- Meta is set to report earnings today

- What's next for Zuckerberg's "year of efficiency" plans?

- Meta has a 10.6% potential upside according to InvestingPro's fair value models

After the U.S. market closes today, it's Meta's (NASDAQ:META) turn to report earnings.

This week is brimming with economic events, from the Fed and ECB interest rate decisions to big players like Microsoft (NASDAQ:MSFT), Amazon.com (NASDAQ:AMZN), and Alphabet (NASDAQ:GOOGL) reporting earnings - all happening in the space of just 72 hours.

Notably, the Mark Zuckerberg-led tech giant has some impressive things going for it. The recently launched social network, Threads has already attracted a staggering 100 million users in just one week. That's an impressive feat, surpassing even ChatGPT in user numbers.

With these numbers, Instagram's social network has come to compete directly with Elon Musk's Twitter or 'X.' However, the latest reports indicate that, after the initial interest, the active user base and engagement have not grown as anticipated.

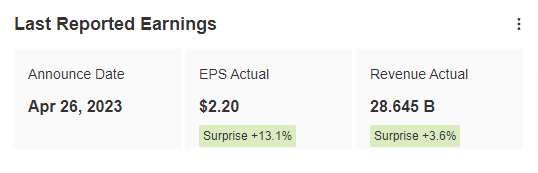

It seems that Zuckerberg's company could achieve better-than-expected results, just like it did in the first quarter of 2023.

Source: InvestingPro

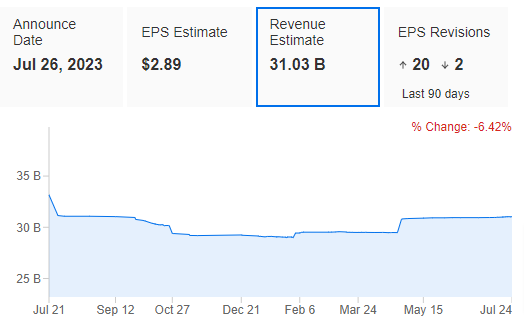

However, even though the analysts have raised their earnings-per-share expectations for this quarter by 4% over the last 12 months (going from 2.78 to 2.89), the estimated profit isn't as positive.

In fact, they have downgraded their revenue expectations for this quarter by -6.4%, going from $33.159 billion to $31.030 billion over the same period.

Source: InvestingPro

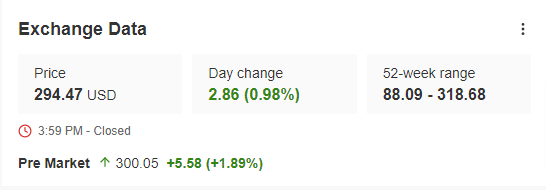

Interestingly, after 4 out of the last 5 quarterly earnings, Meta's stock has gained. However, there was one exception in October 2022, when the company's stock value took a considerable hit, experiencing a decline of -28.7%.

Source: InvestingPro

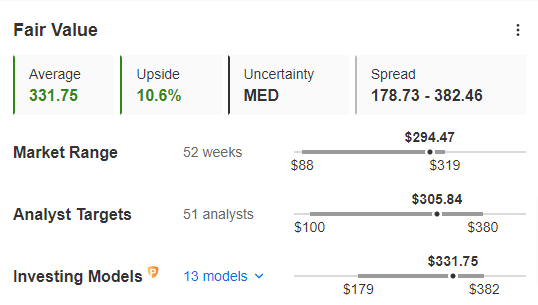

Ahead of Meta's earnings, we need to take into account the analyst insights and the conclusions drawn from various valuation models.

Source: InvestingPro

InvestingPro models indicate that Meta has a potential upside of 10.6% from the current price levels. The stock can still rally to $331.75 before it becomes overvalued.

Source: InvestingPro

The stock's remarkable 144% year-to-date rally can be attributed to the company's proactive cost-cutting measures. Now, as we eagerly await their upcoming results, we'll be on the lookout for any hints about whether they're done with layoffs or if there could be more job cuts in 2023.

Let's keep in mind that Mark Zuckerberg labeled 2023 as the "year of efficiency." Investors will undoubtedly seek more details about all the additional measures the company is taking to enhance efficiency.

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor's own.