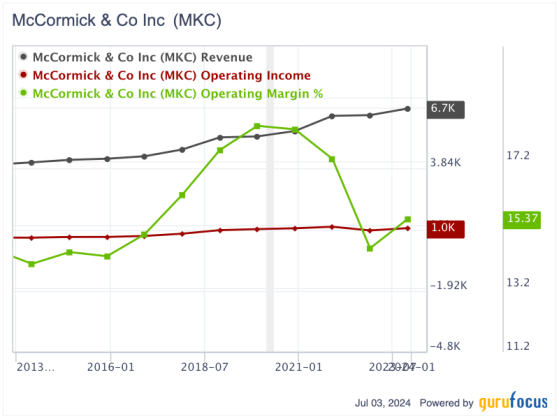

Growing operating performance and consistent positive cash flow generationMcCormick's revenue as well as operating earnings have been on the rise for the last 10 years. Revenue increased from $4.12 billion in 2013 to $6.66 billion in 2023, while operating income rose from $575.50 million to over $1 billion in the period. McCormick was also consistently profitable with operating margins between 13.96% to 18.30%. Its operating margin stood at 15.37% in 2023.

MKC Data by GuruFocus

Its operating cash flow has seen wide fluctuations during the last 10 years as well. Between 2013 and 2020, its operating cash flow soared from $465.20 million to $1.04 billion. In the following two years, its operating cash flow dropped to $651.50 million in 2022 before recovering to $1.24 billion in 2023. Its free cash flow followed the same trend, increasing from $365.30 million in 2013 to $816 million in 2020, falling to $389.50 million in 2022 and rebounding to $973.40 million in 2023.

MKC Data by GuruFocus

Magnificent dividend payment historyMcCormick is famous for its dividend payout record. The company has paid dividends since 1925 and has raised its dividend continuously for 38 years. In the previous 20 years, its dividend per share increased from 23 cents in 2003 to $1.56 in 2023, providing a good compound annual growth rate of 10%.

In order to evaluate the sustainability of its dividend payments, we have to figure out the dividend payout ratio of a company. This critical metric measures the percentage of profits paid to shareholders as cash dividends by dividing total dividends by total net income, expressed as a percentage. A lower ratio suggests the company will keep much of its profits for reinvestment or repayment of debts, and that indicates growth as well as stability. In contrast, a high ratio indicates the company is distributing a big part of its earnings. This seems to be quite attractive to income investors, but raising worries about dividend sustainability in case the company's earnings fluctuate. The dividend payout ratio over the long run can help investors figure out the sustainability of a corporation's dividend policy.

McCormick's dividend payout ratio has fluctuated between 0.36 and 0.84, remaining well below 1, since 2003, showing a sustainable dividend payment policy. The sole exception was in 2018, when the ratio reached a high of 0.84. Besides that outlier, the company's payout ratio has been conservatively kept between 0.36 and 0.59 in the past 20 years.

MKC Data by GuruFocus

Balance sheet strengthInvestors may express their concern regarding the company's low amount of cash compared with total interest-bearing debt. In May 2024, the company had shareholders' equity of $5.35 billion, which included only $166 million in cash. The total interest-bearing debt, including both short-term and long-term debt, reached more than $4.46 billion. Nevertheless, the debt maturities are spread out as far as 2047. By 2027, the annual debt amount which would come due varies from $250 million to $750 million. With the present operating cash flow of over $1 billion, I do not believe McCormick will have problems meeting those debt obligations.

Potential upsideIn order to compute the intrinsic value of McCormick, we are going to use the Gordon Growth Model, which is best suited to businesses with constant dividend growth. This model values stocks by presuming dividends are going to grow forever at a constant rate. It's especially helpful for valuing businesses whose dividend policy is predictable and stable.

We assume McCormick is going to increase its dividend at a reduced growth rate of 8% a year. Using a discount rate of 10%, we are able to compute the intrinsic value of the company using the following calculation:

P = Expected Dividend for 2024 / (Required Rate of Return - Dividend Growth Rate)

= $1.56 *(1+8%) / (10%8%)

= $84.24

Using the Gordon Growth Model, McCormick's intrinsic value is estimated at approximately $84.24 per share, implying a possible 20% increase from the trading price at the time of writing.

Key takeawayMcCormick's growing operating performance, decent balance sheet strength and positive cash flow generation make it a good long-term dividend investment opportunity. Moreover, the company has paid uninterrupted dividends since 1925 and has raised the payment for 38 years straight. According to the Gordon Growth Model, McCormick's intrinsic value implies a potential upside of 20%. All of these factors make McCormick a worthy addition to any income-focused portfolio.

This content was originally published on Gurufocus.com