- META stock plunged again after Q3 earnings; the after-hours quote puts it down more than two-thirds since the end of January

- The operating business is struggling, investments in the metaverse provide additional pressure

- With no sign of changing course, META looks to be in the doghouse for some time to come

Heading into Wednesday’s third quarter report, the bull case for Meta Platforms, Inc. (NASDAQ:META) had two core pillars. First, disappointing first half results — revenue increased less than 3% year-over-year — did not suggest that the operating business was heading into irreversible decline. Second, heavy investments into the company’s metaverse plans could and, potentially, would be reversed if pressure on earnings became too significant.

Given that META was trading at just 13x this year’s earnings — and under 12x accounting for cash net of debt on the balance sheet — that bull case suggested huge potential upside. Many Wall Street analysts supported that bull case: the average price target for META suggested gains of more than 60% in 12 months.

Long term, that case perhaps isn’t irrevocably broken. Mid-term, however, Q3 earnings on Wednesday afternoon mean that case has taken a big, big hit.

Source: Investing.com

Concerns In Family Of Apps

Facebook’s earnings per share plunged 49% year-over-year in Q3. As we shall see, metaverse investments are not the only factor.

An operating lease impairment charge was one factor, accounting for a few percentage points of the decline. But even in what Meta calls its Family of Apps business, results disappointed.

Excluding currency, revenue did increase 2%. But operating expenses rose 18%. As a result, FOA operating profit fell 29% year-over-year. The $3.7 billion decline in the segment dwarfs the ~$1 billion increase in losses from the metaverse (accounted for in the Reality Labs segment).

User numbers don’t look that bad. Family daily active people (which includes Facebook, WhatsApp and Instagram) rose 4%, to an incredible 2.93 billion. The problem is pricing: price per ad fell 18% year-over-year against a 17% increase in ads served.

It’s tempting, perhaps, to chalk falling pricing up to two factors. First, Apple's (NASDAQ:AAPL) ATT (App Tracking Transparency) effort is pressuring ad revenue for Meta’s apps. After Q4 earnings, Meta forecast it would lose roughly $10 billion in revenue from ATT this year. That report began the ongoing collapse in META stock.

The second issue — one cited by Meta management — is macroeconomic challenges. The global economy is on shaky ground, and online advertising is not immune.

That case falls a bit flat, however. As I wrote in August, what’s happened to pricing looks much more like a post-pandemic reversion to the mean than the sign of a plunging global economy. Indeed, global macro data is not that bad — yet.

Indeed, FOA is still vastly outperforming pre-pandemic levels. That year, what was then Facebook generated $24 billion in operating income. In the first three quarters of this year, FOA has earned $32 billion.

Combined with user numbers, that might seem like good news: profits from the apps still are growing. But in the context of the post-pandemic environment, those numbers highlight the core concern: that Meta’s core business has much, much further to fall.

If the macro picture deteriorates further and/or user declines begin, overall profits are going to keep declining. In that scenario, META stock simply doesn’t look that cheap. Investors will struggle to blame ATT at this point: Meta forecast a lightening of headwinds from that policy in Q4, yet revenue guidance still disappointed.

When Metaverse?

The other takeaway from earnings is that Meta is not going to pull back on metaverse spending. On the Q3 conference call, chief executive officer Mark Zuckerberg was firm on that point.

Investors clearly made their displeasure known: META’s after-hours losses accelerated as the call went on.

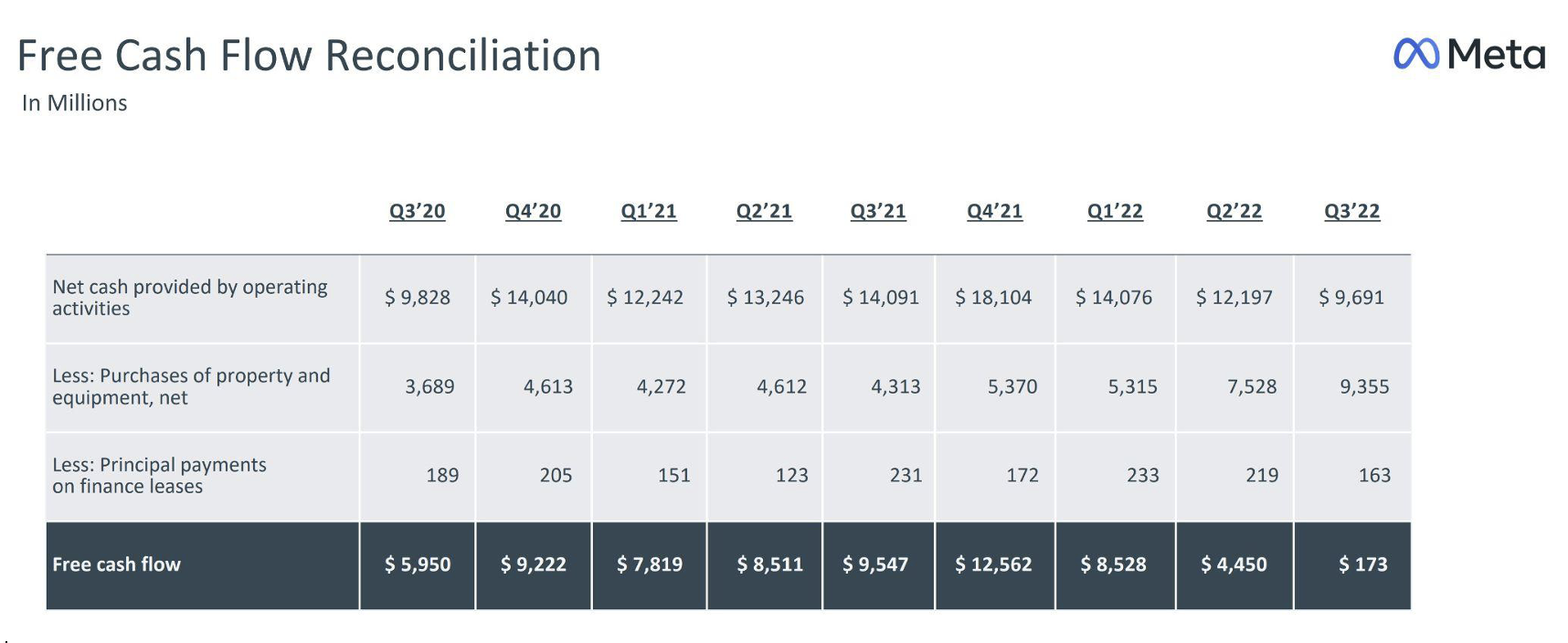

The issue is not just operating spend, but capital expenditures. Higher capex is crushing the company’s free cash flow, as evidenced by a slide from the company’s third quarter presentation:

That operating spend isn’t going anywhere, either. Facebook guided for operating expenses to increase next year to $94 billion to $99 billion (excluding an estimated $2 billion in additional operating lease charges). That compares with $85 billion to $88 billion this year.

That’s 10%-plus expense growth, despite the fact that revenue is unlikely to grow anywhere close to that much. (It may even decline.) As a result, Meta’s earnings are almost certain to decline, even considering the newly reduced expectations for 2022.

Investors likely weren’t expecting that scenario. Indeed, Wall Street consensus heading into the release implied 7% growth to $10.49. Opex guidance probably moves that estimate down toward $8, with room for further revisions if the external environment continues to weaken.

The Long-Term Case For META Stock

Admittedly, even 2023 EPS toward $8 (or worse) leaves META stock relatively cheap. Excluding net cash, META would trade around 12x earnings. Back out metaverse losses, and the multiple drops into the single digits.

That’s a multiple that suggests that both the core business is in permanent decline and that the metaverse spending generates zero return. That’s a combination that sounds an awful lot like a worst-case scenario. It’s also a combination that, as yet, hasn’t yet been proven, particularly with FOA user numbers holding up.

At the same time, it’s not at all inconceivable that both halves of the Meta business will head in the wrong direction. The metaverse efforts are completely unproven, and a gargantuan undertaking. Meta plans to build essentially an entirely new field of computing; the current Internet has been built on trillions of dollars of investment over decades.

As for FOA, TikTok continues to be a challenge, and Meta’s own shift to video through Reels and other efforts suggests permanently lower user monetization levels.

It’s at least possible that Meta profits have peaked. And that risk is what investors are going to focus on until Meta gives them a reason not to.

What’s worrisome about Q3 is what Meta communicated: it’s not terribly interested in providing that kind of catalyst. Zuckerberg is intent on being the dominant player in the metaverse, and he’s not going to let the META stock price change his plans. Any investor even considering the stock here needs to understand that, and be prepared to see this investment through until Zuckerberg’s company either succeeds — or changes tack.

Disclaimer: As of this writing, Vince Martin has no positions in any securities mentioned.