- Reports Q4 2022 results on Tuesday, July 26, after the market close

- Revenue Expectation: $52.43 billion; EPS: $2.29

- Growth in the cloud computing unit is key for stock performance

When Microsoft Corporation (NASDAQ:MSFT) releases its latest earnings report tomorrow after the market close, investors will look closely at the tech giant's main engine of expansion in recent years: its cloud computing business.

The growth rate of Microsoft's Azure unit, the world's No. 2 infrastructure cloud provider, remains one of the most closely watched metrics in the tech space. That business segment has delivered robust performance during the pandemic as companies globally accelerate their shift to cloud-based infrastructure.

In fact, the company's cloud computing unit has been the primary driving force behind the stock's 255% advance in the past five years—a period in which its CEO, Satya Nadella, branched out into many new growth areas.

The Redmond, Washington-based company's last earnings report showed that the Azure unit posted 46% growth in the fiscal third quarter, matching the rate in the second quarter and meeting estimates. The year-on-year growth in that segment has been more than 45% during the past 10 quarters.

However, the strength in the cloud business shouldn't hide the fact that Microsoft isn't completely immune from other headwinds impacting the broader economy. There are signs that demand in the personal computing business is slowing after the past two years' pandemic-driven boom.

Currency Headwinds

In addition, a strong US dollar is becoming a major threat for global companies that make a considerable portion of their sales overseas, as their dollar-priced products become more expensive to the final consumer.

To deal with a possible blow from the softening economy, Microsoft last week announced to eliminate many open jobs, including in its Azure cloud business and its security software unit.

In a recent note, Piper Sandler said currency headwinds and moderate IT spending in the wake of high inflation and concerns about a recession would weigh on Microsoft earnings this year. MSFT's 57% of incremental growth came from outside the United States last year.

Still, an overwhelming majority of analysts remain optimistic about Microsoft due to its diversified business model that includes a suite of Office products, its cloud services, and a gaming unit.

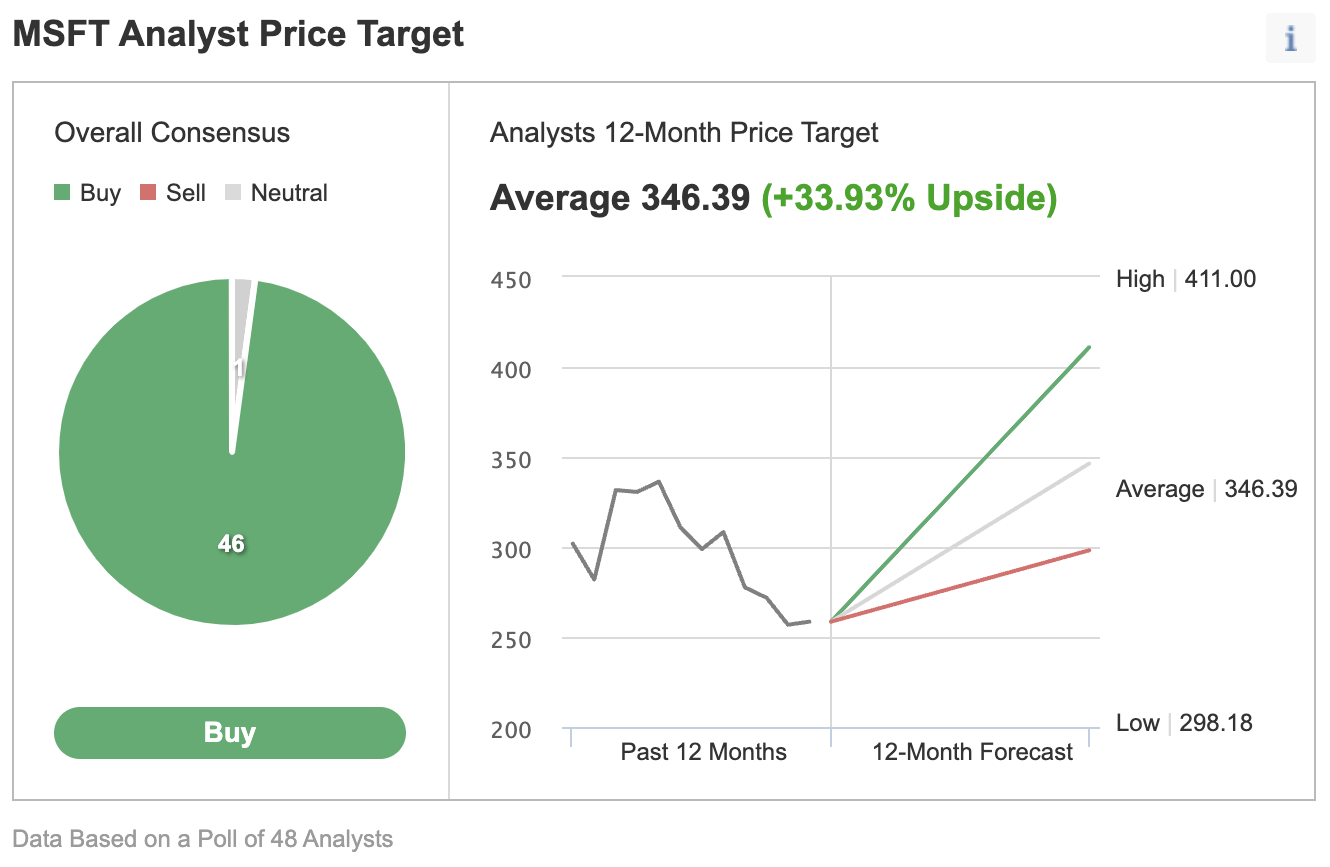

In an Investing.com poll of 48 analysts surveyed, 46 rated the stock a 'buy' with an average price target of about 34% upside potential.

Those ratings reflect the company's ability to outperform during a potential recession on the back of a strong balance sheet, solid share-buyback program, and ever-increasing dividend payouts.

In addition, the cloud segment now accounts for 46% of revenue, protecting growth even in a downturn. Piper Sandler added:

"The Microsoft Cloud segment has reached a critical mass as it eclipses the $100B+ annualized run-rate this quarter, which should help insulate overall growth prospects for Microsoft.

Even assuming growth for Azure moderates to the low 40% and the Office 365 moderates to the low- to mid-teens, we still see a scenario where revenue can grow double-digits."

Bottom Line

Microsoft earnings may show some softness, particularly due to the weakening PC demand and currency headwinds. That weakness, nonetheless, could be a great buying opportunity, given the company's cloud computing lead and strong balance sheet.

Disclosure: The writer owns shares of Microsoft.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »