-

Micron’s massive Q4 cut reflects sharp decline in smartphone and PC demand

-

Shares hit a new 52-week low on Friday

-

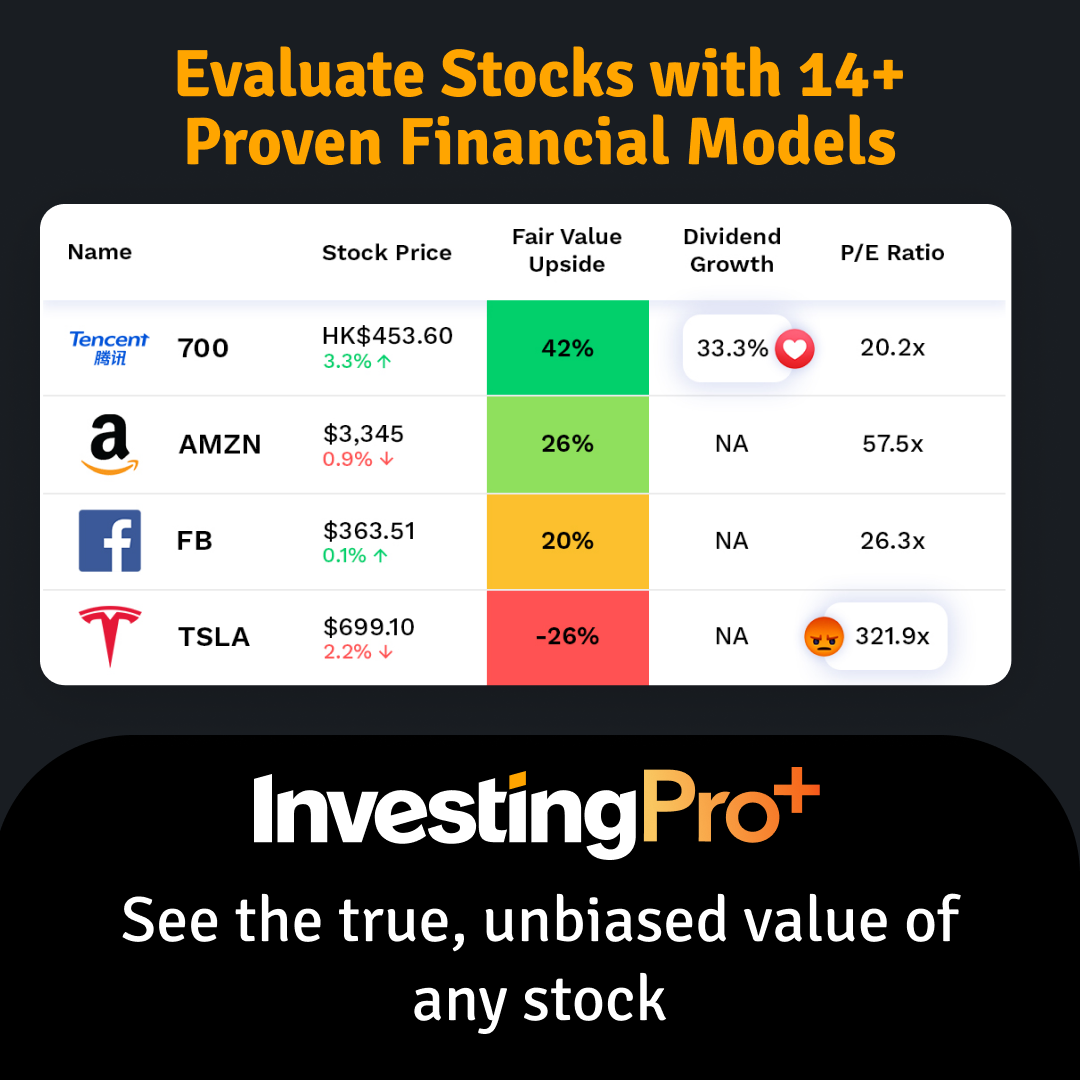

Is now the right time to buy the stock according to InvestingPro+ models?

The boom for semiconductor manufacturers seems to be over as consumer demand weakens sharply and inventory-related headwinds take their toll.

On Friday, Micron Technology's (NASDAQ:MU) share price slumped to a 52-week low after its Q3 earnings release. Although the results beat Wall Street forecasts, Q4 guidance missed significantly due to end demand weakness in consumer markets, including PC and smartphone.

Was the post-earnings slump an overreaction or a sign of things to come?

Micron’s Core Value

Micron is a semiconductor company that designs, manufactures, and sells memory and storage solutions. It operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Storage Business Unit, and Embedded Business Unit. It is an industry leader in DRAM and NAND technology.

-

52-week range: $51.40 - $98.45

-

Market cap: $59.18 billion

-

Forward P/E Ratio: 6.12x

-

Revenue compound annual growth last 5 years: 17.4%

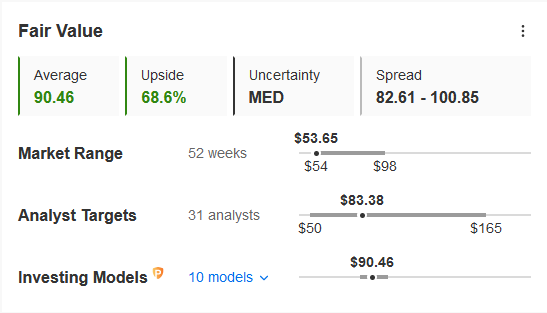

InvestingPro+ shows that the average price target for the 31 analysts who follow the stock is $83.38 (over 55% upside), while the fair value based is $90.46 (over 68% upside).

Source: InvestingPro+

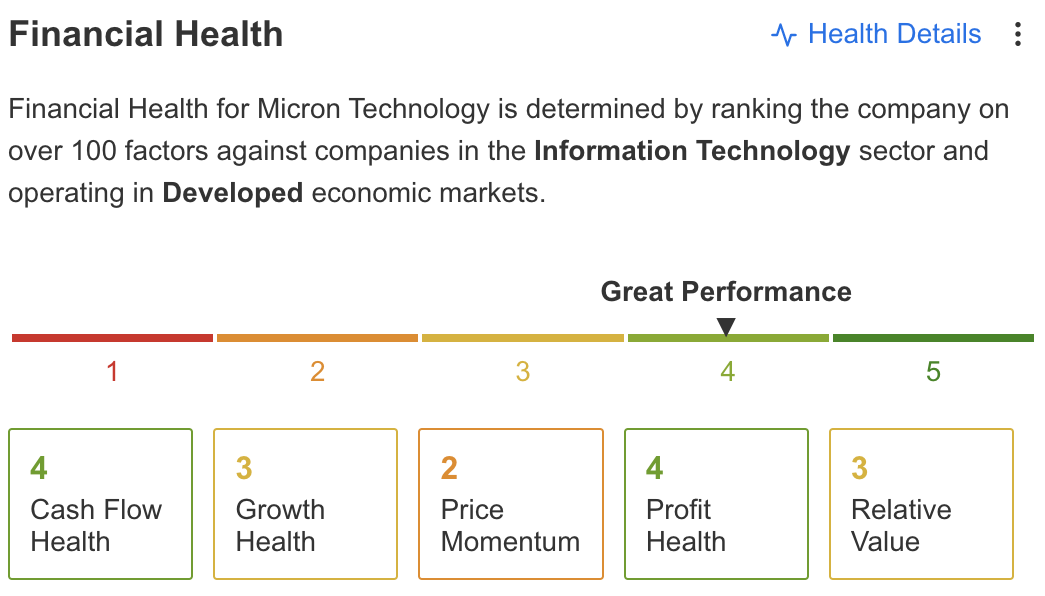

InvestingPro+ also rates the company’s financial health as a 4 out of 5.

Source: InvestingPro+

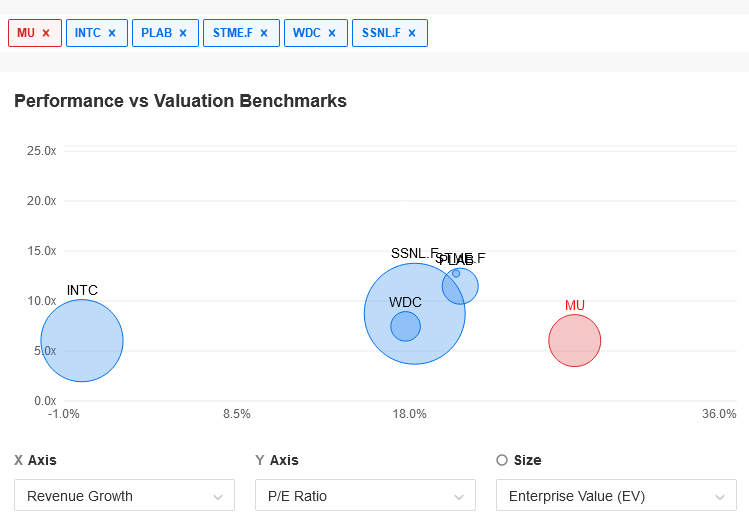

In addition to a strong financial health score, the Performance vs. Valuation Benchmarks graph shows that the company has one of the lowest PE ratios among its peers.

Source: InvestingPro+

Massive Guidance Cut And Earnings Challenges

The highlight of the quarter was a significant cut to Q4 guidance due to lower demand. PC shipments are now expected to decline 10% year-over-year (YoY) (vs. an initial flat estimate), and handset shipments are expected to be off mid-single digits YoY (vs. the initial mid-single-digit growth estimate).

Furthermore, according to the company’s earnings call remarks, several customers, primarily in PC and smartphones, are adjusting their inventories, as COVID-19 control measures in China have exacerbated supply chain challenges, and the macroeconomic environment is also creating some caution among customers.

The company expects Q4 EPS to be in the range of $1.43-$1.83, compared to the Street estimate of $2.62, and revenue in the range of $6.8 billion-$7.6 billion, compared to estimates of $9.05 billion. Both bit shipments and ASPs are expected to decline in Q4.

Given these challenges, Micron decided to reduce its supply growth trajectory, planning to minimize bit supply growth in fiscal 2023 and use existing inventory to supply part of the market demand next year. As a result, it will reduce wafer fab equipment CAPEX for fiscal 2023, which is now expected to decline YoY.

Micron’s Long-Term Outlook

Cloud, networking, automotive and industrial markets continue showing resilience.

Given weaker demand expectations for H2/22, the company anticipates year-over-year 2022 industry bit demand growth to be below its long-term CAGRs of mid-to-high teens for DRAM and high-20s for NAND.

However, secular demand trends (data center, automotive, and other areas) remain strong, and the company maintained its long-term DRAM and NAND bit demand CAGR estimates.

This suggests that we may be seeing a typical cyclical turn rather than something truly damaging to MU’s prospects. And given MU only closed down 3% after the guidance cut, it suggests the market has already priced in a slowdown.

Summary: When The Chips Are Down, Value Wins Out

Given the over 40% decline in MU YTD as well as InvestingPro+ fair value estimates which imply significant upside, we think the short-term challenges facing the company are already priced in.

In addition, management maintained its long-term CAGR outlook, has a strong balance sheet, plans for more aggressive share repurchases in Q4, and has a significantly improved competitive positioning in DRAM and NAND markets, so the shares are undervalued.

Disclaimer: The author has no positions in MU or any of the stocks mentioned.