Republican Everett Dirksen was the Senate Minority Leader during the 1960s. Cautioning that federal spending had a way of getting out of control, Dirksen reportedly observed, "A billion here, a billion there, and pretty soon you're talking real money." Proponents of Modern Monetary Theory (MMT) have been claiming in recent years that the US federal government can run large budget deficits to fund social welfare programs without any serious adverse economic or financial consequences.

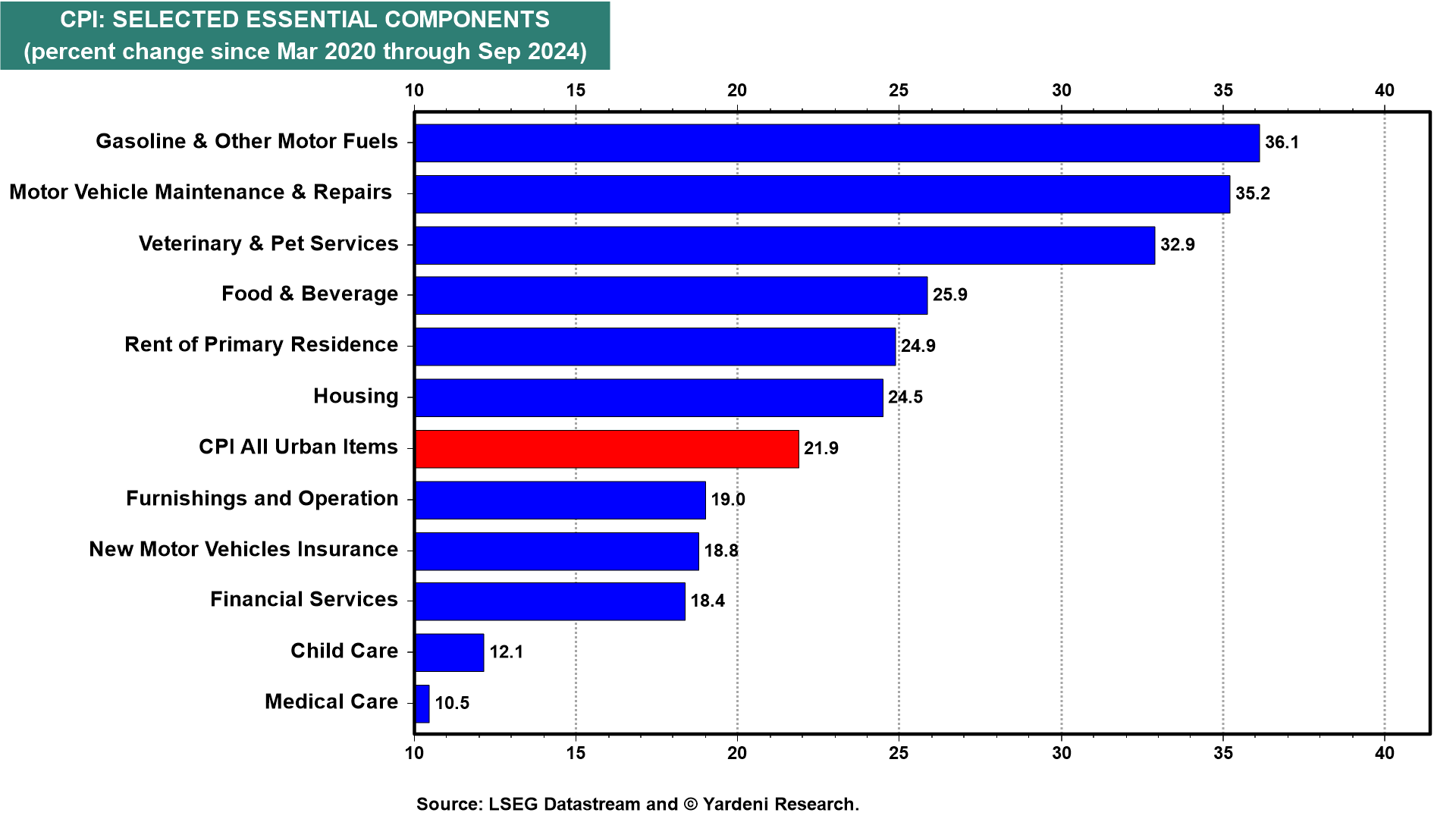

MMT’s claim that a government that borrows in its currency can finance its spending at will with more debt lost credibility as inflation soared in 2022 and 2023. But now it seems to be working. As much as we dislike MMT, we have to admit that tremendous fiscal stimulus by the current administration helped to offset the tightening of monetary policy, thus helping to avert a recession (along with other stimulative forces such as spending by retiring Baby Boomers). Nevertheless, while the y/y inflation rate has subsided, prices are much higher now than at the start of the pandemic (chart).

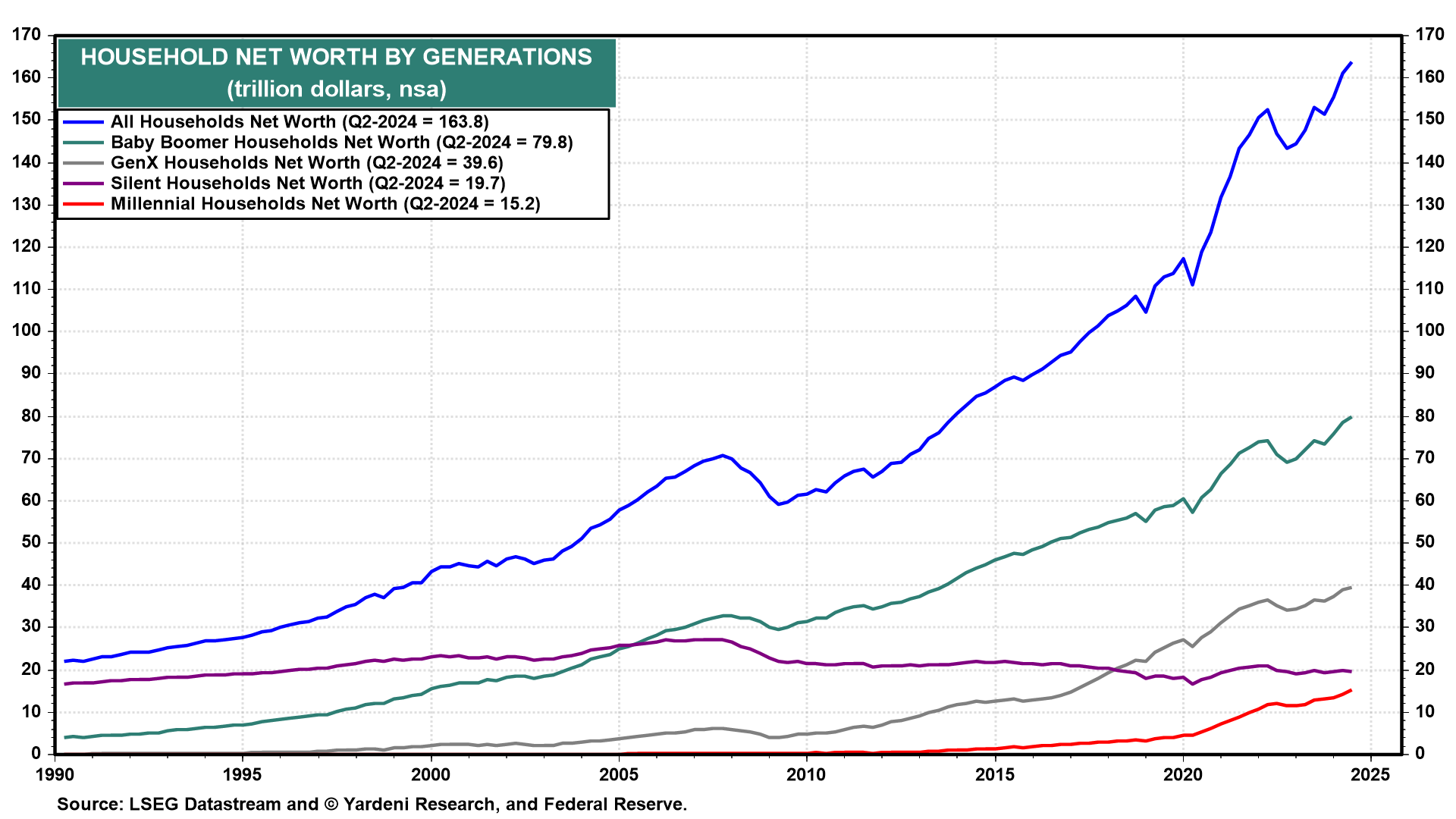

Even more troubling is that MMT is essentially intergenerational theft. The Baby Boomers enjoyed the benefits of government spending without fully funding such outlays with tax receipts. Meanwhile, they managed to accumulate $79.8 trillion in net worth for themselves (chart).

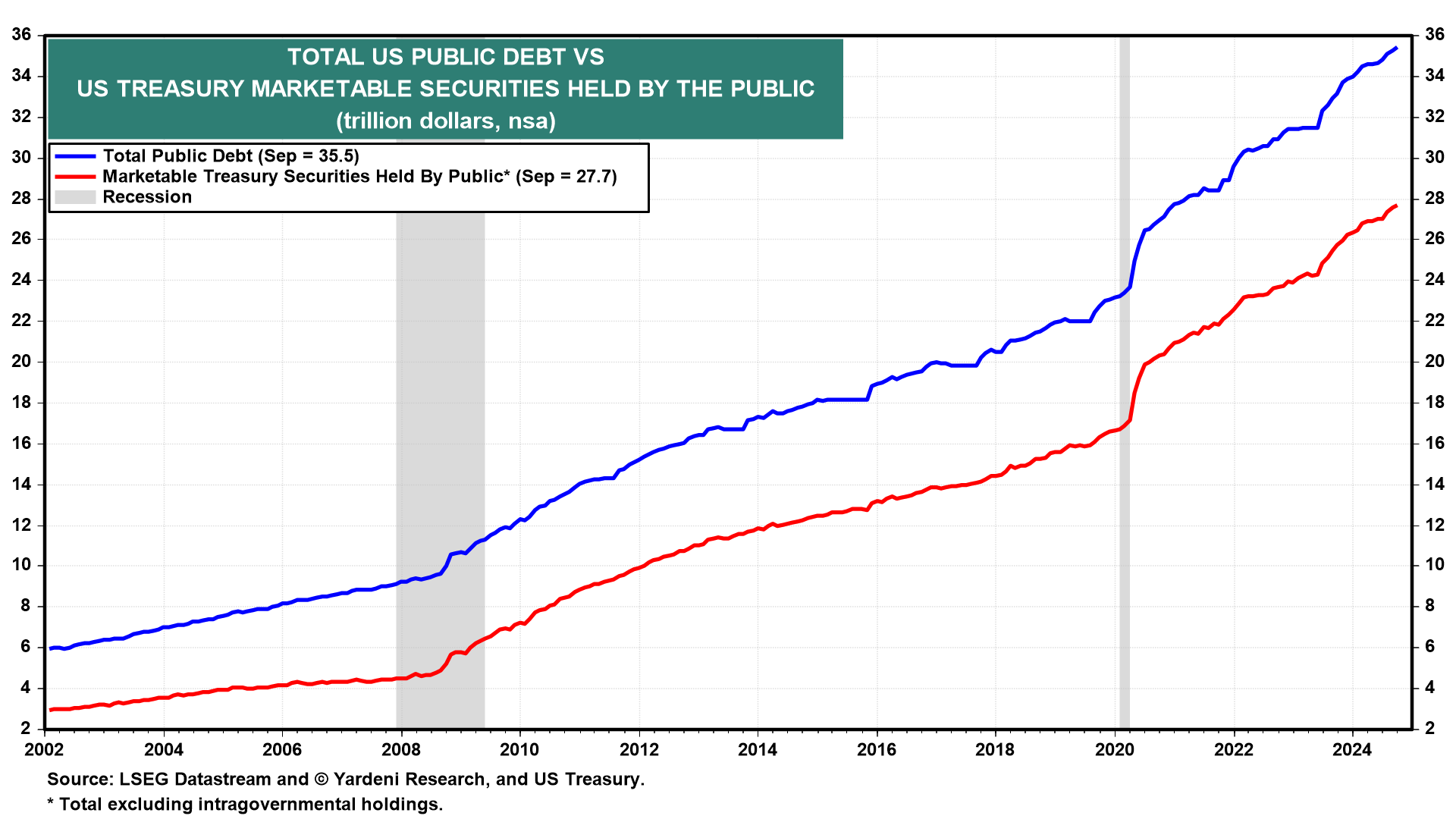

Presumably, many of their children will inherit what's left of those funds when their parents pass away. At the same time, the post-Baby Boom generation will inherit a huge amount of government debt (chart).

Total US public debt is currently $35.5 trillion including $27.7 trillion of US Treasury marketable debt and $7.2 trillion of intragovernmental holdings. The latter is the government's IOUs to itself to fund its raids on public trust funds such as those for Social Security and Medicare.

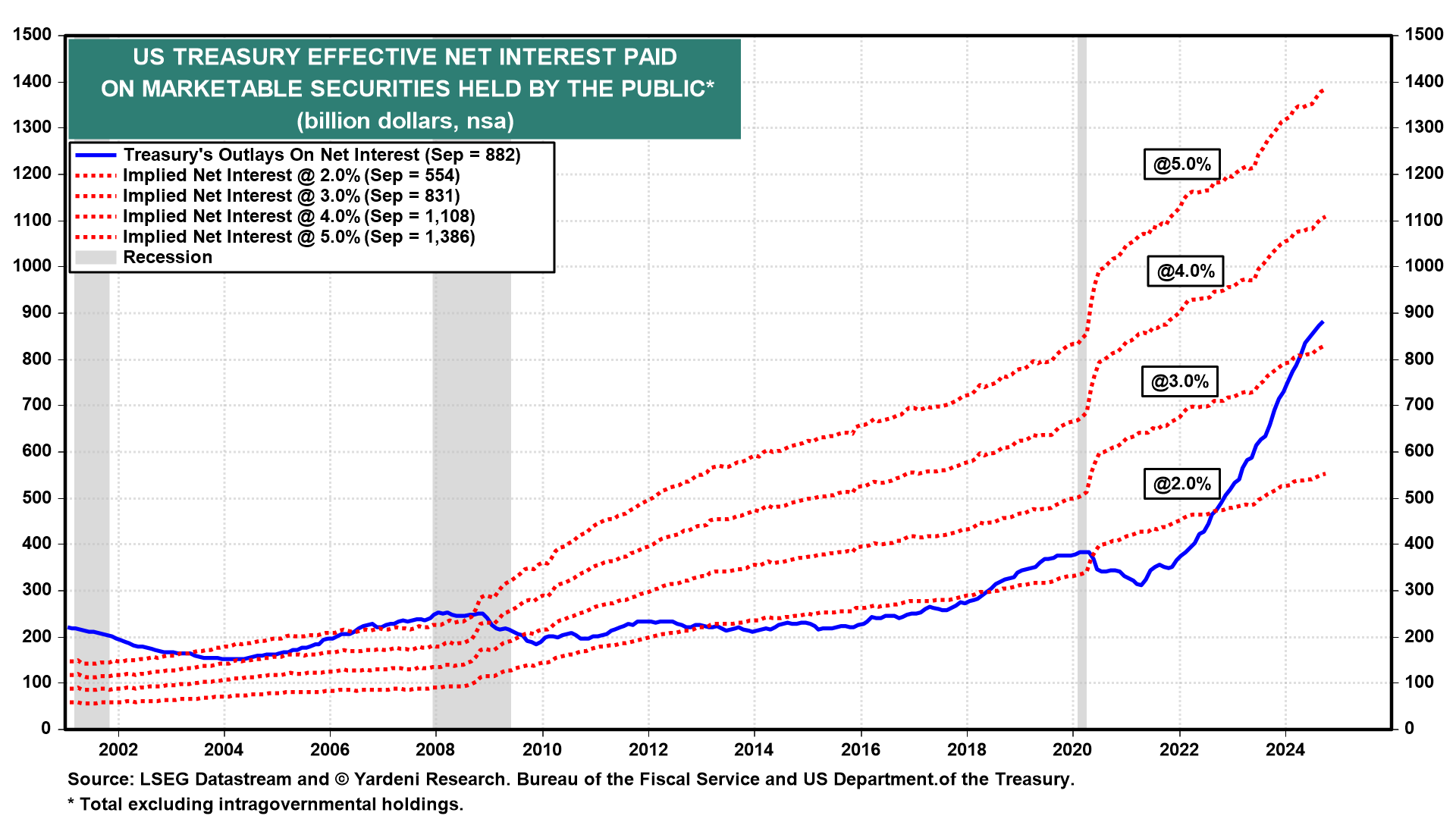

That debt will soon be expanding at an annual rate of over $1.0 trillion just to cover the net interest outlays of the Treasury (chart).

We are discussing this topic because the Treasury announced its marketable borrowing estimates today. The projected financing is $546 billion in Q4-2024 and $823 billion during Q1-2025.

Might this explain why the bond yield has risen from 3.62% on September 16 to 4.27% today even though the Fed cut the federal funds rate by 50bps on September 18? Yes, of course. We did anticipate this move on better-than-expected economic indicators, not the beginning of another debt crisis that occurred from August to October 2023.

We've also always said that when the bond market starts to worry about the federal deficit and debt, we will do so too. That may be starting to happen as the bond market recognizes that the November 5 elections won't change the reckless course of fiscal policy.

For now, we are forecasting that the bond yield will be range-bound between 4.25% and 4.50% through yearend. The S&P 500 should end the year around 5800, where it is now on jitters about the bond market's response to the next administration.

A billion here, a billion there, and pretty soon you're talking real money.