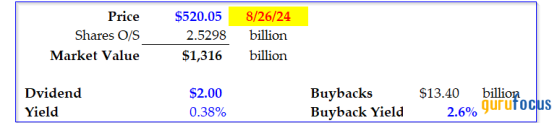

At its current level, Meta Platforms Inc. (NASDAQ:META) looks too cheap. Even though its market cap is now worth $1.31 trillion, its powerful free cash flow could push the stock higher.

This analysis will show how why and set a price target based on Meta Platforms' free cash flow margin and analysts' revenue estimates. This method uses a FCF yield metric to value the stock. However, the company is attracting value investors due to its strong free cash flow generation.

Meta's basic growth is solidThe social media giant's basic growth is intact, which is powering its revenue and FCF growth. In the quarter ending June 30, revenue was up 22% year over year and climbed 7.90% quarter over quarter (i.e., $39.10 billion versus $36.50 billion in the first quarter).

This is based on strong viewer participation in Facebook (NASDAQ:META) and other sites. As of June 30, it had 3.27 billion daily active people in its family of apps (including Instagram and WhatsApp). That was a little less than 1% higher than the prior quarter's 3.24 billion DAP stat. More importantly, this was 6.50% higher than a year earlier (3.07 billion DAP) and 13.50% over two years ago (2.88 billion DAP).

Source: Meta's second-quarter 2024 earnings slides

As a result, analysts now expect revenue will rise 17.50% this year to $158.50 billion and 12.50% to $178 billion in 2025. That works out to a three-year compound annual growth rate of 10% this year and over 15% by the end of 2025.

Free cash flow is strong and growingLast year, Meta Platforms generated $43 billion in adjusted free cash flow. Over the next two years, despite a dip in 2024, adjusted FCF will grow significantly. FCF is cash flow after all its operating cash expenses, including working capital changes and capital expenditure spending. It also deducts principal payments on leases as a FCF adjustment.

The table above shows Meta is forecasted to make $40.30 billion in adjusted FCF this year. That is is slightly lower than last year (6.20% below $43 billion in 2023). But next year, the company is likely to have substantially stronger FCF (up 17.50% at $47.40 billion).

Moreover, Meta's margins will stay strong despite a dip in 2024. For example, adjusted FCF margins should stay over 25% in both 2024 and 2025, although this is lower than the 31.90% achieved in 2023. That can be seen in the chart below.

These strong FCF margins are despite much higher spending by Meta on capex due to the buildout of its artificial intelligence capabilities. Management told analysts in the earnings call that its capex spending will be in the range of $37-40 billion, updated from our prior range of $35-40 billion.

Moreover, in 2025, the company said it "currently expect[s] significant capex growth in 2025 as we invest to support our AI research and our product development efforts.

Modeling adjusted free cash flowHere is how this was modeled in a spreadsheet on Meta. Starting with a $161.50 billion estimate for 2024 revenue, I applied an operating cash flow margin of 49.50%.

The table below shows this was the average of the past two quarters. This results in a forecast of $79.80 billion for 2024 (close to last year's $71.10 billion operating cash flow) and $90.50 billion for 2025.

The net result is that by 2025, Meta may be generating $47.40 billion in adjusted FCF, up 17.50% over 2024 ($40.30 billion) and 10.50% over 2023 ($43 billion).

Price targetsWe can use this FCF estimate to set a price target. I like to use a FCF yield metric to do this. This assumes the company pays out 100% of its free cash flow as a dividend. So the value is set by using the company's historical FCF yield.

For example, in the last 12 months ending June 30, Meta has generated $48.60 billion in adjusted FCF (which includes $23.40 billion in the first half of 2024 and $25.10 billion in the second quarter of 2023).

This last 12-month adjusted FCF of $48.60 billion represents 3.69% of Meta's existing market value. Moreover, the forecasted 2024 adjusted FCF ($40.30 billion) is equal to 3.06% of its market cap.

That implies that we can use a 3.33% FCF yield metric (i.e., 30 times FCF) to value Meta. Over time, as the market's outlook on the company improves, that could rise to a 3% FCF yield (33.30 multiple). Using a 3.33% FCF yield (30 times FCF) shows Meta is fairly valued today.

However, using a slightly better metric of 3% FCF yield (i.e., 33.30 multiple), which is equivalent to Alphabet (NASDAQ:GOOGL)'s (NASDAQ:GOOG) valuation, the upside is better:

What will likely happenI think the latter forecast (with up to a 20% upside) is more likely to occur. This is because I expect the market will raise its valuation on the stock as free cash flow stays strong despite higher capex spending.

In other words, the market will incorporate the company's spending on AI initiatives into forecasts, and likely apply some benefits with higher margins and earnings.

However, in the medium term, the stock could tread water as Meta's higher capex spending continues to lower forecasts for its FCF this year.

Analysts tend to agree with me. For example, AnaChart.com, a new sell-side analyst tracking service, shows the average price target of 46 analysts today is $587.02 per share. That is 11% above today's price and close to my target price of $577.82.

However, the highest target price projection by AnaChart's survey is $645 per share. This is close to my upside price target of $624.30 based on its free cash flow margin and FCF yield.

Here is the bottom line. Meta looks undervalued given its strong revenue and DAP forecasts. This is despite higher capex spending, which will lower its free cash flow in the near term.

This content was originally published on Gurufocus.com

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI