McDonald's Corporation (NYSE: NYSE:MCD) remains a dominant force in the global fast-food industry, supported by its strong cash flow, robust dividend growth, and successful digital initiatives. However, with its stock trading at an elevated P/E ratio of 25.4 and facing competition in a crowded quick-service restaurant (QSR) market, McDonald's is a hold for me at current levels. While it's a reliable long-term investment due to its consistent performance, the current valuation doesn't offer much upside for new investors. Wait for a better entry point before adding to your position.

Financial Performance: Resilience in a Tough EnvironmentMcDonald's Q2 2024 earnings reveal a company holding steady in the face of challenges. The company reported revenues of $6.49 billion, remaining flat year-over-year, with a slight 1% gain when adjusted for constant currencies. Global comparable sales declined by 1%, driven by drops in key markets like the U.S. (down 0.7%) and international regions such as France and China. Despite these challenges, McDonald's reported diluted earnings per share of $2.80, down 11% from the prior year.

These figures reflect a company successfully navigating inflationary pressures and softening consumer demand, but they also underscore the limits of its pricing power. The dip in guest counts, particularly in the USA shows that consumers are beginning to feel the pinch of higher prices.

Valuation: Premium Priced with Limited UpsideA cornerstone of any stock investment thesis is understanding whether the current price accurately reflects a company's financial health and growth prospects. In McDonald's case, its premium valuation poses a critical question for investors: Is the stock too expensive given its growth outlook, or does the company's operational strength justify its elevated price?

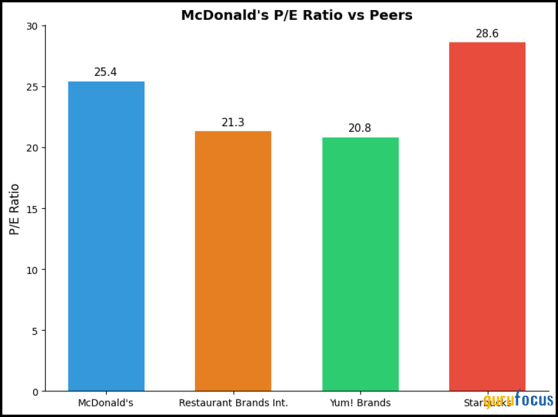

First, let's examine McDonald's Price-to-Earnings (P/E) ratio of 25.4, which is substantially higher than the industry average of around 20.2 and the broader S&P 500 index at 19.8. When we examine its P/E in comparison to key competitors such as Yum! Brands (NYSE:YUM) (20.8) and Restaurant Brands International (TSX:QSR) (21.3), we see a marked premium. Notably, Starbucks (NASDAQ:SBUX) has a higher P/E ratio of 28.6, but Starbucks is experiencing faster revenue growth, especially in international markets and with its more upscale consumer base.

Below is a comparison of McDonald's P/E ratio against its major competitors, which highlights the premium McDonald's stock commands relative to the industry.

A higher P/E ratio for McDonald's means that a multiplicative factor has been assigned to future earnings growth. Nonetheless the fact that the company recorded 1% year on year growth in constant currencies of Q2 2024 for the revenue confirms whether this much optimism is really warranted or not. Furthermore, global comparable sales were down 1%, and major markets of USA, France and China were disappointing. From these metrics extrapolated for future growth, it appears that McDonald's might not be as big of a growth machine as its current price might suggest, meaning that yet again, people buying into this stock at the current prices are risking their money.

The McDonald's company has a P/S ratio of 7.2 a figure that is actually higher than the companies in the restaurant industry. This means that investors are willing to give $7.20 for every $1 of McDonald's sales, which is more than Yum! Brands and Restaurant Brands (TSX:QSP_u) International respectively which both currently further down than the 5 level.

Even if higher P/S might be largely attributed to booming revenue, McDonald's recent sales growth show otherwise. For this reason, coupled with low or even falling comparable sales in global locations and steady revenues, there seems to be little possibility for the company's top line to grow in the near future. The idea of such a P/S ratio is based on investors' expectations that McDonald can easily translate incremental sales into profits, when in fact guest traffic continues to fall and the competitiveness in the QSR space is heating up.

The next metric is McDonald's Enterprise Value to EBITDA (EV/EBITDA) ratio, which assesses a company's valuation based on operational efficiency regardless of capital structure and is currently 16.4. This is higher than the industry average; significant competitors like Restaurant Brands International have 14.7, whereas Yum! Starbucks has a higher EV/EBITDA ratio of 19.8, compared to brands' 15.1.Starbucks' forecast rate of growth is more manageable than that of other companies because Starbucks is now expanding rapidly abroad and focusing on products with greater profits than standard Starbucks locations.

Below is a comparison of McDonald's EV/EBITDA ratio against key peers, reinforcing the stock's premium pricing relative to its industry competitors.

As illustrated in the chart, McDonald's EV/EBITDA ratio is higher than those of Restaurant Brands International (14.7) and Yum! Brands (15.1), although slightly lower than Starbucks (19.8).

McDonald's, on the other hand, has seen its comparable sales decline, and its operating income fell 6% in the second quarter of 2024. All of this suggests that the higher EV/EBITDA ratio indicates increasing profitability or the identification of new growth engines in the McDonald's value chain. It appears unlikely in the foreseeable future, given the current macroeconomic situation, which is characterized by consistent increases in debt expenses.

Debt and Profitability: Balancing Risk and RewardMcDonald's Debt-to-Equity (D/E) ratio of -789.36% highlights the company's heavy reliance on debt financing. While this is common for mature companies in the industry, it raises red flags in the current environment of high interest rates. McDonald's interest expenses increased by 13% in Q2 2024, further squeezing margins. This exposure to rising rates could become a significant headwind, especially if McDonald's struggles to drive enough top-line growth to offset the higher debt-servicing costs.

Despite the debt burden, McDonald's boasts strong free cash flow, which mitigates some of these concerns. The company's Free Cash Flow Conversion Ratea measure of how effectively it turns net income into free cash flowis relatively strong, and its cash flow from operations supports continued dividend payments and share buybacks. However, the question for new investors is whether the company's cash flow can continue to grow in an environment of higher interest expenses and slower revenue growth.

In addition, the McDonald's company achieves 30.04% as ROIC which is good and far above the industry average. This implies that McDonald's management has great efficiency in the way it turns invested capital to profits. This is a matter of some significance for long-term shareholders, as it shows that the company is earning high returns on its investments regardless of the difficulty of the surroundings.

However, even when McDonalds' ROIC is high, its current multiple mandates that it has almost no margin for error. Operating efficiency and solid cash flow generation appear to be baked into the market multiple, so if McDonald's fails to meet these forecasts due to slowing sales and increasing costs, it would be disastrous.

Lastly, we look at McDonald's Dividend Yield ratio which is 2.32%. This yield is though fairly decent, though still slightly below the average yield in the region running around 3% and as such while individuals seeking stable investments may find its provided yield fairly reasonable, it might not be the most ideal option for income investment. That said, McDonald's has displayed good growth in dividends, and, most importantly, demonstrated good shareholder remuneration policy. As such, McDonald will continue to grow its dividend in the coming years, which makes it perfect for two impeccably timed and informative reports for value investors the long-term investor with an interest in cash dividends. However, with a view to capital gains, and purely from a dividend perspective, the yield may not be sufficient to explain the current stock price.

Conclusion:McDonald's remains a highly efficient business with strong cash flow, robust dividends, and a management team that has demonstrated operational process. The company's high ROIC and stable cash flow make it a solid hold for long-term investors seeking reliable income.

However, the premium valuation across multiple metricsP/E, P/S, EV/EBITDAlimits upside potential in the short term. With slowing sales, increasing debt costs, and flat revenue growth, McDonald's current price does not offer a compelling entry point for new investors. The stock is priced for perfection, and any further deterioration in sales or profitability could lead to a price correction.

For income-focused investors, McDonald's dividend yield of 2.32%, combined with its history of consistent dividend growth, makes it an attractive long-term hold. However, for those seeking capital appreciation, the stock's current valuation leaves little room for growth, especially in a market where other opportunities may provide better risk-adjusted returns.

This content was originally published on Gurufocus.com